PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833643

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833643

Augmented and Virtual Reality in Healthcare Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

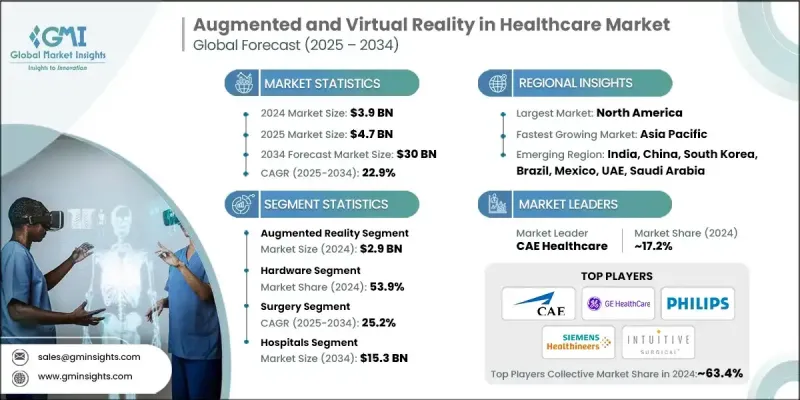

The Global Augmented and Virtual Reality in Healthcare Market was valued at USD 3.9 billion in 2024 and is estimated to grow at a CAGR of 22.9% to reach USD 30 billion by 2034.

The healthcare industry is increasingly adopting digital technologies for diagnostics, treatment planning, and patient engagement. AR and VR offer innovative solutions for enhancing healthcare delivery, providing immersive experiences for surgeons, medical trainees, and patients, driving their widespread adoption in the industry.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.9 Billion |

| Forecast Value | $30 Billion |

| CAGR | 22.9% |

Rising Demand for Augmented Reality

The augmented reality (AR) segment held a notable share in 2024 owing to its ability to enhance medical procedures with real-time data overlays. This technology is being increasingly used in medical imaging, diagnostics, and patient education, providing healthcare professionals with more accurate and efficient tools for treatment. Key strategies adopted by companies in this segment include partnerships with healthcare providers to integrate AR solutions into clinical settings, along with continuous R&D to improve the precision and interactivity of AR applications.

Increasing Adoption of Hardware

The hardware segment held a sizeable share in 2024, as the development of specialized headsets, sensors, and computing devices enables immersive experiences. Companies are focusing on creating lightweight, comfortable, and high-performance devices that cater to various healthcare needs, such as surgical simulation, physical therapy, and patient monitoring.

Surgery to Gain Traction

The surgery segment held a notable share in 2024. Surgeons now use VR simulations for preoperative planning and AR tools during surgery to visualize critical structures, improving precision and reducing the risk of errors. Key strategies driving this segment include the development of specialized software solutions that integrate with surgical instruments, as well as forming alliances with leading medical device companies to ensure smoother integration of AR/VR tools into existing surgical workflows.

North America to Emerge as a Propelling Region

North American augmented and virtual reality in healthcare market is expected to grow at a decent CAGR during 2025-2034, driven by high healthcare spending, technological advancements, and early adoption of AR/VR solutions by leading healthcare institutions across the region. The U.S. and Canada are at the forefront of integrating AR/VR into medical training, surgical procedures, and patient care.

Major players in the augmented and virtual reality in healthcare market are MindMaze, Virtual Reality Medical Center (VRMC), Augmedix, CAE Healthcare, Vicarious Surgical, HoloAnatomy, GE HealthCare, Surgical Theater, Bioflight VR, Proprio Vision, Augmedics, SentiAR, XR Health, Intuitive Surgical, Siemens, Medical Augmented Intelligence, Medivis, Mobiliya, Osso VR, FundamentalVR, Health Scholars, Koninklijke Philips N.V., AppliedVR, and In vivo.

Companies are strengthening their presence by collaborating with universities and healthcare providers, focusing on expanding their research and development activities, and ensuring compliance with regional regulations. Additionally, they are capitalizing on the growing demand for remote healthcare services and virtual consultations, which further propels the adoption of AR/VR solutions.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Technology

- 2.2.3 Component

- 2.2.4 Application

- 2.2.5 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising mental health and pain management needs

- 3.2.1.2 Growth in telemedicine and remote care

- 3.2.1.3 Rapid advancements in AR/VR hardware and software enhancing usability, realism, and affordability

- 3.2.1.4 Government and institutional support

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High upfront costs

- 3.2.2.2 Data privacy and security concerns

- 3.2.3 Market opportunities

- 3.2.3.1 AI and 5G integration

- 3.2.3.2 Expanding digital twins and personalized medicine

- 3.2.3.3 Expansion into emerging markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Rest of the world

- 3.5 Technological landscape

- 3.5.1 Current technologies

- 3.5.2 Emerging technologies

- 3.6 Value chain analysis

- 3.7 Product lifecycle analysis

- 3.8 Future market trends

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Augmented reality

- 5.3 Virtual reality

Chapter 6 Market Estimates and Forecast, By Component, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hardware

- 6.3 Software

- 6.4 Services

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Surgery

- 7.3 Training and education

- 7.4 Behavioral therapy

- 7.5 Medical imaging

- 7.6 Other applications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Academic institutions

- 8.3 Hospitals

- 8.4 Clinics/dentists

- 8.5 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AppliedVR

- 10.2 Augmedics

- 10.3 Augmedix

- 10.4 Bioflight VR

- 10.5 CAE Healthcare

- 10.6 FundamentalVR

- 10.7 GE HealthCare

- 10.8 Health Scholars

- 10.9 HoloAnatomy

- 10.10 Intuitive Surgical

- 10.11 Invivo

- 10.12 Koninklijke Philips N.V.

- 10.13 Medical Augmented Intelligence

- 10.14 Medivis

- 10.15 MindMaze

- 10.16 Mobiliya

- 10.17 OSSO VR

- 10.18 Proprio Vision

- 10.19 SentiAR

- 10.20 Siemens Healthineers

- 10.21 Surgical Theater

- 10.22 Vicarious Surgical

- 10.23 Virtual Reality Medical Center (VRMC)

- 10.24 VRHealth

- 10.25 XR Health