PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833672

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833672

Ceramic Filters Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

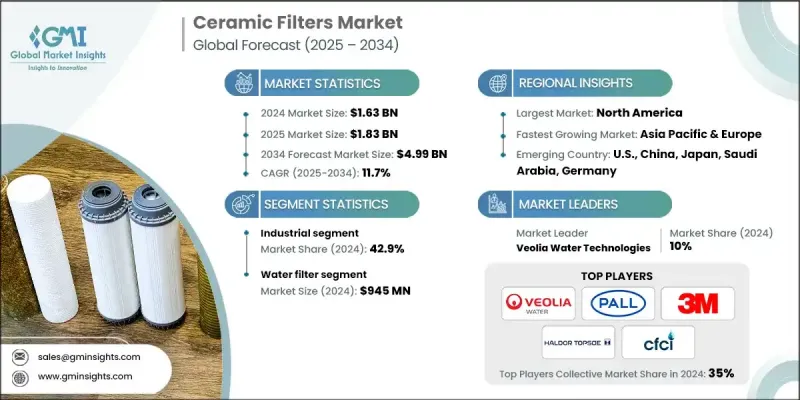

The global ceramic filters market was estimated at USD 1.63 billion in 2024 and is expected to grow from USD 1.83 billion in 2025 to USD 4.99 billion by 2034, at a CAGR of 11.7%, according to the latest report published by Global Market Insights Inc.

The growing global demand for clean and safe drinking water is one of the main drivers for the ceramic filters market. With rising concerns over water contamination, particularly in developing regions, ceramic filters are gaining popularity due to their effective filtration properties, affordability, and ease of use in providing potable water.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.63 Billion |

| Forecast Value | $4.99 Billion |

| CAGR | 11.7% |

Rising Adoption in the Industrial Sector

The industrial segment held a notable share in 2024, driven by the increasing demand for efficient filtration in various industries, including chemicals, pharmaceuticals, food processing, and petrochemicals. The high temperature resistance and durability of ceramic filters make them ideal for challenging industrial environments, where they offer long-term performance and low maintenance. Companies in this segment are focusing on developing more robust and customizable filter solutions that can meet the specific needs of diverse industrial sectors, further propelling market growth.

Water Filter to Gain Traction

The water filter segment generated a significant share in 2024, as these filters offer a highly effective and affordable solution for clean drinking water, especially in developing countries. Their ability to remove bacteria, sediments, and other impurities make them a popular choice for households, NGOs, and municipal water treatment plants. With increasing concerns over water contamination, companies are introducing new ceramic filter designs that are easier to use, more efficient, and eco-friendly, catering to the growing need for safe drinking water worldwide.

North America to Emerge as a Lucrative Region

North America ceramic filters market is poised for significant growth through 2034, driven by the increasing adoption of ceramic filters in both industrial and consumer applications. In the U.S. and Canada, there is a rising demand for water filtration solutions that are cost-effective, durable, and capable of improving water quality, particularly in rural and remote areas. With stringent environmental regulations and a growing focus on sustainability, ceramic filters are gaining popularity for their eco-friendly and reusable nature.

Key players in the ceramic filters market are Pall, Veolia Water Technologies, Morgan Advanced Materials, LiqTech International, Ceramicx, Doulton, Kyocera, Nanostone Water, Aquacera, Metkem Silicon, Haldor Topsoe, 3M, CeramTec, Klean Kanteen, and Ceramic Filters Company.

To strengthen their presence and position in the ceramic filters market, companies are focusing on several strategic initiatives. First, they are investing in research and development to enhance the efficiency and functionality of their ceramic filters, incorporating advanced materials and innovative manufacturing techniques. Companies are also expanding their product portfolios to include customized solutions that cater to specific customer needs, such as higher filtration precision or faster filtration speeds.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product Type

- 2.2.3 Ceramic Type

- 2.2.4 Application

- 2.2.5 End use

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing environmental concerns

- 3.2.1.2 Increasing demand for cleaner water and air

- 3.2.1.3 Stringent regulations

- 3.2.1.4 Technological advancements

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial cost

- 3.2.2.2 Availability of alternatives

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034, (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Air filters

- 5.3 Water filters

Chapter 6 Market Estimates & Forecast, By Ceramic Type, 2021 - 2034, (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Alumina

- 6.3 Zirconia

- 6.4 Silicon carbide

- 6.5 Titania

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034, (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Water treatment

- 7.3 Air filtration

- 7.4 Food and beverage filtration

- 7.5 Automotive emission control

- 7.6 Industrial process filtration

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034, (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Commercial

- 8.3 Residential

- 8.4 Industrial

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Million) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.4.6 Indonesia

- 10.4.7 Malaysia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 UAE

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 3M

- 11.2 Aquacera

- 11.3 Ceramic Filters Company

- 11.4 Ceramicx

- 11.5 CeramTec

- 11.6 Doulton

- 11.7 Haldor Topsoe

- 11.8 Klean Kanteen

- 11.9 Kyocera

- 11.10 LiqTech International

- 11.11 Metkem Silicon

- 11.12 Morgan Advanced Materials

- 11.13 Nanostone Water

- 11.14 Pall

- 11.15 Veolia Water Technologies