PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844261

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844261

Environmental Management System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

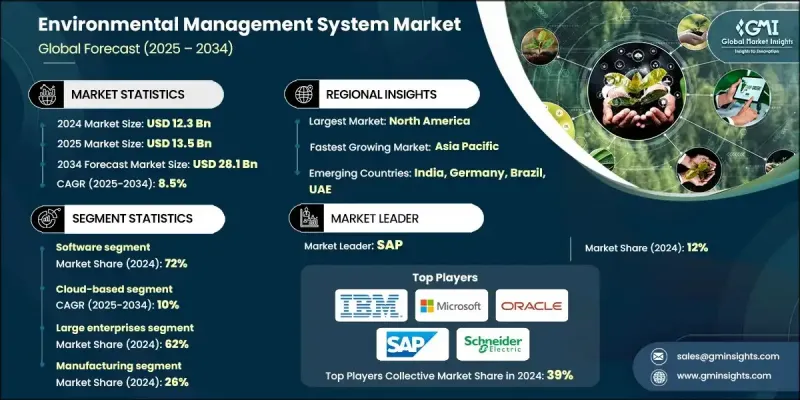

The Global Environmental Management System Market was valued at USD 12.3 billion in 2024 and is estimated to grow at a CAGR of 8.5% to reach USD 28.1 billion by 2034.

Environmental Management System solutions are seeing increased adoption as businesses work toward stronger environmental accountability and regulatory compliance. These systems provide structured frameworks and digital platforms to manage environmental responsibilities efficiently. Built on global standards such as ISO 14001 and EMAS, EMS solutions help organizations develop policies, plan and implement operational controls, monitor performance, and conduct reviews to maintain regulatory alignment.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $12.3 Billion |

| Forecast Value | $28.1 Billion |

| CAGR | 8.5% |

Market growth is fueled by tightening compliance demands, corporate sustainability objectives, and the rising need for digital solutions that track environmental performance across sectors. Businesses are leveraging EMS to demonstrate transparency, manage environmental risks, and integrate ESG priorities into their operations. From energy and construction to manufacturing and public sector services, EMS tools are deployed to standardize procedures and reduce environmental impact across various functions. With mounting pressure from regulators and stakeholders to meet strict environmental goals, companies are aligning EMS with wider business strategies, improving efficiency and long-term sustainability in the process.

In 2024, the software segment held a 72% share. These platforms are designed to streamline environmental data collection, automate compliance reporting, and centralize key metrics for better decision-making. Integration with enterprise software, IoT sensors, and cloud systems enables real-time performance monitoring across multiple locations. Software-based EMS helps organizations adhere to environmental regulations while optimizing their resource usage and operational workflows. Companies following ISO 14001 and other standards rely heavily on EMS software to maintain records, predict potential issues, and coordinate sustainability initiatives across complex operations.

The cloud-based EMS solutions segment is forecasted to grow at a CAGR of 10% from 2025 to 2034. These platforms offer scalable, internet-hosted environments that enable rapid deployment and remote access from any location. Cloud EMS eliminates the need for heavy upfront investment and supports seamless integration with IoT devices for real-time tracking. Subscriptions help reduce capital costs, while centralized systems support cross-site collaboration, analytics, and automated updates. Cloud infrastructure also enhances disaster recovery, maintenance, and version control, allowing teams to operate with greater agility and responsiveness across different regions.

United States Environmental Management System Market generated USD 3.8 billion in 2024. Adoption of EMS platforms in the US continues to rise, driven by environmental policy enforcement and sustainability commitments across federal and state levels. Agencies promote reducing emissions, improving waste control, and enhancing environmental equity, creating demand for structured systems to ensure compliance. Industries such as utilities, manufacturing, and energy are increasingly turning to EMS to monitor emissions, manage resources, and streamline compliance reporting.

