PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844274

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844274

Europe Bus Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

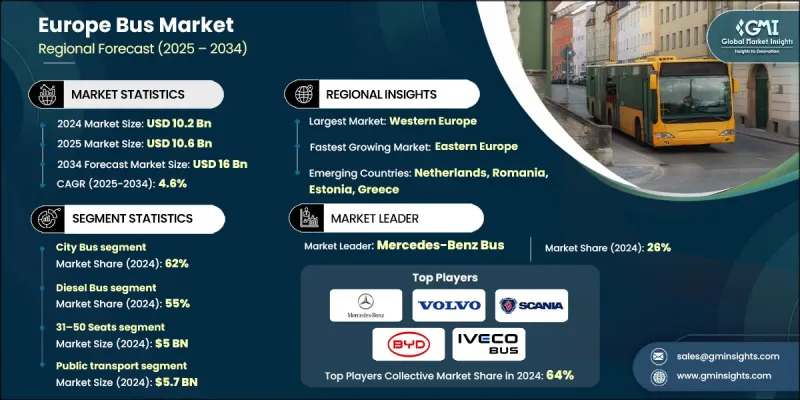

The Europe Bus Market was valued at USD 10.2 billion in 2024 and is estimated to grow at a CAGR of 4.6% to reach USD 16 billion by 2034.

This market expansion is fueled by the growing emphasis on sustainable transportation, ongoing fleet upgrades, and compliance with stringent EU emission regulations. The industry is rapidly advancing with the adoption of electric and hydrogen propulsion systems, as manufacturers prioritize zero-emission buses to enhance urban air quality, passenger comfort, and operational efficiency. Buses remain essential in reducing traffic congestion, supporting eco-friendly mobility initiatives, and providing affordable mass transit options. In densely populated urban centers, zero-emission buses are particularly crucial for minimizing noise and emissions, thus promoting environmental sustainability and enhancing the rider experience. Modern buses now incorporate state-of-the-art telematics, lightweight materials, and high-capacity batteries, enabling longer driving ranges, quicker charging times, and better lifecycle cost efficiency compared to traditional models. The Europe bus market continues to evolve through technological innovation, increased adoption of electric and hydrogen vehicles, and regulatory pressures mandating zero-emission solutions. Notably, fleet-as-a-service models have emerged, integrating buses with charging or refueling infrastructure, predictive maintenance, and digital passenger services.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.2 Billion |

| Forecast Value | $16 Billion |

| CAGR | 4.6% |

The city bus segment held a 62% share in 2024 and is anticipated to grow at a CAGR of 4.4% through 2034. Urban transit authorities favor city buses that deliver passenger comfort, operational efficiency, and environmental benefits. Fleet operators seek buses with high passenger capacity, accessible low-floor designs, advanced safety features, and connectivity to support fleet management. Consequently, European manufacturers are equipping city buses with electric and hybrid powertrains, modular interiors, and intelligent technologies to maximize passenger satisfaction and operational efficiency.

The diesel bus segment held a 55% market share in 2024 and is forecasted to grow at a CAGR of 3.4% from 2025 to 2034. Despite the rise of alternative propulsion, diesel buses remain popular due to their reliability, extended driving range, and well-established fueling infrastructure. Manufacturers are increasingly integrating fuel-efficient technologies and low-emission engines in diesel buses to comply with tougher EU emission standards while maintaining cost-effectiveness for operators.

Germany Bus Market held a 29% share and generated USD 1.63 billion in 2024. The country's dominance stems from its advanced transport network, strong focus on sustainable transit, and progressive policies promoting low-emission and energy-efficient buses. As Europe's largest economy, Germany represents a critical market opportunity for bus manufacturers, supported by a public transportation system that prioritizes reliability, safety, and environmental responsibility.

Key players in the Europe bus market include BYD Europe, Irizar, Iveco Bus, MAN Truck & Bus, Mercedes-Benz Bus, Scania, Solaris Bus & Coach, Van Hool, VDL Bus & Coach, and Volvo Bus. To solidify their foothold in the Europe bus market, leading companies have adopted several strategic initiatives. They are investing heavily in research and development to innovate electric and hydrogen-powered buses, aiming to meet stricter environmental regulations and growing demand for zero-emission vehicles. Collaborations and partnerships with technology firms and infrastructure providers enable these companies to offer integrated solutions like fleet-as-a-service, combining vehicles with charging or refueling stations and predictive maintenance. Expanding manufacturing capabilities and optimizing supply chains allow them to improve production efficiency and reduce costs.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Propulsion

- 2.2.4 Seating Capacity

- 2.2.5 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Electrification & environmental regulations

- 3.2.1.2 Urbanization & public transport demand

- 3.2.1.3 Technological advancements

- 3.2.1.4 Government incentives & subsidies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial investment costs

- 3.2.2.2 Charging & infrastructure limitations

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of electric & hybrid fleets

- 3.2.3.2 Integration of smart & connected technologies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 EU Clean vehicle directive requirements

