PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833686

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833686

Pneumonia Therapeutics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

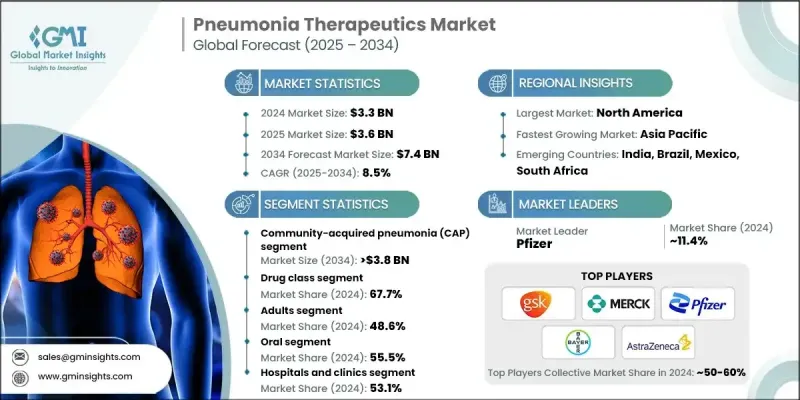

The Global Pneumonia Therapeutics Market was valued at USD 3.3 billion in 2024 and is estimated to grow at a CAGR of 8.5% to reach USD 7.4 billion by 2034.

Pneumonia incidence is increasing globally, especially among older adults, young children, and people with weakened immune systems. Respiratory failure, a serious complication that impairs oxygen transfer and carbon dioxide removal, significantly increases mortality risk in these vulnerable populations. Hospital-acquired and ventilator-associated pneumonia are also growing concerns as stays lengthen, and mechanical ventilation becomes more common. Therapeutic options for pneumonia encompass antibacterial, antiviral, antifungal drugs, vaccines, and supportive treatments like oxygen therapy. These are distinguished from broader respiratory medications by targeting specific pathogens, guided by diagnostic testing. Innovations in molecular diagnostics and point-of-care testing are making pathogen identification more precise, allowing treatment to be better tailored and reducing misuse of antibiotics. With online pharmacies and direct-to-consumer channels expanding, patients and caregivers are gaining easier access to both prescription and over-the-counter treatments. Regionally, North America holds a dominant position, supported by high healthcare spending, strong diagnostic infrastructure, and early adoption of advanced therapies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.3 Billion |

| Forecast Value | $7.4 Billion |

| CAGR | 8.5% |

In 2024, the community-acquired pneumonia (CAP) segment held 51.4% share, driven by a wide mix of pathogens, patient risk factors like age and underlying health conditions, and environmental influences contributing to its high incidence. CAP remains the most prominent category in pneumonia therapeutics globally, affecting both pediatric and adult populations, and rising hospitalization rates for CAP are spurring demand for novel therapeutic solutions.

The drug class segment held 67.7% share in 2024 owing to its effectiveness in treating both mild and severe pneumonia. This segment breaks down into antibacterial, antiviral, antifungal, and other drug types, with antibacterial treatments further divided into quinolones, macrolides, and other antibacterial agents. The prevalence of bacterial pneumonia, coupled with increasing multidrug-resistant organisms, has driven demand for new drug formulations and combination therapies.

U.S. Pneumonia Therapeutics Market was estimated at USD 1.2 billion in 2024. Rising prevalence, increasing hospitalizations, and mortality associated with pneumonia in the U.S. are fueling market expansion. The demand for vaccines and targeted therapies is growing sharply as risk factors become more prevalent and diagnostic capabilities become more advanced.

Major players operating in the pneumonia therapeutics industry include Novartis, Abbott Laboratories, GlaxoSmithKline, AstraZeneca, Cipla, Teva Pharmaceuticals, Bayer, Lupin Pharmaceuticals, F. Hoffmann-La Roche, Baxter International, Merck & Co., Mylan, Johnson & Johnson, Daiichi Sankyo, AbbVie, Bristol Myers Squibb. Leading firms in pneumonia therapeutics market are focusing on precision medicine, translational research, and diagnostic integration to solidify their competitive positions. Many are investing heavily in molecular diagnostic tools and point-of-care testing to distinguish between viral, bacterial, and fungal cases, enabling more effective therapy and reducing wastage. Companies are also developing novel antibiotics and biologics to address drug resistance, and combination treatments that shorten treatment duration. Strategic alliances with vaccine developers strengthen portfolios, while expanding into digital and telehealth channels increases access and awareness.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumption and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Infection type

- 2.2.3 Treatment type

- 2.2.4 Age group

- 2.2.5 Route of administration

- 2.2.6 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising global pneumonia cases

- 3.2.1.2 Aging population and immunocompromised patients

- 3.2.1.3 Expansion of telehealth and e-pharmacy

- 3.2.1.4 Government vaccination programs

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of branded drugs and vaccines

- 3.2.2.2 Limited awareness in developing regions

- 3.2.3 Market opportunities

- 3.2.3.1 Development of combination therapies

- 3.2.3.2 Emerging markets with rising healthcare investment

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S.

- 3.4.1.2 Canada

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.1 North America

- 3.5 Future market trends

- 3.6 Technology landscape

- 3.6.1 Current technology

- 3.6.2 Emerging technologies

- 3.7 Pricing analysis

- 3.8 Pipeline analysis

- 3.9 Gap analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Infection Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Community-acquired pneumonia (CAP)

- 5.3 Hospital-acquired pneumonia (HAP)

- 5.4 Ventilator-associated pneumonia (VAP)

- 5.5 Other infection types

Chapter 6 Market Estimates and Forecast, By Treatment Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Drug class

- 6.2.1 Antibacterial drugs

- 6.2.1.1 Quinolones

- 6.2.1.2 Macrolide

- 6.2.1.3 Other antibacterial drugs

- 6.2.2 Antiviral drugs

- 6.2.3 Antifungal drugs

- 6.2.4 Other drug classes

- 6.2.1 Antibacterial drugs

- 6.3 Vaccines

- 6.4 Oxygen therapy

Chapter 7 Market Estimates and Forecast, By Age Group, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Pediatrics

- 7.3 Adults

- 7.4 Geriatrics

Chapter 8 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Oral

- 8.3 Parenteral

- 8.4 Other routes of administration

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals and clinics

- 9.3 Homecare settings

- 9.4 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Abbott Laboratories

- 11.2 AbbVie

- 11.3 AstraZeneca

- 11.4 Baxter International

- 11.5 Bayer

- 11.6 Bristol Myers Squibb

- 11.7 Cipla

- 11.8 Daiichi Sankyo

- 11.9 F. Hoffmann-La Roche

- 11.10 GlaxoSmithKline

- 11.11 Johnson & Johnson

- 11.12 Lupin Pharmaceuticals

- 11.13 Merck & Co.

- 11.14 Mylan

- 11.15 Novartis

- 11.16 Pfizer

- 11.17 Teva Pharmaceuticals