PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844270

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844270

Infrared (IR) Sensors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

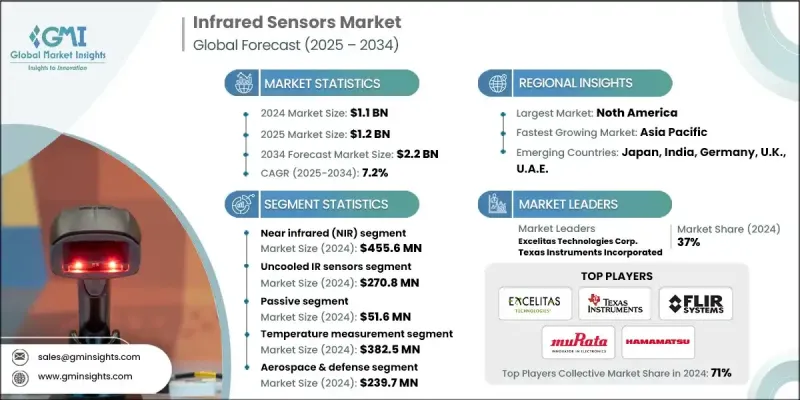

The Global Infrared Sensors Market was valued at USD 1.1 billion in 2024 and is estimated to grow at a CAGR of 7.2% to reach USD 2.2 billion by 2034.

Rising deployment of IR sensing across climate monitoring, environmental observation, industry, and consumer electronics is fueling this growth. Infrared sensors provide critical insights into temperature gradients, atmospheric phenomena, and heat signatures data vital for weather forecasting, environmental protection, and disaster resilience. Innovations such as high-resolution thermal imaging, compact detectors, and smart algorithms are driving adoption across sectors. Governments and private entities are integrating IR technology into remote sensing infrastructure, early warning systems, and urban planning frameworks to strengthen climate resilience. As global attention intensifies on sustainability, pollution control, and ecosystem management, the need for precise thermal data is expanding, thus broadening the addressable market for infrared sensors.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.1 billion |

| Forecast Value | $2.2 billion |

| CAGR | 7.2% |

In 2024, the near infrared (NIR) segment generated USD 455.6 million. NIR sensors dominate due to their widespread use in consumer devices facial recognition, gesture sensing, biometric applications as well as in industrial quality control and medical diagnostics. Their cost efficiency, compactness, and ease of integration underpin their popularity.

The uncooled infrared sensor segment was valued at USD 270.8 million in 2024. Uncooled IR detectors strike an effective balance between affordability, compactness, and robustness, making them well suited for consumer electronics, handheld thermal cameras, medical thermography, and industrial safety systems.

U.S. Infrared Sensor Market generated USD 247.5 million in 2024 and will grow at a CAGR of 7.7% through 2034. The American market is powered by investments in defense, remote sensing, autonomous vehicles, and medical imaging. Ongoing wildfires and climate events have heightened demand for high-performance field IR systems, while telehealth expansion is encouraging thermal applications in diagnostics and monitoring.

Prominent players in the Global Infrared Sensor Market include Lockheed Martin Corporation, Melexis N.V., FLIR Systems, Panasonic Holdings Corporation, Hamamatsu Photonics K.K., Omron Corporation, Leonardo DRS, Inc., New Imaging Technologies (NIT), Murata Manufacturing Co., Ltd., InfraTec GmbH, Opgal Optronic Industries Ltd., Excelitas Technologies Corp., Heimann Sensor GmbH, BAE Systems plc, L3Harris Technologies, Inc., Nippon Avionics Co., Ltd., Texas Instruments Incorporated, Raytheon Technologies Corporation, and Honeywell International Inc. Leading infrared sensor firms are focusing on innovation in materials, miniaturization, and integration to boost competitive edge. Many are developing next generation quantum or quantum inspired detectors with higher sensitivity and lower noise. Partnerships with semiconductor manufacturers, camera OEMs, and IoT platforms accelerate adoption.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1. Material Type

- 2.2.2 Product Type

- 2.2.3 Form

- 2.2.4 End use Industry

- 2.2.5 North America

- 2.2.6 Europe

- 2.2.7 Asia Pacific

- 2.2.8 Latin America

- 2.2.9 Middle East & Africa

- 2.3 TAM Analysis, 2025-2034 (USD Million)

- 2.4 CXO perspective: Strategic imperatives

- 2.5 Executive decision points

- 2.6 Critical Success Factors

- 2.7 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Climate & environmental monitoring missions

