PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844276

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844276

DTP Vaccines Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

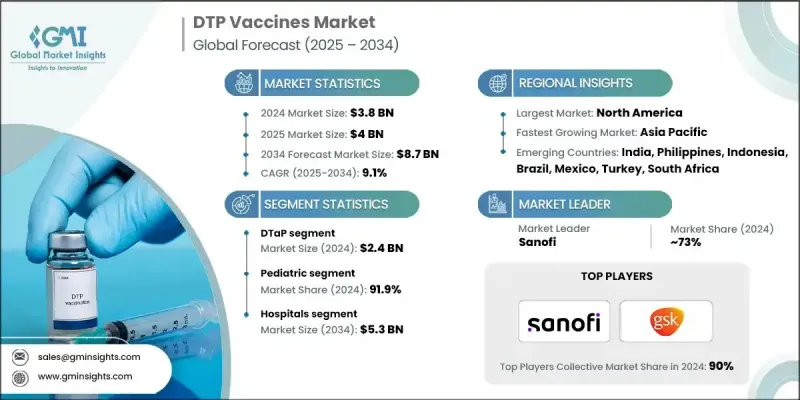

The Global DTP Vaccines Market was valued at USD 3.8 billion in 2024 and is estimated to grow at a CAGR of 9.1% to reach USD 8.7 billion by 2034.

This significant growth is driven by increasing immunization efforts worldwide, especially across developing countries where infectious diseases remain a serious threat. Enhanced awareness of vaccine-preventable diseases and improvements in healthcare infrastructure are playing a key role in boosting vaccine uptake. Further, innovation in vaccine technology, especially the development of safer and more effective combination vaccines, is increasing public confidence and driving higher adoption rates. Pediatric immunization continues to be a major demand driver, supported by global health organizations and national healthcare programs. The growing need to prevent diphtheria, tetanus, and pertussis among infants is encouraging greater investment in vaccine research and distribution. As immunization coverage expands, the integration of DTP vaccines into larger combination schedules is improving compliance, simplifying administration, and increasing accessibility. Governments across the globe are allocating more resources to strengthen their immunization networks, while public-private collaborations are enhancing outreach and coverage. These factors, combined with rising birth rates and broader healthcare access, are expected to support the global DTP vaccines market over the forecast period.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.8 Billion |

| Forecast Value | $8.7 Billion |

| CAGR | 9.1% |

In 2024, the DTaP segment generated USD 2.4 billion. This segment remains dominant due to its broad adoption in routine pediatric immunization schedules. DTaP vaccines utilize acellular pertussis components, which offer a safer profile and fewer adverse effects compared to earlier whole-cell options. Global health bodies and national immunization programs actively promote DTaP's use, further driving demand. The rising preference for combination vaccines and increased administration of booster shots are key growth factors for the segment, especially in regions with better access to healthcare infrastructure and government vaccination programs.

The pediatric segment held a 91.9% share in 2024. This is due to high global birth rates and the inclusion of DTP vaccines in early childhood immunization schedules. Governments and health organizations continue to prioritize pediatric vaccinations, leading to increased funding, improved vaccine delivery systems, and heightened awareness of disease prevention in children. With the growing integration of DTP components into multivalent formulations, such as pentavalent and hexavalent vaccines, pediatric coverage is further strengthened. These formulations streamline vaccine schedules, simplify logistics, and increase compliance from both healthcare providers and parents.

North America DTP Vaccines Market held a 41.3% share in 2024. The leading position is supported by high healthcare investments, established immunization frameworks, and continuous public education efforts. Robust distribution networks of key pharmaceutical companies like Sanofi, Merck, and GSK ensure broad vaccine availability across the U.S. and Canada. Comprehensive reimbursement policies and national awareness initiatives help sustain consistent vaccination rates. Public health agencies actively promote childhood immunizations, reinforcing the region's leadership in vaccine coverage and adoption.

Key players actively involved in the Global DTP Vaccines Market include LG Chem, Biological E, Walvax, Finlay Institute, Indian Immunologicals, HLL Lifecare Limited (HLL), Bilthoven Biologicals, GlaxoSmithKline (GSK), Sanofi, Merck, Microgen, Panacea Biotec, PT Bio Farma, Arab Company for Pharmaceutical Products (Arabio), IBSS Biomed, Boryung, Serum Institute of India, Beijing Minhai Biological Technology, and ST Pharma. To strengthen their position in the DTP vaccines market, leading companies are adopting strategic initiatives that include expanding production capacity and scaling manufacturing operations to meet growing demand across global markets. Firms are increasingly collaborating with public health bodies and governments to secure supply contracts and enhance vaccine distribution. Many are also investing in research to develop next-generation formulations with fewer side effects and better immunogenicity.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Vaccine type trends

- 2.2.3 Age group trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising emphasis on preventive healthcare

- 3.2.1.2 Expanding immunization programs

- 3.2.1.3 Government initiatives and supportive measures

- 3.2.1.4 Growing technological advancements

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulatory approval processes

- 3.2.2.2 High development and production costs

- 3.2.3 Market opportunities

- 3.2.3.1 Growing public-private partnerships for vaccine distribution

- 3.2.3.2 Expanding adult vaccination programs

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Pipeline analysis

- 3.6 Technology landscape

- 3.7 Investment and funding landscape

- 3.8 Future market trends

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Company matrix analysis

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Vaccine Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 DTaP

- 5.3 DTwP

- 5.4 Td/TdaP

Chapter 6 Market Estimates and Forecast, By Age Group, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Pediatric

- 6.3 Adult

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.2.1 Public

- 7.2.2 Private

- 7.3 Specialty clinics

- 7.4 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Arab Company for Pharmaceutical Products (Arabio)

- 9.2 Beijing Minhai Biological Technology

- 9.3 Bilthoven Biologicals

- 9.4 Biological E

- 9.5 Boryung

- 9.6 Finlay Institute

- 9.7 GlaxoSmithKline (GSK)

- 9.8 HLL Lifecare Limited (HLL)

- 9.9 IBSS Biomed

- 9.10 Indian Immunologicals

- 9.11 LG Chem

- 9.12 Merck

- 9.13 Microgen

- 9.14 Panacea Biotec

- 9.15 PT Bio Farma

- 9.16 Sanofi

- 9.17 Serum Institute of India

- 9.18 Walvax