PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833664

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833664

Dental Chair Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

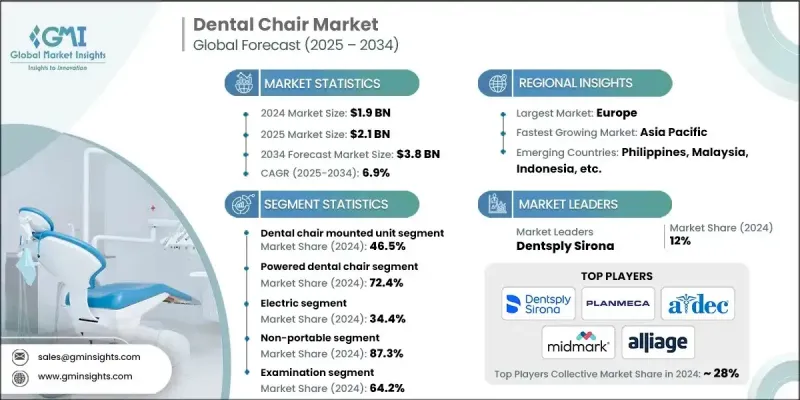

The Global Dental Chair Market was valued at USD 1.9 billion in 2024 and is estimated to grow at a CAGR of 6.9% to reach USD 3.8 billion by 2034.

This growth is primarily fueled by the rising volume of dental procedures, heightened awareness around oral health, and an increasing demand for ergonomic and technologically advanced dental chairs. The expansion of dental clinics, government programs promoting oral hygiene, and growing investments in modern dental infrastructure are also propelling market growth worldwide, boosting adoption in both mature and emerging regions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.9 Billion |

| Forecast Value | $3.8 Billion |

| CAGR | 6.9% |

The surge in dental treatments and oral health consciousness, coupled with the use of advanced dental equipment, is significantly driving the dental chair market. Patients today prioritize not only effective care but also comfort and convenience during dental visits, pushing clinics to invest in innovative and ergonomic chairs. Features like adjustable seating, digital controls, and multifunctional units enhance operational efficiency, reduce treatment time, and improve clinical outcomes, making these chairs a crucial part of contemporary dental practices. The rise of dental clinics and chains across developed and developing markets, backed by greater infrastructure investments, has expanded the customer base for dental chairs. Technological progress, such as automated positioning, improved lighting, and the integration of imaging and diagnostic tools, has further increased demand by making dental procedures smoother and more comfortable for patients. Additionally, the growth of dental tourism in countries offering affordable, high-quality care has driven the adoption of advanced dental chairs to meet global standards.

In 2024, the dental chair-mounted unit segment held a 46.5% share, driven by the increasing need for integrated dental solutions and improved operational efficiency. This segment's popularity stems from its ability to combine essential dental equipment such as handpieces, suction systems, waterlines, and controls into a single ergonomic unit. This integration streamlines workflow, reduces treatment durations, and enhances patient comfort, making it the preferred option for modern dental clinics.

The electric dental chair segment held the largest share of 34.4% in 2024, driven by the growing preference for precise, energy-efficient, and low-maintenance dental procedures. Electric chairs provide smooth and accurate movements during treatments, decreasing procedure times and increasing patient comfort. Their advanced automation features, including programmable positioning and integrated control systems, boost efficiency in busy dental practices. The rising adoption of digital dentistry and cutting-edge dental technologies worldwide has further accelerated demand for electric dental chairs.

North America Dental Chair Market was valued at USD 449.6 million in 2024. The region's increasing elderly population is driving demand and creating new opportunities for dental services and advanced procedures that rely on high-tech dental chairs. With the rise of modern dental technologies, there is a growing need for chairs that integrate seamlessly with digital workflows, enabling dentists to deliver more precise diagnoses and improved treatment results. Dental practices are seeking chairs with automated functions and digital capabilities to enhance staff efficiency and productivity.

Key players shaping the Global Dental Chair Market include Dentsply Sirona, Alliage, Midmark, PLANMECA, A-dec, KAVO, MEGAGEN, Belmont, Boyd Industries, DIPLOMAT DENTAL SOLUTIONS, Flight Dental Systems, MORITA, OSSTEM IMPLANT, VIC Dental, Zevadent, HEKA, Neodent, Paloma, and Summit Dental Systems (SDS). Companies in the dental chair market focus heavily on innovation to maintain their competitive edge, continuously enhancing ergonomics, comfort, and automation in their products. Expanding distribution networks and forming strategic partnerships with dental clinics and healthcare providers are critical to increasing market reach. Many players invest in R&D to integrate digital technologies such as smart controls and diagnostic tools, aligning with the growing trend of digital dentistry. They also target emerging markets by customizing products to local needs and price sensitivities. Additionally, companies emphasize after-sales service, training, and customer support to build strong relationships with dental professionals.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Technology trends

