PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833677

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833677

Construction Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

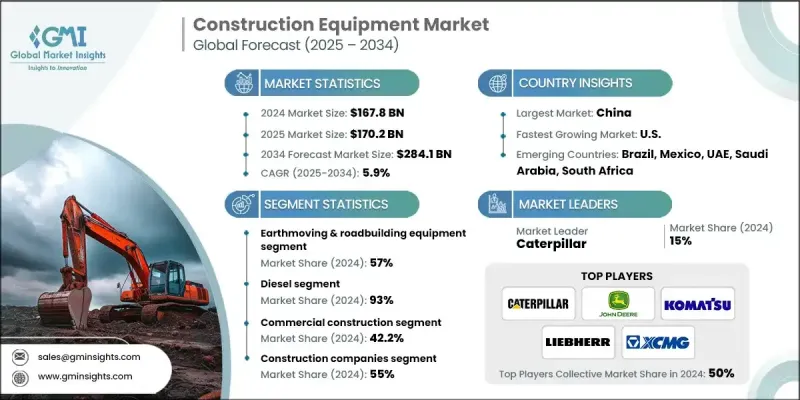

The Global Construction Equipment Market was valued at USD 167.8 billion in 2024 and is estimated to grow at a CAGR of 5.9% to reach USD 284.1 billion by 2034.

The growth is driven by the rising infrastructure development and urbanization. Governments are investing heavily in infrastructure such as roads, bridges, airports, and railways to boost economic growth and improve connectivity. This increase in construction demands advanced machinery, increasing the demand for construction equipment. The integration of technological advancements such as AI and IoT into manufacturing devices is increasing productivity and safety, making these devices more attractive to manufacturing companies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $167.8 Billion |

| Forecast Value | $284.1 Billion |

| CAGR | 5.9% |

The rise in private sector investments and real estate development will also influence market growth. As industry expands and new industries emerge, the need for retail, industrial, and construction work increases. This increases the demand for construction equipment, ranging from excavators and forklifts to cranes and bulldozers. The shift towards industrialization in agriculture and mining is important, as these industries require specialized equipment to be efficient.

The earthmoving and road-building equipment segment held a 57% share in 2024 and is forecasted to grow at a CAGR of 5% between 2025 and 2034. This segment, which includes machinery such as backhoes, excavators, loaders, and compactors, is poised for accelerated growth due to increasing investments in public infrastructure and the rapid execution of road development projects by governments worldwide. The surge in demand for efficient road transportation systems and better connectivity to rural and underdeveloped regions has solidified the dominance of earthmoving and road construction machinery in the overall construction equipment sector.

In terms of fuel type, the diesel-powered equipment segment held a 93% share in 2024 and is anticipated to grow at a CAGR of 5% during 2025-2034. Leading manufacturers are equipping their diesel fleets with smart technologies to enhance performance, reduce downtime, and improve fuel efficiency. Advanced telematics solutions featuring GPS integration, diagnostics, and sensor-based monitoring are being deployed to collect and transmit operational data in real time via mobile networks. These innovations provide insights into equipment usage, predictive maintenance, and performance optimization, helping operators extend machine life while maximizing job site productivity.

Asia Pacific Construction Equipment Market held a 45.7% share in 2024. The regional expansion is underpinned by consistent upgrades in telecommunications and infrastructure sectors. Growth in telecommunication tower construction and fiber-optic rollout is propelling demand for cranes and other lifting equipment. Additionally, rental models are gaining popularity across the region, especially for high-performance, low-maintenance machines. Contractors are increasingly opting to rent modern equipment rather than purchasing older machinery, minimizing operational costs and ensuring better efficiency on construction sites.

