PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844251

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844251

U.S. Circular Economy Materials in Construction Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

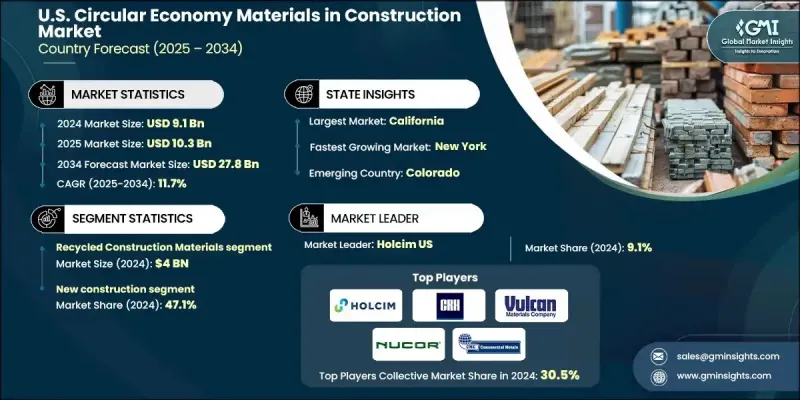

U.S. Circular Economy Materials in Construction Market was valued at USD 9.1 billion in 2024 and is estimated to grow at a CAGR of 11.7% to reach USD 27.8 billion by 2034.

This growth is fueled by strong policy backing, increased infrastructure funding, and a widespread shift toward sustainable building practices. Public investments and mandates are shaping material choices in both commercial and public-sector construction, accelerating the transition from linear to circular resource flows. Market uptake is also supported by a growing preference for low-carbon, durable materials that comply with green building certifications. Cities are actively embedding circularity into their redevelopment projects, while contractors and developers are responding to incentives by integrating recycled, bio-based, and waste-derived materials into designs. Economic competitiveness is also improving, as seen in the significant drop in the cost of carbon-infused materials, which are now able to rival conventional options. The market's evolution is tied closely to regulatory developments, advancements in product performance, and the scaling of circular supply chains.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.1 Billion |

| Forecast Value | $27.8 Billion |

| CAGR | 11.7% |

The recycled construction materials segment is USD 4 billion in 2024, holding a 48% share. These materials are widely used due to their compatibility with current construction codes and the existence of well-established processing and distribution systems. Products made from reclaimed steel, recycled concrete, and salvaged wood are finding broader applications in both infrastructure and commercial developments. Additionally, rising interest in natural, renewable materials like strawboard and hemp-based composites is pushing innovation in the residential and low-rise segments.

The new construction segment held a 47.1% share in 2024, supported by flexibility in design planning and a preference for performance-certified building materials. Architects and general contractors are specifying low-emission materials early in the project lifecycle to meet energy, emissions, and durability targets. Circular inputs are increasingly present in high-growth sectors like commercial real estate and multifamily housing, driven by the need for sustainable systems that offer traceable lifecycle value and resilience.

Northeast Circular Economy Materials in Construction Market generated USD 3.1 billion in 2024, reflecting strong regional policy support and robust demand for circular material solutions. Numerous city-level programs in this region are creating demand for recycled aggregates, bio-based alternatives, and repurposed inputs in public infrastructure. Partnerships between municipalities and construction firms are forming a foundational ecosystem for the reuse and reintegration of materials into both public and private developments. Green building codes and performance-based incentives are also driving innovation and procurement in transit-oriented and redevelopment zones.

Key players driving this U.S. Circular Economy Materials in Construction Market include CRH Americas, Vulcan Materials, CarbonCure Technologies, Holcim US, Urban Mining CT, SmartLam North America, Nucor Corporation, Trex Company, Strategic Materials, SEFA Group, Granite Construction, Commercial Metals Company, Charah Solutions, Azek Company, and Eco Material Technologies. To strengthen their foothold, leading companies in the U.S. circular economy materials in the construction market are investing in advanced recycling technologies and expanding processing infrastructure for reclaimed materials. Several are developing proprietary low-carbon product lines, including circular aggregates and composite solutions, to meet regulatory and project-specific requirements. Firms are also forming strategic partnerships with local governments, builders, and green certifying bodies to streamline product certification and drive adoption.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Material trends

- 2.2.2 Application trends

- 2.2.3 End use sector trends

- 2.2.4 Regional trends

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By material

- 3.9 Future market trends

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Material Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Bio-based construction materials

- 5.2.1 Hemp-based materials

- 5.2.2 Agricultural residue-based materials

- 5.2.3 Timber & engineered wood products

- 5.2.4 Mycelium-based materials

- 5.2.5 Natural fiber insulation

- 5.3 Recycled construction materials

- 5.3.1 Recycled concrete aggregate (RCA)

- 5.3.2 Recycled steel and metal components

- 5.3.3 Recycled glass and ceramic materials

- 5.3.4 Recycled plastic construction products

- 5.3.5 Reclaimed timber and wood

- 5.4 Circular and innovative composites

- 5.4.1 Fiber-reinforced polymer composites

- 5.4.2 Bio-based polymer composites

- 5.4.3 Hybrid circular material systems

- 5.5 Waste-to-material technologies

- 5.5.1 Construction & demolition waste processing

- 5.5.2 Industrial symbiosis feedstocks

- 5.5.3 Advanced sorting & recovery systems

- 5.6 Others

Chapter 6 Market Estimates and Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 New construction

- 6.2.1 Structural applications

- 6.2.2 Building envelope & insulation

- 6.2.3 Interior finishing materials

- 6.3 Renovation & retrofit

- 6.3.1 Envelope upgrades

- 6.3.2 Interior renovation

- 6.3.3 Energy efficiency improvements

- 6.4 Infrastructure development

- 6.4.1 Transportation & road infrastructure

- 6.4.2 Utility & public works

- 6.4.3 Modular civil infrastructure

- 6.5 Deconstruction & reuse

- 6.5.1 Selective deconstruction

- 6.5.2 Component refurbishment & remanufacturing

- 6.5.3 Material banking & reuse platforms

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By End Use Sector, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Residential construction

- 7.3 Commercial construction

- 7.4 Industrial construction

- 7.5 Infrastructure & civil engineering

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Northeast

- 8.2.1 New York

- 8.2.2 Massachusetts

- 8.2.3 Pennsylvania

- 8.2.4 New Jersey

- 8.3 Midwest

- 8.3.1 Illinois

- 8.3.2 Ohio

- 8.3.3 Michigan

- 8.3.4 Minnesota

- 8.4 South

- 8.4.1 Texas

- 8.4.2 Florida

- 8.4.3 Georgia

- 8.4.4 North Carolina

- 8.5 West

- 8.5.1 California

- 8.5.2 Washington

- 8.5.3 Oregon

- 8.5.4 Colorado

- 8.6 Southwest / Mountain States

- 8.6.1 Arizona

- 8.6.2 Nevada

- 8.6.3 Utah

Chapter 9 Company Profiles

- 9.1 Holcim US

- 9.2 CRH Americas

- 9.3 Vulcan Materials

- 9.4 Granite Construction

- 9.5 Eco Material Technologies

- 9.6 Charah Solutions

- 9.7 SEFA Group

- 9.8 Nucor Corporation

- 9.9 Commercial Metals Company

- 9.10 Trex Company

- 9.11 Azek Company

- 9.12 Strategic Materials

- 9.13 Urban Mining CT

- 9.14 CarbonCure Technologies

- 9.15 SmartLam North America