PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833671

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833671

Clinical Nutrition Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

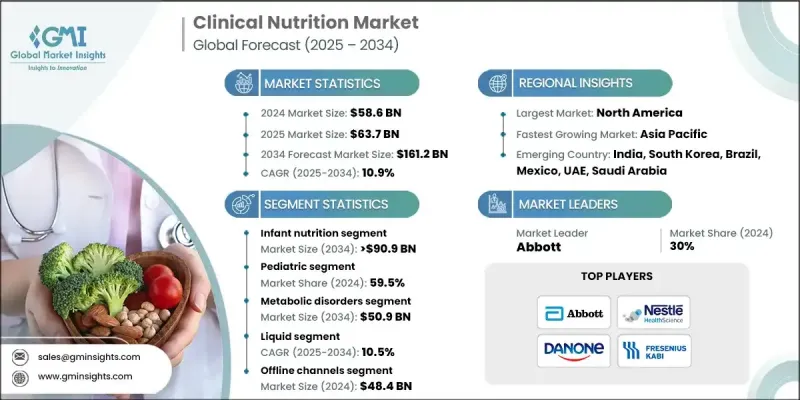

The Global Clinical Nutrition Market was valued at USD 58.6 billion in 2024 and is estimated to grow at a CAGR of 10.9% to reach USD 161.2 billion by 2034.

Chronic conditions such as cancer, diabetes, gastrointestinal disorders, and kidney disease often lead to impaired nutrient absorption and increased nutritional needs. As a result, clinical nutrition plays a vital role in patient recovery and disease management, driving consistent demand.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $58.6 Billion |

| Forecast Value | $161.2 Billion |

| CAGR | 10.9% |

Rising Demand for Infant Nutrition

The infant nutrition segment held a substantial share in 2024, driven by rising birth rates, increasing rates of preterm births, and growing awareness of the importance of early-life nutrition. Infant formulas are used to supplement or replace breastfeeding, especially in working households and in cases of medical complications.

Growing Adoption Among Pediatrics

The pediatric segment will grow at a decent CAGR during 2025-2034. Nutritional support is essential in cases of gastrointestinal disorders, cystic fibrosis, and neurological impairments, where regular food intake may be insufficient. Demand for ready-to-use pediatric formulas and condition-specific nutrition continues to grow as awareness among caregivers and pediatricians increases.

Increasing Prevalence of Metabolic Disorders

The metabolic disorders segment generated significant revenues in 2024. Conditions like phenylketonuria (PKU), maple syrup urine disease, and other inborn errors of metabolism require lifelong dietary management, often through medical nutrition. Manufacturers are developing protein-modified and amino acid-based formulas to cater to these unique requirements.

North America to Emerge as a Lucrative Region

North America clinical nutrition market held a robust share in 2024, driven by a well-established healthcare infrastructure, higher diagnosis rates, and strong insurance coverage. The U.S. leads the region, with increasing demand across hospitals, long-term care centers, and home healthcare settings. Product innovation and personalized nutrition are gaining traction, especially in the context of chronic disease management and post-surgical recovery.

Major players in the clinical nutrition market are Nestle Health Science, Baxter, BASF, Hormel Foods, Fresenius Kabi, Abbott (Abbott Nutrition), Danone, Grifols SA, Perrigo, Mead Johnson (Reckitt Benckiser), Meiji Holdings, Hero Nutritionals, Aculife Healthcare, and B. Braun.

To solidify their market presence, companies in the clinical nutrition space are focusing on R&D to develop specialized and condition-specific products that align with modern medical protocols. Strategic partnerships with hospitals and healthcare providers are expanding access, while digital tools deploy to track patient outcomes and improve compliance. Firms are also targeting emerging economies through localized manufacturing and tailored marketing strategies. Mergers and acquisitions remain common, as leading players seek to expand their product portfolios and global reach.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Consumer

- 2.2.4 Application

- 2.2.5 Dosage Form

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of chronic diseases

- 3.2.1.2 High incidence of malnutrition

- 3.2.1.3 Advancements in nutritional science

- 3.2.1.4 Growing awareness and healthcare spending

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced formulations

- 3.2.2.2 Limited reimbursement policies

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of the home healthcare sector

- 3.2.3.2 Digital health integration

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Technology landscape

- 3.4.1 Current technological trends

- 3.4.2 Emerging technologies

- 3.5 Supply chain analysis for clinical nutrition

- 3.6 Dietary supplements usage scenario

- 3.7 Regulatory landscape

- 3.8 Future market trends

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Infant nutrition

- 5.2.1 Milk-based

- 5.2.2 Soy-based

- 5.2.3 Organic formula

- 5.2.4 Other infant formulas

- 5.3 Enteral nutrition

- 5.3.1 Standard composition

- 5.3.2 Disease-specific composition

- 5.3.3 Elemental formulas

- 5.3.4 Other enteral formulas

- 5.4 Parenteral nutrition

- 5.4.1 Amino acids

- 5.4.2 Fats

- 5.4.3 Carbohydrates

- 5.4.4 Vitamins & minerals

- 5.4.5 Other parenteral formulas

Chapter 6 Market Estimates and Forecast, By Consumer, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Pediatric

- 6.3 Adult

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Malnutrition

- 7.3 Cancer nutrition

- 7.4 Metabolic disorders

- 7.5 Neurological diseases

- 7.6 Gastrointestinal disorder

- 7.7 Other applications

Chapter 8 Market Estimates and Forecast, By Dosage Form, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Powder

- 8.3 Liquid

- 8.4 Solid

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Offline channels

- 9.2.1 Hospital pharmacies

- 9.2.2 Retail pharmacies

- 9.2.3 Other offline channels

- 9.3 Online channels

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 Japan

- 10.4.2 China

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Abbott (Abbott Nutrition)

- 11.2 Aculife Healthcare

- 11.3 B Braun

- 11.4 BASF

- 11.5 Baxter

- 11.6 Danone

- 11.7 Fresenius Kabi

- 11.8 Grifols

- 11.9 Hero Nutritionals

- 11.10 Hormel Foods

- 11.11 Mead Johnson (Reckitt Benckiser)

- 11.12 Meiji Holdings

- 11.13 Nestle Health Science

- 11.14 Perrigo