- 3.2.1.2 Automotive ADAS & EV safety adoption

- 3.2.1.3 Healthcare digitization

- 3.2.1.4 Defense & border security modernization

- 3.2.1.5 Consumer electronics integration

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of cooled IR sensors

- 3.2.2.2 Export control regulations

- 3.2.3 Market Opportunities

- 3.2.3.1 Industrial Safety & Energy Efficiency Mandates

- 3.2.3.2 Integration of AI & Edge Processing with IR Sensors

- 3.2.3.3 Miniaturization & Low-Cost Uncooled IR Sensors

- 3.2.3.4 Automotive Electrification & ADAS Adoption

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technological and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price Trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Pricing strategies

- 3.10 Emerging business models

- 3.11 Compliance requirements

- 3.12 Sustainability measures

- 3.13 Consumer sentiment analysis

- 3.14 Patent and IP analysis

- 3.15 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction Company market share analysis

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1. North America

- 4.2.2. Europe

- 4.2.3. Asia Pacific

- 4.2.2 Market concentration analysis

- 4.3 Competitive Benchmarking of key Players

- 4.3.1 Financial Performance Comparison

- 4.3.1.1. Revenue

- 4.3.1.2. Profit Margin

- 4.3.1.3. R&D

- 4.3.2 Product Portfolio Comparison

- 4.3.2.1. Product Range Breadth

- 4.3.2.2. Technology

- 4.3.2.3. Innovation

- 4.3.3 Geographic Presence Comparison

- 4.3.3.1. Global Footprint Analysis

- 4.3.3.2. Service Network Coverage

- 4.3.3.3. Market Penetration by Region

- 4.3.4 Competitive Positioning Matrix

- 4.3.4.1. Leaders

- 4.3.4.2. Challengers

- 4.3.4.3. Followers

- 4.3.4.4. Niche Players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial Performance Comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and Acquisitions

- 4.4.2 Partnerships and Collaborations

- 4.4.3 Technological Advancements

- 4.4.4 Expansion and Investment Strategies

- 4.4.5 Sustainability Initiatives

- 4.4.6 Digital Transformation Initiatives

- 4.5 Emerging/ Startup Competitors Landscape

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 (USD Million)

- 5.1 Near Infrared (NIR)

- 5.2 Infrared

- 5.3 Far Infrared (FIR)

Chapter 6 Market estimates & forecast, By Working Mechanism, 2021 - 2034 (USD Million)

- 6.1 Active

- 6.2 Passive

Chapter 7 Market estimates & forecast, By Technology, 2021 - 2034 (USD Million)

- 7.1 Uncooled IR Sensors

- 7.2 Cooled IR Sensors

- 7.3 Hyperspectral

- 7.4 AI-Integrated

- 7.5 Miniaturized

- 7.6 Others

Chapter 8 Market estimates & forecast, By Application, 2021-2034 (USD Million)

- 8.1 Temperature Measurement

- 8.2 Motion sensing

- 8.3 Gas and Fire Detection

- 8.4 Security and Surveillance

- 8.5 Others

Chapter 9 Market estimates & forecast, By End use, 2021-2034 (USD Million)

- 8.6 Manufacturing

- 8.7 Automotive

- 8.8 Consumer Appliances

- 8.9 Aerospace & Defense

- 8.10 Healthcare

- 8.11 Oil and Gas

- 8.12 Others

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 U.K.

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East & Africa

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profile

- 11.1 FLIR Systems

- 11.2 Hamamatsu Photonics K.K.

- 11.3 Murata Manufacturing Co., Ltd.

- 11.4 Omron Corporation

- 11.5 Excelitas Technologies Corp.

- 11.6 Honeywell International Inc.

- 11.7 Texas Instruments Incorporated

- 11.8 Panasonic Holdings Corporation

- 11.9 InfraTec GmbH

- 11.10 Kollmorgen (Danaher Corporation)

- 11.11 Leonardo DRS, Inc.

- 11.12 BAE Systems plc

- 11.13 Raytheon Technologies Corporation

- 11.14 Lockheed Martin Corporation

- 11.15 L3Harris Technologies, Inc.

- 11.16 Heimann Sensor GmbH

- 11.17 New Imaging Technologies (NIT, France)

- 11.18 Nippon Avionics Co., Ltd. (NEC Group)

- 11.19 Melexis N.V.

- 11.20 Opgal Optronic Industries Ltd.