Major players operating in the construction equipment industry include Terex, Komatsu, CNH Industrial, Caterpillar, XCMG, Hitachi Construction Machinery, Liebherr, Volvo, Doosan, Deere & Co., and Sany. Leading construction equipment manufacturers are focusing on innovation, sustainability, and digital transformation to strengthen their global footprint. Many are integrating telematics, IoT, and automation technologies to enhance equipment performance, safety, and remote operability. Companies are expanding their hybrid and electric product lines to comply with tightening emission regulations and meet green construction demands. Strategic partnerships with technology firms are enabling next-gen machinery that supports smart construction practices. Additionally, firms are strengthening their aftermarket services, parts supply chains, and global dealer networks to improve customer experience and support.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Propulsion

- 2.2.4 Application

- 2.2.5 End use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

- 2.6 Strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Urbanization and infrastructure development

- 3.2.1.2 Rising government investments in smart cities & public works

- 3.2.1.3 Technological advancements (automation, telematics, IoT)

- 3.2.1.4 Shift toward electric and hybrid construction equipment

- 3.2.1.5 Rental and leasing boom

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High capital and maintenance costs

- 3.2.2.2 Volatility in raw material prices

- 3.2.2.3 Shortage of skilled operators

- 3.2.2.4 Regulatory and emission compliance requirements

- 3.2.2.5 Intense competition from rental and used equipment

- 3.2.3 Market opportunities

- 3.2.3.1 Electric & Hybrid Equipment Adoption Acceleration

- 3.2.3.2 Autonomous Construction Operations & AI Integration

- 3.2.3.3 Precision Construction Technology & GPS Guidance

- 3.2.3.4 Equipment-as-a-Service (EaaS) Business Models

- 3.2.3.5 Retrofit & Upgrade Market for Legacy Equipment

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Major market trends and disruptions

- 3.5 Future market trends

- 3.6 Regulatory landscape

- 3.6.1 North America

- 3.6.2 Europe

- 3.6.3 Asia Pacific

- 3.6.4 Latin America

- 3.6.5 MEA

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent analysis

- 3.11 Price trends

- 3.11.1 By region

- 3.11.2 By product

- 3.12 Cost breakdown analysis

- 3.13 Production statistics

- 3.13.1 Production hubs

- 3.13.2 Import and export

- 3.13.3 Major import countries

- 3.14 Sustainability and environmental aspects

- 3.14.1 Sustainable practices

- 3.14.2 Waste reduction strategies

- 3.14.3 Energy efficiency in production

- 3.14.4 Eco-friendly initiatives

- 3.14.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Earthmoving & roadbuilding equipment

- 5.2.1 Backhoe

- 5.2.2 Excavator

- 5.2.3 Loader

- 5.2.4 Compaction equipment

- 5.2.5 Others

- 5.3 Material handling and cranes

- 5.3.1 Storage and handling equipment

- 5.3.2 Engineered systems

- 5.3.3 Industrial trucks

- 5.3.4 Bulk material handling equipment

- 5.4 Concrete equipment

- 5.4.1 Concrete pumps

- 5.4.2 Crusher

- 5.4.3 Transit mixers

- 5.4.4 Asphalt pavers

- 5.4.5 Batching plants

Chapter 6 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Diesel

- 6.3 CNG/LNG

- 6.4 Electric

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Residential construction

- 7.3 Commercial construction

- 7.4 Industrial construction

- 7.5 Mining & quarrying

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Construction companies

- 8.3 Mining operators

- 8.4 Rental companies

- 8.5 Government & municipalities

- 8.6 Industrial users

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 Caterpillar

- 10.1.2 Komatsu

- 10.1.3 John Deere

- 10.1.4 Volvo

- 10.1.5 Liebherr

- 10.1.6 Hitachi

- 10.1.7 JCB

- 10.1.8 Sany

- 10.2 Regional Champions

- 10.2.1 Case

- 10.2.2 New Holland

- 10.2.3 Doosan

- 10.2.4 Hyundai

- 10.2.5 XCMG

- 10.2.6 Zoomlion

- 10.2.7 Terex

- 10.2.8 Manitou

- 10.2.9 Wacker Neuson

- 10.3 Emerging Players & Service Providers

- 10.3.1 United Rentals

- 10.3.2 Ashtead Group / Sunbelt Rentals

- 10.3.3 H&E Equipment Services

- 10.3.4 Home Depot Tool Rental

- 10.3.5 Built Robotics

- 10.3.6 SafeAI

- 10.3.7 Trimble

- 10.3.8 Topcon