- 2.2.4 Operation trends

- 2.2.5 Configuration trends

- 2.2.6 Application trends

- 2.2.7 Dental speciality trends

- 2.2.8 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of oral health disorders

- 3.2.1.2 Rise in medical tourism

- 3.2.1.3 Increasing awareness of dental aesthetics

- 3.2.1.4 Surge in number of dentists and infrastructural spending in developing regions

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of dental chairs

- 3.2.2.2 Apathy towards dental procedure

- 3.2.3 Opportunities

- 3.2.3.1 Expansion in emerging economies

- 3.2.3.2 Rise in number of private dental clinics

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Consumer behavior trends

- 3.7 Pricing analysis, by region, 2024

- 3.8 Sustainability and environmental impact

- 3.8.1 Use of recyclable materials

- 3.8.2 Energy-efficient manufacturing processes

- 3.9 Investment landscape

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

- 3.12 Gap analysis

- 3.13 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 LAMEA

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

- 4.7 Key developments

- 4.7.1 Mergers and acquisitions

- 4.7.2 Partnerships and collaborations

- 4.7.3 New product launches

- 4.7.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn and Units)

- 5.1 Key trends

- 5.2 Ceiling mounted chair

- 5.3 Mobile independent chair

- 5.4 Dental chair mounted unit

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn and Units)

- 6.1 Key trends

- 6.2 Powered dental chair

- 6.3 Non-powered dental chair

Chapter 7 Market Estimates and Forecast, By Operation, 2021 - 2034 ($ Mn and Units)

- 7.1 Key trends

- 7.2 Electromechanical

- 7.3 Hydraulic

- 7.4 Electric

- 7.5 Manual

- 7.6 Pneumatic

- 7.7 Electropneumatic

Chapter 8 Market Estimates and Forecast, By Configuration, 2021 - 2034 ($ Mn and Units)

- 8.1 Key trends

- 8.2 Portable

- 8.3 Non-portable

- 8.3.1 General dental chair

- 8.3.2 Pediatric dental chair

- 8.3.3 Exodontics dental chair

Chapter 9 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn and Units)

- 9.1 Key trends

- 9.2 Examination

- 9.3 Surgery

Chapter 10 Market Estimates and Forecast, By Dental Speciality, 2021 - 2034 ($ Mn and Units)

- 10.1 Key trends

- 10.2 General practice

- 10.3 Oral and maxillofacial surgery

- 10.4 Orthodontics and dentofacial orthopedics

- 10.5 Pediatric dentistry

- 10.6 Dental pathology

- 10.7 Other dental speciality

Chapter 11 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn and Units)

- 11.1 Key trends

- 11.2 Dental clinics

- 11.3 Hospitals

- 11.4 Ambulatory surgery centers

- 11.5 Other end use

Chapter 12 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn and Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Spain

- 12.3.5 Italy

- 12.3.6 Russia

- 12.3.7 Austria

- 12.3.8 Sweden

- 12.3.9 Denmark

- 12.3.10 Finland

- 12.3.11 Norway

- 12.3.12 Switzerland

- 12.3.13 Netherlands

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 Japan

- 12.4.3 India

- 12.4.4 Australia

- 12.4.5 South Korea

- 12.4.6 Indonesia

- 12.4.7 Philippines

- 12.4.8 Malaysia

- 12.4.9 Singapore

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.5.4 Colombia

- 12.5.5 Peru

- 12.5.6 Chile

- 12.6 MEA

- 12.6.1 South Africa

- 12.6.2 Saudi Arabia

- 12.6.3 UAE

- 12.6.4 Egypt

- 12.6.5 Israel

- 12.6.6 Iran

Chapter 13 Company Profiles

- 13.1 Global players

- 13.1.1 A-dec

- 13.1.2 alliage

- 13.1.3 Dentsply Sirona

- 13.1.4 DIPLOMAT DENTAL SOLUTIONS

- 13.1.5 FLiGHT DENTAL SYSTEMS

- 13.1.6 MORITA

- 13.1.7 KAVO

- 13.1.8 MEGAGEN

- 13.1.9 Midmark

- 13.1.10 OSSTEM IMPLANT

- 13.1.11 PLANMECA

- 13.1.12 zevadent

- 13.2 Regional players

- 13.2.1 Belmont

- 13.2.2 Boyd Industries

- 13.2.3 Chirana

- 13.2.4 FLiGHT DENTAL SYSTEMS

- 13.2.5 VIC dental

- 13.3 Emerging players

- 13.3.1 DIPLOMAT DENTAL SOLUTIONS

- 13.3.2 HEKA

- 13.3.3 neodent

- 13.3.4 Paloma

- 13.3.5 Summit Dental Systems (SDS)