PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833655

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833655

Venous Thromboembolism Treatment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

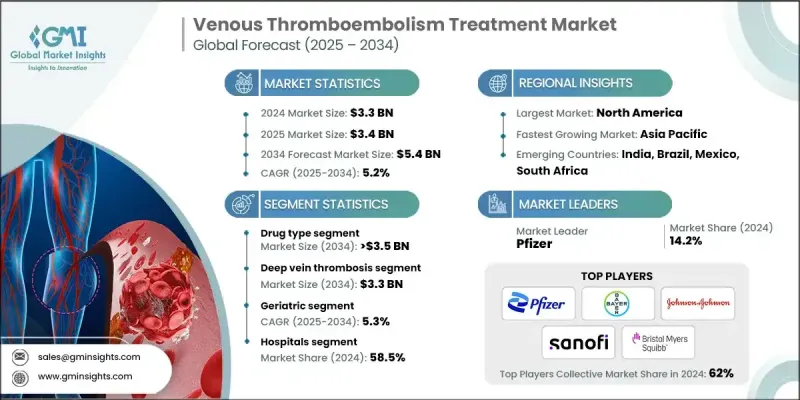

The Global Venous Thromboembolism Treatment Market was valued at USD 3.3 billion in 2024 and is estimated to grow at a CAGR of 5.2% to reach USD 5.4 billion by 2034.

The upward trend is driven by the growing incidence of VTE conditions globally, which has heightened demand for anticoagulant medications, thrombolytic therapies, and vascular intervention devices. VTE treatment includes a targeted group of drugs and devices that are specifically designed to dissolve, prevent, or manage blood clots within the venous system. These therapies are customized based on multiple patient-specific factors, including age, immune response, overall health, and the severity of the condition. The market growth is further fueled by increased public and professional awareness about the dangers of untreated VTE, the expansion of preventive care protocols in clinical settings, and the broader use of telemedicine for remote anticoagulant monitoring. Additionally, the widespread availability of pharmaceutical e-commerce platforms has improved access to both oral treatments and compression products, promoting earlier and more effective intervention. The continued focus on education, diagnostics, and digital care integration is supporting more proactive management of the condition, leading to improved patient outcomes and increased adoption of therapeutic solutions across both hospital and home settings.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.3 Billion |

| Forecast Value | $5.4 Billion |

| CAGR | 5.2% |

Modern treatment options are transforming how healthcare systems manage VTE, offering greater safety, accuracy, and convenience for patients. Technological progress in drug formulation and clot-removal tools is helping enhance therapeutic precision and limit complications. The development of longer-acting oral anticoagulants, AI-guided clot retrieval systems, and less invasive vascular devices is significantly improving patient adherence to treatment plans and minimizing adverse reactions. These innovations are not only improving the standard of care but also enabling physicians to deliver efficient treatment with better long-term outcomes.

In 2024, the drug-based segment held a 65.5% share, driven by the wide-scale use of anticoagulants and thrombolytic drugs across both clinical and outpatient environments. This segment is divided into two main categories: anticoagulants and thrombolytics. The anticoagulant category is further segmented into direct oral anticoagulants, heparin products, and vitamin K antagonists. This dominance is the result of modern anticoagulants offering predictable therapeutic effects, longer activity durations, and requiring less intensive monitoring. These features make them ideal for both initial and ongoing management of VTE, especially in varied patient settings.

The deep vein thrombosis (DVT) segment generated USD 2 billion in 2024 and will reach USD 3.3 billion by 2034, making it the largest contributor to the overall VTE treatment market. DVT is characterized by clot formation in deep veins, primarily in the lower limbs, and poses serious health risks if not identified and treated promptly. The prevalence of DVT is influenced by multiple risk factors such as sedentary lifestyles, smoking, high body weight, and chronic illnesses. This increasing burden has prompted medical professionals to emphasize early detection, guided use of anticoagulant therapy, and, where necessary, mechanical interventions to improve recovery rates and reduce life-threatening complications.

North America Venous Thromboembolism Treatment Market held a 40.1% share. The dominance of this region stems from its well-established healthcare framework, including advanced diagnostic resources, skilled healthcare personnel, and high patient awareness levels. Public health campaigns focused on prevention and early symptom recognition have contributed to the timely treatment of VTE, while research investments continue to bring new products and technologies to the market. Pharmaceutical and medical technology companies based in North America are consistently developing innovative solutions that offer superior efficacy and safety, which support the region's strong market performance.

