PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844266

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844266

Power Conductor Switches Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

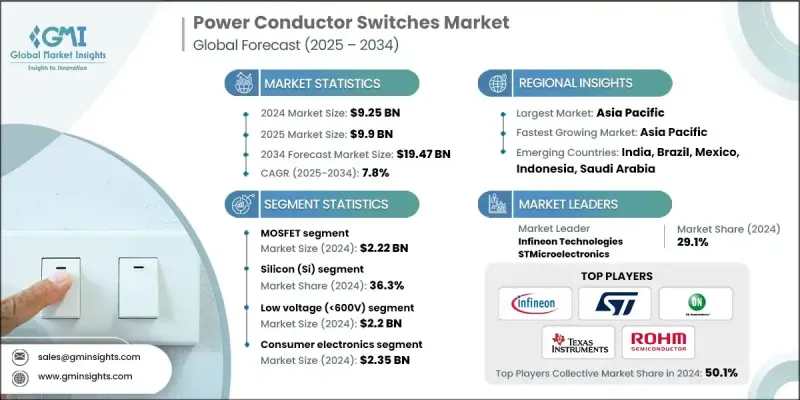

The Global Power Conductor Switches Market was valued at USD 9.25 billion in 2024 and is estimated to grow at a CAGR of 7.8% to reach USD 19.47 billion by 2034.

The market expansion is driven by the increasing need for energy-efficient, high-performance power switching in sectors like automotive, industrial automation, and data centers. As demand surges for efficient power conversion, companies are moving toward advanced switch types such as IGBTs, MOSFETs, and wide-bandgap devices, including GaN and SiC. These switches deliver higher power density, reduced thermal losses, and faster switching speeds, essential for applications like EV powertrains, renewable energy systems, high-performance computing, and smart energy infrastructure. The shift to wide-bandgap materials is proving critical, as SiC and GaN switches outperform traditional silicon counterparts in both voltage and thermal performance. With more applications requiring compact, high-voltage, and high-frequency operation, such as AI hardware, advanced driver-assistance systems, and edge computing, power semiconductor switches are rapidly becoming foundational in next-generation power architectures, especially where efficiency and reliability are essential.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.25 Billion |

| Forecast Value | $19.47 Billion |

| CAGR | 7.8% |

The MOSFET segment is forecast to grow at a CAGR of 9.7% between 2025 and 2034. This strong performance is backed by the widespread adoption of MOSFETs in energy-efficient applications such as electric vehicles, renewable power systems, and consumer electronics. Their ability to deliver low conduction losses and operate at high switching frequencies makes them ideal for compact, thermally efficient, high-power systems. Ongoing electrification across sectors and the global shift to sustainable energy technologies are further amplifying their market traction across industrial and automotive sectors.

In 2024, the silicon-based switches segment held a 36.3% share. Their continued leadership comes from decades of proven use in mass-produced electronics, reliable performance, and cost efficiency. Silicon's dominance is reinforced by mature manufacturing ecosystems and widespread deployment in motor control systems, industrial drives, power supplies, and inverter solutions. While SiC and GaN switches are gaining ground, the affordability and manufacturing scalability of silicon solutions remain a major advantage, especially for high-volume applications in emerging markets and traditional industries.

North America Power Conductor Switches Market held 26.1% share in 2024, fueled by rising EV adoption, smart grid investments, and advanced manufacturing facilities. As automation, clean energy, and digital transformation continue to shape infrastructure in the region, the demand for power conductor switches with better thermal performance, high-speed switching, and energy optimization is accelerating. North America's emphasis on clean energy transition and smart distribution grids continues to attract significant investments, reinforcing its leadership in adopting high-performance switching devices.

