PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844252

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844252

CubeSat Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

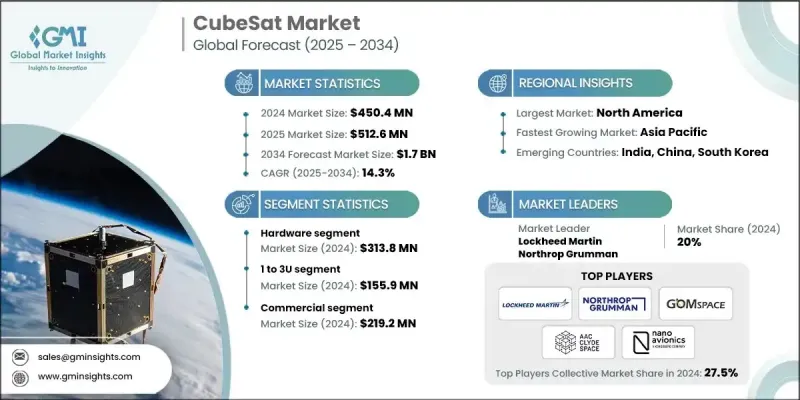

The Global CubeSat Market was valued at USD 450.4 million in 2024 and is estimated to grow at a CAGR of 14.3% to reach USD 1.7 billion by 2034.

The demand for Earth observation data, the rapid expansion of IoT and global connectivity, and advancements in miniaturization are key factors driving this market. Increased government and commercial investments in space technologies are also playing a significant role in accelerating CubeSat development, leading to more frequent missions focused on communication, Earth monitoring, scientific exploration, and educational purposes. The rise in satellite constellations is further boosting the need for low-cost, flexible CubeSat solutions, making them highly valuable for global connectivity and IoT applications. With the growing need for massive data transmission, CubeSats are becoming integral to meeting the communication and remote sensing needs of the modern world.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $450.4 million |

| Forecast Value | $1.7 billion |

| CAGR | 14.3% |

The hardware segment was valued at USD 313.8 million in 2024, driven by the increasing demand for miniaturized components and the adoption of CubeSats for communication, Earth observation, and scientific research. Technological advancements in satellite design, including increased durability and the integration of AI and IoT, are expected to continue shaping the hardware segment. To remain competitive, manufacturers need to focus on reducing costs, improving durability, and integrating cutting-edge technologies to align with the market's rapid evolution.

In 2024, the 1-3U CubeSat segment was valued at USD 155.9 million. This segment is widely utilized for Earth observation, communication, and scientific applications due to its compact size, cost-effectiveness in launching payloads, and capability to carry smaller but advanced sensor technologies. Manufacturers are encouraged to prioritize developing highly efficient, miniaturized sensors and increasing power efficiency while ensuring these systems are durable and customizable for swift deployment in the 1 to 3U segment.

U.S. CubeSat Market was valued at USD 166.8 million in 2024, fueled by substantial venture capital and private equity funding, fostering innovation in CubeSat technology. Strong collaboration between government entities and the private sector, along with a robust space launch infrastructure, enables further expansion. U.S.-based manufacturers should focus on strengthening partnerships with government agencies, exploring venture capital opportunities, and developing cost-effective CubeSat technologies to leverage the nation's advanced launch capabilities and cater to the growing demand for commercial and research-driven missions.

Several prominent companies are leading the Global CubeSat industry, including AAC Clyde Space, CU Aerospace, Dragonfly Aerospace, EnduroSat, EXOLAUNCH GmbH, GomSpace, ISISPACE GROUP, Lockheed Martin, Maverick Space Systems Inc., NanoAvionics, Northrop Grumman, Pumpkin Space Systems, RTX Corporation, Space Inventor A/S, SpaceX, Surrey Satellite Technology Ltd, and Tyvak International.