- 3.4.2 European green deal transport targets

- 3.4.3 Euro 6 emissions standards compliance

- 3.4.4 Public service vehicle accessibility regulations

- 3.4.5 National transport policy variations

- 3.4.6 Safety & certification requirements

- 3.4.7 Public procurement directive impact

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation Landscape

- 3.7.1 Electric powertrain technology evolution

- 3.7.2 Battery technology & energy density

- 3.7.3 Charging infrastructure development

- 3.7.4 Autonomous driving technology

- 3.7.5 Connected bus & IoT integration

- 3.7.6 Alternative fuel technology

- 3.7.7 Lightweight materials & design

- 3.7.8 Passenger information systems

- 3.7.9 Predictive maintenance technology

- 3.7.10 Digital ticketing & payment systems

- 3.7.11 Technology adoption curves

- 3.7.12 R&D investment patterns

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

- 3.13 Investment Landscape Analysis

- 3.13.1 Eu transport infrastructure investment

- 3.13.2 Manufacturer r&d investment

- 3.13.3 Government electrification funding

- 3.13.4 Private sector investment

- 3.13.5 Green bond financing

- 3.13.6 ROI analysis by investment type

- 3.13.7 Public-private partnership funding

- 3.14 Risk Assessment Framework

- 3.14.1 Regulatory compliance risks

- 3.14.2 Technology transition risks

- 3.14.3 Market demand volatility

- 3.14.4 Supply chain disruption risks

- 3.14.5 Economic downturn impact

- 3.14.6 Competitive pressure risks

- 3.14.7 Infrastructure dependency risks

- 3.15 Best Case Scenarios

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Western Europe

- 4.2.2 Eastern Europe

- 4.2.3 Northern Europe

- 4.2.4 Southern Europe

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($ Bn & Units)

- 5.1 Key trends

- 5.2 City bus

- 5.3 Coaches

- 5.4 Intercity bus

- 5.5 Shuttle & minibus

- 5.6 School bus

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($ Bn & Units)

- 6.1 Key trends

- 6.2 Diesel

- 6.3 Electric

- 6.4 Hybrid

Chapter 7 Market Estimates & Forecast, By Seating Capacity, 2021 - 2034 ($ Bn & Units)

- 7.1 Key trends

- 7.2 31-50 Seats

- 7.3 More than 50 Seats

- 7.4 Less than 30 Seats

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($ Bn & Units)

- 8.1 Key trends

- 8.2 Public transport

- 8.3 Tourism & travel operators

- 8.4 Private fleets & corporate mobility

- 8.5 School transportation

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($ Bn & Units)

- 9.1 Key trends

- 9.2 Western Europe

- 9.2.1 Austria

- 9.2.2 Belgium

- 9.2.3 France

- 9.2.4 Germany

- 9.2.5 Ireland

- 9.2.6 Luxembourg

- 9.2.7 Monaco

- 9.2.8 Netherlands

- 9.2.9 Switzerland

- 9.2.10 United Kingdom

- 9.3 Eastern Europe

- 9.3.1 Bulgaria

- 9.3.2 Croatia

- 9.3.3 Czech Republic

- 9.3.4 Hungary

- 9.3.5 Poland

- 9.3.6 Romania

- 9.3.7 Serbia

- 9.3.8 Slovakia

- 9.3.9 Slovenia

- 9.3.10 Ukraine

- 9.4 Northern Europe

- 9.4.1 Denmark

- 9.4.2 Estonia

- 9.4.3 Finland

- 9.4.4 Iceland

- 9.4.5 Latvia

- 9.4.6 Lithuania

- 9.4.7 Norway

- 9.4.8 Sweden

- 9.5 Southern Europe

- 9.5.1 Albania

- 9.5.2 Greece

- 9.5.3 Italy

- 9.5.4 Portugal

- 9.5.5 Spain

- 9.5.6 Turkey

Chapter 10 Company Profiles

- 10.1 Global players

- 10.1.1 BYD Europe

- 10.1.2 Iveco Bus

- 10.1.3 Irizar

- 10.1.4 MAN Truck & Bus

- 10.1.5 Mercedes-Benz Bus

- 10.1.6 Scania

- 10.1.7 Solaris Bus & Coach

- 10.1.8 Van Hool

- 10.1.9 VDL Bus & Coach

- 10.1.10 Volvo Bus

- 10.2 Regional players

- 10.2.1 Caetano Bus

- 10.2.2 Castrosua

- 10.2.3 Irisbus

- 10.2.4 Karsan

- 10.2.5 King Long

- 10.2.6 Neoplan

- 10.2.7 Otokar

- 10.2.8 Setra

- 10.2.9 Temsa

- 10.2.10 Yutong Bus

- 10.3 Emerging players

- 10.3.1 Alexander Dennis

- 10.3.2 Arrival

- 10.3.3 Bluebus

- 10.3.4 CaetanoBus

- 10.3.5 Ebusco