Key players dominating the Global Power Conductor Switches Market include Texas Instruments, Analog Devices, Hitachi Energy, STMicroelectronics, Diodes Incorporated, Infineon Technologies, ROHM Semiconductor, Toshiba Electronic Devices & Storage, Vishay Intertechnology, Wolfspeed, ON Semiconductor (onsemi), GaN Systems, Littelfuse, NXP Semiconductors, Fuji Electric, Renesas Electronics, Power Integrations / Qorvo, Microchip Technology, Semikron, and Mitsubishi Electric. Leading companies in the power conductor switches market are strengthening their positions through a combination of product innovation, material advancement, and strategic partnerships. Many are shifting focus toward wide-bandgap technologies such as silicon carbide and gallium nitride to meet demand for higher efficiency, faster switching, and smaller device footprints. Firms are also enhancing R&D efforts to develop next-gen power devices tailored for high-growth segments like EVs, data centers, and renewables. Several players are forming collaborations with automakers, energy firms, and infrastructure providers to accelerate technology adoption.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Offering trends

- 2.2.2 Operating trends

- 2.2.3 Application trends

- 2.2.4 End use industry trends

- 2.2.5 Regional trends

- 2.3 TAM Analysis, 2025-2034 (USD Billion)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand from data centers and cloud infrastructure

- 3.2.1.2 Adoption of wide-bandgap (SiC and GaN) power devices

- 3.2.1.3 Integration of power switches in consumer and high-performance electronics

- 3.2.1.4 Use of power switches in industrial and automation systems

- 3.2.1.5 Deployment of power switches in automotive and EV applications

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High implementation and upgrade costs

- 3.2.2.2 Competition from alternative power conversion technologies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Emerging business models

- 3.9 Compliance requirements

- 3.10 Consumer sentiment analysis

- 3.11 Patent and IP analysis

- 3.12 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.2 Market concentration analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Digital Transformation Initiatives

- 4.5 Emerging/ Startup Competitors Landscape

Chapter 5 Market Estimates & Forecast, By Device Type, 2021-2034 (USD Billion and Units)

- 5.1 Key trends

- 5.2 MOSFETs

- 5.3 IGBTs

- 5.4 Thyristors

- 5.5 Diodes & rectifiers

- 5.6 Wide bandgap devices

- 5.7 Power modules

- 5.8 Others

Chapter 6 Market Estimates & Forecast, By Material, 2021-2034 (USD Billion and Units)

- 6.1 Key trends

- 6.2 Silicon (Si)

- 6.3 Silicon Carbide (SiC)

- 6.4 Gallium Nitride (GaN)

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Voltage rating, 2021-2034 (USD Billion and Units)

- 7.1 Key trends

- 7.2 Low voltage (<600V)

- 7.3 Medium voltage (600V - 1.2kV)

- 7.4 High voltage (>1.2kV)

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion and Units)

- 8.1 Key trends

- 8.2 Consumer electronics

- 8.3 Automotive

- 8.4 Industrial

- 8.5 Energy and power

- 8.6 ICT / datacenters

- 8.7 Aerospace & defense

- 8.8 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion and Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 Analog Devices

- 10.1.2 Infineon Technologies

- 10.1.3 Microchip Technology

- 10.1.4 Mitsubishi Electric

- 10.1.5 NXP Semiconductors

- 10.1.6 ON Semiconductor (onsemi)

- 10.1.7 Renesas Electronics

- 10.1.8 ROHM Semiconductor

- 10.1.9 STMicroelectronics

- 10.1.10 Texas Instruments

- 10.1.11 Toshiba Electronic Devices & Storage

- 10.1.12 Vishay Intertechnology

- 10.1.13 Wolfspeed (Cree)

- 10.1.14 Qorvo

- 10.2 Regional Players

- 10.2.1 Fuji Electric

- 10.2.2 Hitachi Energy

- 10.2.3 Littelfuse

- 10.2.4 Semikron

- 10.3 Emerging Players

- 10.3.1 Diodes Incorporated

- 10.3.2 GaN Systems

- 10.3.3 Power Integrations