PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833674

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833674

Fundus Cameras Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

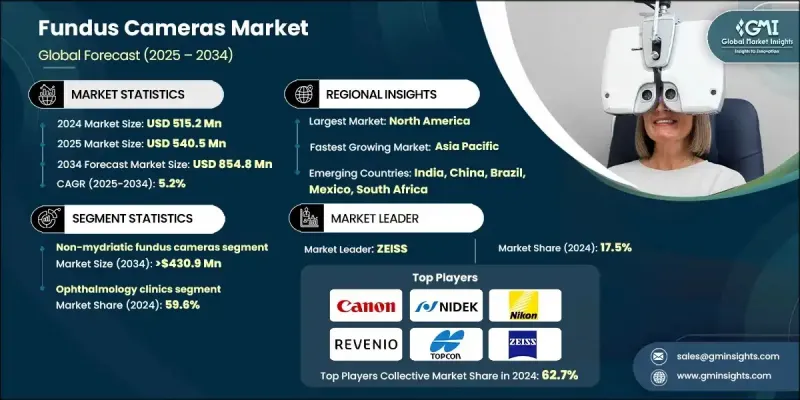

The Global Fundus Cameras Market was valued at USD 515.2 million in 2024 and is estimated to grow at a CAGR of 5.2% to reach USD 854.8 million by 2034.

The market is seeing consistent growth due to an increase in eye-related disorders, expanding geriatric populations, rapid improvements in imaging technology, and growing initiatives by governments and healthcare organizations to enhance vision care. Rising demand for early diagnosis and management of chronic eye diseases is increasing the adoption of advanced retinal imaging tools across medical settings. The transition to telehealth services has also played a vital role in broadening access to eye care, especially in underserved areas. Fundus cameras integrated with digital technologies are making it easier for healthcare providers to conduct remote screenings, enabling early detection of conditions and reducing the need for in-person visits. Continued innovation in product design, including compact and user-friendly interfaces, has enhanced clinical workflows and boosted efficiency. The combination of optical coherence tomography with fundus imaging in a single device is also transforming how ophthalmologists diagnose and treat patients, providing high-resolution, comprehensive retinal evaluations that save both time and resources.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $515.2 million |

| Forecast Value | $854.8 million |

| CAGR | 5.2% |

The non-mydriatic fundus cameras segment accounted for a 52.8% share in 2024, fueled by their ability to perform quick and efficient imaging without the need for pupil dilation. These cameras have gained widespread popularity across primary care settings and teleophthalmology programs, making them ideal for high-throughput eye disease screening. Their ease of use and patient comfort have helped improve compliance and accessibility in both clinical and remote settings. These systems eliminate the discomfort and delay of traditional dilation processes, making them the preferred choice for first-line screening and regular eye checkups.

The ophthalmology clinics segment held a 59.6% share in 2024 and will reach USD 512.9 million by 2034. Clinics serve as the main centers for diagnosis and ongoing treatment of eye conditions such as macular degeneration, diabetic retinopathy, and glaucoma. As the incidence of these chronic diseases continues to grow globally, clinics are increasingly adopting advanced diagnostic solutions to support faster and more accurate care. Many are turning to hybrid imaging systems that combine fundus photography with OCT technology for comprehensive assessments in a single session.

North America Fundus Cameras Market held a 41.6% share in 2024. The region benefits from strong healthcare infrastructure, well-defined reimbursement systems for diagnostic eye exams, and proactive government involvement in preventive care. Insurance coverage significantly supports the uptake of fundus cameras in hospitals, clinics, and specialty centers. North America also leads in embracing advanced ophthalmic technologies, particularly AI-enabled and hybrid systems that streamline imaging and enhance diagnostic accuracy.

Major manufacturers and suppliers in the Global Fundus Cameras Market include ZEISS, Nikon (Optos), NIDEK, TOPCON, Canon, Samsung, Visionix, epipole, Forus Health, Huvitz, Kowa, OPTOMED, Remidio, REVENIO, and Volk Optical. To gain a competitive edge, leading companies in the fundus cameras market are focusing on continuous product development, smart integration with digital platforms, and expanding global reach. Many are enhancing their devices with artificial intelligence, cloud-based storage, and telehealth compatibility to meet evolving clinical demands. Partnerships with healthcare providers, NGOs, and government programs help companies penetrate emerging markets and improve screening access in remote areas.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of eye disorders

- 3.2.1.2 Favorable reimbursement scenario

- 3.2.1.3 Technological advancements

- 3.2.1.4 Rising demand for early disease detection and screening

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of fundus cameras

- 3.2.2.2 Lack of ophthalmologists in developing economies

- 3.2.3 Market opportunities

- 3.2.3.1 Growing adoption of handheld and portable fundus cameras

- 3.2.3.2 Increasing focus on pediatric and neonatal retinal screening

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Reimbursement scenario

- 3.5 Regulatory landscape

- 3.5.1 North America

- 3.5.2 Europe

- 3.5.3 Asia Pacific

- 3.6 Technology landscape

- 3.6.1 Current technological trends

- 3.6.2 Emerging technologies

- 3.7 Pricing analysis, 2024

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

- 3.11 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 LAMEA

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn and Units)

- 5.1 Key trends

- 5.2 Mydriatic fundus cameras

- 5.2.1 Tabletop

- 5.2.2 Handheld

- 5.3 Non-mydriatic fundus cameras

- 5.3.1 Tabletop

- 5.3.2 Handheld

- 5.4 Hybrid fundus cameras

Chapter 6 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Ophthalmology clinics

- 6.3 Hospitals

- 6.4 Other end use

Chapter 7 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn and Units)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.3.7 Poland

- 7.3.8 Sweden

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.4.6 Indonesia

- 7.4.7 Philippines

- 7.4.8 Vietnam

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.5.4 Colombia

- 7.5.5 Chile

- 7.5.6 Peru

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

- 7.6.4 Turkey

- 7.6.5 Israel

- 7.6.6 Iran

Chapter 8 Company Profiles

- 8.1 Canon

- 8.2 epipole

- 8.3 Forus Health

- 8.4 Huvitz

- 8.5 Kowa

- 8.6 NIDEK

- 8.7 Nikon (Optos)

- 8.8 OPTOMED

- 8.9 Remidio

- 8.10 REVENIO

- 8.11 SAMSUNG

- 8.12 TOPCON

- 8.13 Visionix

- 8.14 Volk Optical

- 8.15 ZEISS