Key strategies adopted by companies in the Global CubeSat market to strengthen their market position include focusing on reducing production costs through economies of scale and enhancing the durability of satellite components. Companies are also emphasizing the development of modular CubeSat platforms, allowing for quick and flexible customization to meet the varying needs of clients. Additionally, companies are integrating advanced technologies such as artificial intelligence, Internet of Things (IoT), and miniaturized sensors to keep pace with evolving customer requirements. Strong partnerships with government agencies and private investors, along with collaboration in satellite launch infrastructure, are also vital to maintaining a competitive edge in this growing market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry snapshot

- 2.2 Key market trends

- 2.2.1 Size trends

- 2.2.2 Component trends

- 2.2.3 Application trends

- 2.2.4 End use trends

- 2.2.5 Regional

- 2.3 TAM Analysis, 2025-2034 (USD Million)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for earth observation data

- 3.2.1.2 Expansion of IoT and global connectivity

- 3.2.1.3 Technological advancements in miniaturization

- 3.2.1.4 Increased government and commercial investments in space

- 3.2.1.5 Rising use of satellite constellations

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Space debris and regulatory challenges

- 3.2.2.2 Limited durability leads to frequent replacements

- 3.2.3 Market opportunities

- 3.2.3.1 Emerging space tourism and exploration missions

- 3.2.3.2 Development of in-orbit servicing and debris removal

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Emerging business models

- 3.9 Compliance requirements

- 3.10 Defense budget analysis

- 3.11 Global defense spending trends

- 3.12 Regional defense budget allocation

- 3.12.1 North America

- 3.12.2 Europe

- 3.12.3 Asia Pacific

- 3.12.4 Middle East and Africa

- 3.12.5 Latin America

- 3.13 Key defense modernization programs

- 3.14 Budget forecast (2025-2034)

- 3.14.1 Impact on Industry Growth

- 3.14.2 Defense Budgets by Country

- 3.15 Supply chain resilience

- 3.16 Geopolitical analysis

- 3.17 Workforce analysis

- 3.18 Digital transformation

- 3.19 Mergers, acquisitions, and strategic partnerships landscape

- 3.20 Risk assessment and management

- 3.21 Major contract awards (2021-2024)

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.2 Market Concentration Analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Size, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 0.25U to 1U

- 5.3 1 to 3U

- 5.4 3U to 6U

- 5.5 6U to 12U

- 5.6 12U and above

Chapter 6 Market Estimates and Forecast, By Component, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Hardware

- 6.2.1 Payloads

- 6.2.2 Structure

- 6.2.3 Electrical power systems (EPS)

- 6.2.4 Attitude determination & control systems (ADCS)

- 6.2.5 Propulsion systems

- 6.2.6 Communication systems

- 6.2.7 Others

- 6.3 Software

- 6.3.1 Flight software

- 6.3.2 Ground control software

- 6.3.3 Data processing & AI/ML solutions

- 6.4 Services

- 6.4.1 Integration & testing

- 6.4.2 Launch services

- 6.4.3 Mission operations & ground support

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Earth observation & remote sensing

- 7.3 Communication & data relay

- 7.4 Scientific research & exploration

- 7.5 Space observation

- 7.6 Military & defense applications

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Million)

- 8.1 Commercial

- 8.1.1 Telecommunication companies

- 8.1.2 Earth observation & remote sensing companies

- 8.1.3 Newspace startups

- 8.1.4 Others

- 8.2 Government and military

- 8.3 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 Uk

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company profiles

- 10.1 Global Key Players

- 10.1.1 Lockheed Martin

- 10.1.2 Northrop Grumman

- 10.1.3 RTX Corporation

- 10.1.4 SpaceX

- 10.2 Regional Key Players

- 10.2.1 North America

- 10.2.1.1 Maverick Space Systems Inc.

- 10.2.1.2 Pumpkin Space Systems

- 10.2.2 Europe

- 10.2.2.1 AAC Clyde Space

- 10.2.2.2 EnduroSat

- 10.2.2.3 EXOLAUNCH GmbH

- 10.2.2.4 GomSpace

- 10.2.2.5 ISISPACE GROUP

- 10.2.2.6 NanoAvionics

- 10.2.2.7 Space Inventor A/S

- 10.2.2.8 Surrey Satellite Technology Ltd

- 10.2.2.9 Tyvak International

- 10.2.3 Asia-Pacific

- 10.2.3.1 CU Aerospace

- 10.2.1 North America

- 10.3 Disruptors / Niche Players

- 10.3.1 Dragonfly Aerospace.