Prominent companies actively shaping the venous thromboembolism treatment market include Johnson & Johnson, Philips Healthcare, Boehringer Ingelheim, Daiichi Sankyo, Sanofi, Novartis, AngioDynamics, Bayer, Argon Medical Products, Boston Scientific, Daesung Maref, Pfizer, Cardinal Health, Cook Medical, GlaxoSmithKline, Bristol Myers Squibb, and Covidien (Medtronic). Leading players in the venous thromboembolism treatment market are focusing on a blend of innovation, strategic partnerships, and geographic expansion to solidify their market standing. Many are investing heavily in R&D to launch next-generation therapies and devices that provide safer, more effective treatment options. Strategic collaborations with academic and clinical institutions are helping accelerate clinical trials and technology development. Companies are also expanding their global footprint by entering emerging markets and strengthening distribution networks to improve access.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumption and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Treatment type trends

- 2.2.3 Application trends

- 2.2.4 Age group trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence venous thromboembolism

- 3.2.1.2 Aging population and immobility

- 3.2.1.3 Advancements in anticoagulant therapy

- 3.2.1.4 Growing awareness of post-thrombotic syndrome

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Risk of bleeding complications

- 3.2.2.2 Limited awareness in developing regions

- 3.2.3 Market opportunities

- 3.2.3.1 Development of dual-action therapies

- 3.2.3.2 Expansion of telehealth platforms

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S.

- 3.4.1.2 Canada

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.1 North America

- 3.5 Future market trends

- 3.6 Technological landscape

- 3.6.1 Current technologies

- 3.6.2 Emerging technologies

- 3.7 Patent landscape

- 3.8 Pipeline analysis

- 3.9 Pricing analysis

- 3.10 Epidemiology of the disease

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Treatment Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Devices

- 5.2.1 Compression system

- 5.2.2 Thrombectomy systems

- 5.2.3 IVC filters

- 5.2.4 Stockings

- 5.2.5 Other devices

- 5.3 Drug type

- 5.3.1 Anticoagulants

- 5.3.1.1 Direct oral anticoagulants

- 5.3.1.2 Heparin

- 5.3.1.3 Vitamin K antagonists

- 5.3.2 Thrombolytics

- 5.3.1 Anticoagulants

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Deep vein thrombosis

- 6.3 Pulmonary embolism

Chapter 7 Market Estimates and Forecast, By Age Group, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Adults

- 7.3 Geriatric

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Catheterization laboratories

- 8.4 Ambulatory surgical centers (ASCs)

- 8.5 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AngioDynamics

- 10.2 Argon Medical Products

- 10.3 Bayer

- 10.4 Boehringer Ingelheim

- 10.5 Boston Scientific

- 10.6 Bristol Myers Squibb

- 10.7 Cardinal Health

- 10.8 Cook Medical

- 10.9 Covidien (Medtronic)

- 10.10 Daesung Maref

- 10.11 Daiichi Sankyo

- 10.12 GlaxoSmithKline

- 10.13 Johnson & Johnson

- 10.14 Novartis

- 10.15 Pfizer

- 10.16 Philips Healthcare

- 10.17 Sanofi

Table of Contents

Chapter 11 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumption and limitations

Chapter 12 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Treatment type trends

- 2.2.3 Application trends

- 2.2.4 Age group trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 13 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence venous thromboembolism

- 3.2.1.2 Aging population and immobility

- 3.2.1.3 Advancements in anticoagulant therapy

- 3.2.1.4 Growing awareness of post-thrombotic syndrome

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Risk of bleeding complications

- 3.2.2.2 Limited awareness in developing regions

- 3.2.3 Market opportunities

- 3.2.3.1 Development of dual-action therapies

- 3.2.3.2 Expansion of telehealth platforms

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S.

- 3.4.1.2 Canada

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.1 North America

- 3.5 Future market trends

- 3.6 Technological landscape

- 3.6.1 Current technologies

- 3.6.2 Emerging technologies

- 3.7 Patent landscape

- 3.8 Pipeline analysis

- 3.9 Pricing analysis

- 3.10 Epidemiology of the disease

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 14 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 15 Market Estimates and Forecast, By Treatment Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Devices

- 5.2.1 Compression system

- 5.2.2 Thrombectomy systems

- 5.2.3 IVC filters

- 5.2.4 Stockings

- 5.2.5 Other devices

- 5.3 Drug type

- 5.3.1 Anticoagulants

- 5.3.1.1 Direct oral anticoagulants

- 5.3.1.2 Heparin

- 5.3.1.3 Vitamin K antagonists

- 5.3.2 Thrombolytics

- 5.3.1 Anticoagulants

Chapter 16 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Deep vein thrombosis

- 6.3 Pulmonary embolism

Chapter 17 Market Estimates and Forecast, By Age Group, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Adults

- 7.3 Geriatric

Chapter 18 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Catheterization laboratories

- 8.4 Ambulatory surgical centers (ASCs)

- 8.5 Other end use

Chapter 19 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 20 Company Profiles

- 10.1 AngioDynamics

- 10.2 Argon Medical Products

- 10.3 Bayer

- 10.4 Boehringer Ingelheim

- 10.5 Boston Scientific

- 10.6 Bristol Myers Squibb

- 10.7 Cardinal Health

- 10.8 Cook Medical

- 10.9 Covidien (Medtronic)

- 10.10 Daesung Maref

- 10.11 Daiichi Sankyo

- 10.12 GlaxoSmithKline

- 10.13 Johnson & Johnson

- 10.14 Novartis

- 10.15 Pfizer

- 10.16 Philips Healthcare

- 10.17 Sanofi