Key players shaping the Global Environmental Management System Market include Thermo Fisher Scientific, SAP, IBM, Veolia Environnement, Schneider Electric, Oracle, Microsoft, Siemens, Honeywell International, and Emerson Electric. Leading companies in the Environmental Management System Market are focusing on product innovation, cloud integration, and data-driven insights to strengthen their market position. Many are developing AI-powered platforms that enable predictive analytics, real-time reporting, and automated compliance tracking. Partnerships with ERP and IoT vendors allow for smoother integration of EMS solutions into enterprise operations. Businesses are also expanding global reach through regional offices, cloud-based services, and multilingual support systems. Ongoing investment in cybersecurity ensures secure data handling, while scalable subscription models attract a wider range of clients.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Deployment

- 2.2.4 Enterprise Size

- 2.2.5 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing regulatory compliance requirements

- 3.2.1.2 Expansion of corporate sustainability and ESG programs

- 3.2.1.3 Rising use of digital platforms for environmental data management

- 3.2.1.4 Growth in public sector environmental oversight systems

- 3.2.1.5 Adoption of international standards like ISO 14001 and EMAS

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Complex integration with existing enterprise systems

- 3.2.2.2 Lack of specialized expertise within organizations

- 3.2.3 Market opportunities

- 3.2.3.1 Integration with IoT, cloud, and analytics platforms

- 3.2.3.2 Rising focus on lifecycle resource efficiency

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 Pestel analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Cost breakdown analysis

- 3.8.1 Software licensing & subscription costs

- 3.8.2 Hardware & sensor investment

- 3.8.3 Implementation & integration expenses

- 3.8.4 Training & change management costs

- 3.8.5 Ongoing maintenance & support

- 3.8.6 Compliance & audit costs

- 3.9 Patent analysis

- 3.10 Sustainability & environmental aspects

- 3.10.1 Green IT implementation

- 3.10.2 Carbon neutral technology operations

- 3.10.3 Sustainable software development

- 3.10.4 Environmental impact of technology

- 3.10.5 Circular economy principles

- 3.10.6 Net-zero technology goals

- 3.11 Use cases and applications

- 3.12 Best-case scenario

- 3.13 Risk assessment framework

- 3.13.1 Environmental compliance risks

- 3.13.2 Technology implementation risks

- 3.13.3 Data security & privacy risks

- 3.13.4 Vendor dependency risks

- 3.13.5 Regulatory change risks

- 3.13.6 Operational disruption risks

- 3.13.7 Reputation & brand risks

- 3.14 Investment landscape analysis

- 3.14.1 Venture capital in environmental technology

- 3.14.2 Corporate sustainability investment

- 3.14.3 Government environmental funding

- 3.14.4 Green bond & sustainable finance

- 3.14.5 ESG investment trends

- 3.14.6 ROI analysis by investment type

- 3.14.7 Climate technology funding

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Mn)

- 5.1 Key trends

- 5.2 Software

- 5.3 Services

Chapter 6 Market Estimates & Forecast, By Deployment, 2021 - 2034 ($Mn)

- 6.1 Key trends

- 6.2 On-Premises

- 6.3 Cloud-Based

Chapter 7 Market Estimates & Forecast, By Enterprise Size, 2021 - 2034 ($Mn)

- 7.1 Key trends

- 7.2 Large Enterprises

- 7.3 Small and Medium Enterprises

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn)

- 8.1 Key trends

- 8.2 Manufacturing

- 8.3 Construction

- 8.4 Energy and utilities

- 8.5 Chemicals

- 8.6 Automotive

- 8.7 Pharmaceuticals

- 8.8 Food and Beverage

- 8.9 Government & public sector

- 8.10 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Nordics

- 9.3.7 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 Emerson Electric

- 10.1.2 Honeywell

- 10.1.3 IBM

- 10.1.4 Microsoft

- 10.1.5 Oracle

- 10.1.6 SAP

- 10.1.7 Schneider Electric

- 10.1.8 Siemens

- 10.1.9 Thermo Fisher Scientific

- 10.1.10 Veolia Environnement

- 10.2 Regional Players

- 10.2.1 ABB

- 10.2.2 APEVA

- 10.2.3 AspenTech

- 10.2.4 Bentley Systems

- 10.2.5 Dassault Systemes

- 10.2.6 GE Digital

- 10.2.7 Hexagon

- 10.2.8 Rockwell Automation

- 10.2.9 Trimble

- 10.2.10 Yokogawa Electric

- 10.3 Emerging Players & Innovators

- 10.3.1 EcoOnline

- 10.3.2 Enablon

- 10.3.3 Gensuite

- 10.3.4 Intelex Technologies

- 10.3.5 ProcessMAP

- 10.3.6 Quentic

- 10.3.7 SafetySync

- 10.3.8 SHE Software

- 10.3.9 Sphera Solutions

- 10.3.10 VelocityEHS