PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833653

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833653

Industrial Air Filtration Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

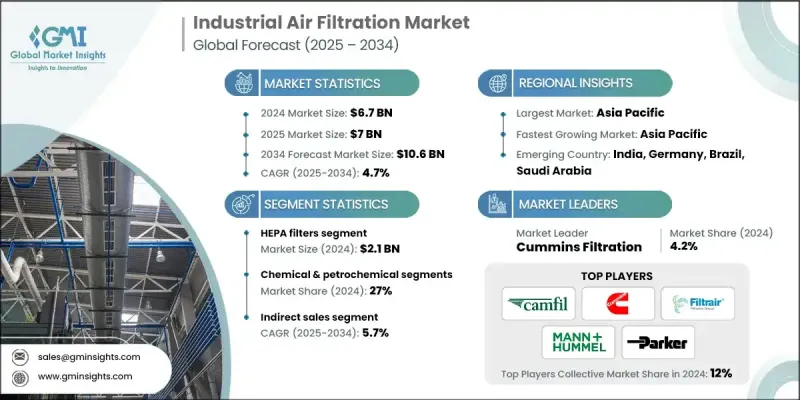

The Global Industrial Air Filtration Market was valued at USD 6.7 billion in 2024 and is estimated to grow at a CAGR of 4.7% to reach USD 10.6 billion by 2034.

Government agencies such as OSHA, EPA, and their global counterparts are enforcing stricter air quality standards in industrial environments. Companies are compelled to install advanced air filtration systems to remain compliant and avoid fines, which significantly boosts market demand.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.7 Billion |

| Forecast Value | $10.6 Billion |

| CAGR | 4.7% |

Rising Adoption of HEPA Filters

The HEPA filters segment held a significant share in 2024, owing to its high efficiency in capturing fine particulate matter, including dust, aerosols, and microorganisms. These filters are especially critical in environments requiring ultra-clean air, such as pharmaceutical production, electronics manufacturing, and food processing.

Increasing Demand in Chemicals and Petrochemicals

The chemical and petrochemical segment generated a substantial share in 2024, driven by high levels of airborne pollutants and hazardous gases involved. Maintaining air quality in these facilities is essential not only for regulatory compliance but also for worker safety and process stability. Filtration solutions in this space often require advanced chemical absorbents and corrosion-resistant materials, further pushing the demand for specialized high-performance systems.

Indirect Sales to Gain Traction

The indirect sales segment will grow at a decent CAGR during 2025-2034, backed by value-added resellers and system integrators. These channels enable manufacturers to extend their market reach without the need for an extensive in-house sales force. Distributors also offer technical consulting, after-sales service, and customized installation, making a critical link between filtration providers and industrial clients.

Asia Pacific to Emerge as a Propelling Region

Asia Pacific industrial air filtration market held a sizeable share in 2024, driven by rapid industrialization, urban pollution challenges, and growing environmental regulations. Countries like China, India, and South Korea are leading demand across sectors such as manufacturing, automotive, cement, and power generation. Market growth is fueled by government initiatives aimed at reducing air pollution and enhancing occupational safety standards. As infrastructure spending increases, the need for robust and scalable air filtration systems is expected to rise steadily.

Major players in the industrial air filtration market are Fives Group, Absolent, Mann+Hummel, Donaldson, BWF, Freudenberg, Universal Air Filter, AAF, Camfil, Cummins Filtration, Pall, Parker Hannifin, Nederman, Filtration Group Corporation, Lydall Gutsche.

To strengthen their foothold, leading players in the industrial air filtration market are investing in product innovation, digital integration, and sustainability. Many companies are launching smart filtration systems equipped with IoT sensors for real-time air quality monitoring and predictive maintenance. Strategic partnerships with OEMs, distributors, and engineering firms help expand distribution networks and tailor solutions to industry-specific needs. Mergers and acquisitions remain a popular route to gain access to new technologies or regional markets.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Application

- 2.2.4 End use industry

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 ($Billion, Thousand Units)

- 5.1 Key trends

- 5.2 HEPA filters

- 5.3 Baghouse/fabric filters

- 5.4 Electrostatic precipitators (ESP)

- 5.5 Cyclone separators

- 5.6 Activated carbon filters

- 5.7 Others (ULPA filters etc.)

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 ($Billion, Thousand Units)

- 6.1 Key trends

- 6.2 Cleanroom air filtration

- 6.3 Industrial process air cleaning

- 6.4 HVAC system filtration

- 6.5 Dust collection systems

- 6.6 Emission control

Chapter 7 Market Estimates & Forecast, By End Use Industry, 2021 - 2034 ($Billion, Thousand Units)

- 7.1 Key trends

- 7.2 Pharmaceuticals & biotechnology

- 7.3 Semiconductor & electronics

- 7.4 Food & beverages

- 7.5 Automotive

- 7.6 Chemical & petrochemical

- 7.7 Others (healthcare & hospitals etc.)

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Billion, Thousand Units)

- 8.1 Key trends

- 8.2 Direct sales

- 8.3 Indirect sales

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Billion, Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AAF

- 10.2 Absolent

- 10.3 BWF

- 10.4 Camfil

- 10.5 Cummins Filtration

- 10.6 Donaldson

- 10.7 Filtration Group Corporation

- 10.8 Fives Group

- 10.9 Freudenberg

- 10.10 Lydall Gutsche

- 10.11 Mann+Hummel

- 10.12 Nederman

- 10.13 Pall

- 10.14 Parker Hannifin

- 10.15 Universal Air Filter