PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833670

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833670

Veterinary Monitoring Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

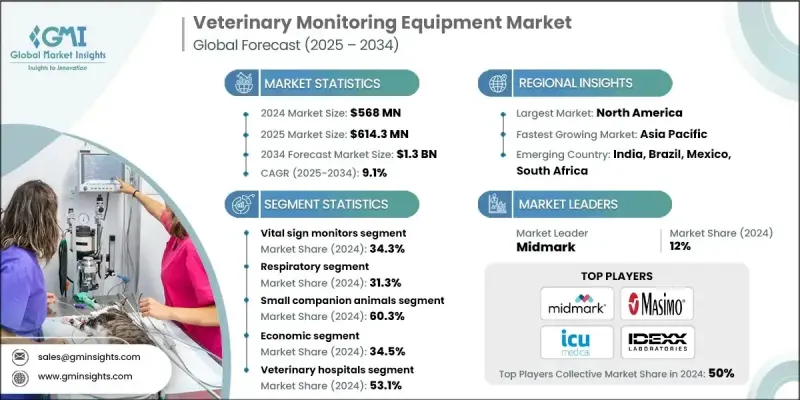

The Global Veterinary Monitoring Equipment Market was valued at USD 568 million in 2024 and is estimated to grow at a CAGR of 9.1% to reach USD 1.3 billion by 2034.

The growing number of pet owners, especially in urban and developed regions, is increasing demand for high-quality veterinary care. As people view pets as family members, they are more willing to invest in advanced monitoring tools to ensure better health outcomes.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $568 Million |

| Forecast Value | $1.3 Billion |

| CAGR | 9.1% |

Rising use of Vital Sign Monitors

The vital sign monitors segment held a notable share in 2024, owing to its essential role in tracking an animal's core health indicators, including heart rate, blood pressure, temperature, and oxygen saturation. These devices are used across a range of settings from routine checkups to surgeries and intensive care units making them indispensable in modern veterinary practice. With increasing demand for early disease detection and preventive care, clinics are adopting multi-parameter monitors that deliver real-time data and integrated analytics.

Growing Demand for Respiratory Monitors

The respiratory monitoring segment will grow at a decent CAGR during 2025-2034 as veterinarians manage rising cases of respiratory illnesses in pets and livestock. Devices like capnographs and spirometers are used to assess ventilation, gas exchange, and overall lung function, especially during anesthesia and post-operative recovery. With more complex surgical procedures being performed on animals, accurate respiratory monitoring is crucial for minimizing complications.

Rising Prevalence Among Small Companion Animals

The small companion animals segment held a significant share in 2024, driven by increasing pet adoption and the humanization of pets. Pet owners are more willing to invest in high-quality medical care, including advanced monitoring during surgeries, chronic disease management, and preventive exams. Veterinary clinics are equipping their facilities with monitors specifically calibrated for smaller species, ensuring accurate readings and minimal discomfort.

North America to Emerge as a Lucrative Region

North America veterinary monitoring equipment will grow at a decent CAGR during 2025-2034, backed by advanced veterinary infrastructure, high pet ownership rates, and a strong focus on animal wellness. The U.S. has seen rising demand for diagnostic technologies in both urban clinics and rural livestock facilities. This regional market benefits from early adoption of digital health tools, robust distribution networks, and favorable reimbursement trends for veterinary procedures. Leading players are enhancing their market position by expanding their presence in academic veterinary hospitals, rolling out cloud-connected monitoring solutions, and providing tailored service contracts to veterinary chains.

Major players in the veterinary monitoring equipment market are Masimo, Vetland Medical, ICU Medical, Digicare Animal Health, Mindray Animal Health, Bionet America, Burtons Veterinary, Midmark, Medtronic, Avante Animal Health, Hallmarq Veterinary Imaging, Dextronix, Nonin, and IDEXX Laboratories.

To gain a competitive edge in the veterinary monitoring equipment market, companies are focusing heavily on product innovation, strategic partnerships, and targeted customer engagement. Many are developing compact, multi-parameter monitors with wireless connectivity and real-time data integration to support efficient diagnostics across a variety of clinical settings.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumption and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Application

- 2.2.4 Animal Type

- 2.2.5 Price Tier

- 2.2.6 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of animal disorders

- 3.2.1.2 Rising adoption of pet insurance

- 3.2.1.3 Growing companion animal population

- 3.2.1.4 Increasing spending on pet health

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of monitoring equipment

- 3.2.2.2 Limited access in low-income and rural areas

- 3.2.3 Market opportunities

- 3.2.3.1 Emerging markets with growing pet care demand

- 3.2.3.2 Adoption of wearable and remote monitoring devices

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S.

- 3.4.1.2 Canada

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.1 North America

- 3.5 Future market trends

- 3.6 Pricing analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technology

- 3.7.2 Emerging technologies

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Vital sign monitors

- 5.3 Capnography and oximetry systems

- 5.4 Anesthesia monitors

- 5.5 ECG and EKG monitors

- 5.6 Magnetic resonance imaging (MRI) systems

- 5.7 Other veterinary monitoring equipment

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Weight and temperature monitoring

- 6.3 Cardiology

- 6.4 Respiratory

- 6.5 Neurology

- 6.6 Multi-parameter monitoring

- 6.7 Other applications

Chapter 7 Market Estimates and Forecast, By Animal Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Small companion animals

- 7.2.1 Dogs

- 7.2.2 Cats

- 7.2.3 Others small companion animals

- 7.3 Large animals

- 7.3.1 Equines

- 7.3.2 Other large animals

- 7.4 Exotic animals

Chapter 8 Market Estimates and Forecast, By Price Tier, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Economic

- 8.3 Mid-range

- 8.4 Premium

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Veterinary clinics and diagnostic centers

- 9.3 Veterinary hospitals

- 9.4 Research institutes

- 9.5 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Avante Animal Health

- 11.2 Bionet America

- 11.3 Burtons Veterinary

- 11.4 Dextronix

- 11.5 Digicare Animal Health

- 11.6 Hallmarq Veterinary Imaging

- 11.7 ICU Medical

- 11.8 IDEXX Laboratories

- 11.9 Masimo

- 11.10 Medtronic

- 11.11 Midmark

- 11.12 Mindray Animal Health

- 11.13 Nonin

- 11.14 Vetland Medical

- 11.15 Vetronic Services