PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844277

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844277

Premium Cookware Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

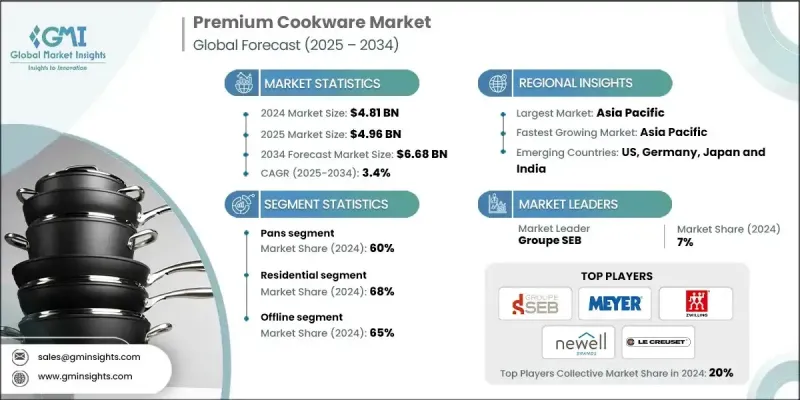

The Global Premium Cookware Market was valued at USD 4.81 billion in 2024 and is estimated to grow at a CAGR of 3.4% to reach USD 6.68 billion by 2034.

A significant shift toward safer, non-toxic cookware largely drives market growth. Consumers are moving away from traditional non-stick cookware that contains PFOA and PFAS chemicals, and instead, they are opting for cookware made with ceramic, sol-gel coatings, or materials like cast iron and carbon steel, which are considered more health-conscious. Additionally, cookware is being increasingly recognized as an aesthetic addition to the kitchen, with brands prioritizing appealing designs and attractive forms. Regulations set by the FDA ensure that cookware products meet strict guidelines for Food Contact Substances (FCS), guaranteeing that materials used are safe for food preparation. The rise of "chemical-free" cookware is being propelled by consumers' concerns over the safety of their cooking tools and the growing preference for healthier lifestyles. The market for premium cookware is expected to continue its upward trajectory as consumers prioritize quality, safety, and design in their kitchen investments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.81 Billion |

| Forecast Value | $6.68 Billion |

| CAGR | 3.4% |

In 2024, the pan segment held a 60% share and is anticipated to grow at a CAGR of 3.5% through 2034, owing to its versatility and essential role in daily cooking, allowing for various techniques such as frying, sauteing, searing, and browning. The demand for high-quality, multi-layered cookware, like stainless steel and ceramic, continues to grow because of their combination of performance, ease of use, and durability.

The residential segment held a 68% share in 2024 and is expected to grow at a 3.5% CAGR through 2034, driven by consumers' increasing desire for premium cookware that aligns with their diverse kitchen designs and enhances their cooking experiences. The residential demographic is more engaged with the cookware innovation process, pushing manufacturers to develop products that cater to both aesthetic appeal and functionality. This shift in consumer behavior continues to drive innovation within the cookware industry.

Asia-Pacific Premium Cookware Market will grow at a CAGR of 3.7% through 2034. Urbanization, rising disposable incomes, and the growing popularity of Western cooking, combined with traditional Asian food habits, have significantly increased demand for premium cookware. As consumers in countries like China, India, and Australia shift toward higher-quality cooking tools, this region is seeing a rapid transformation in its cookware preferences.

Key players in the Global Premium Cookware Market include Groupe SEB, Meyer Corporation, Zwilling J.A. Henckels, Newell Brands, Le Creuset, Demeyere, Made In Cookware, Fissler GmbH, Mauviel, The Cookware Company, Tramontina, TTK Prestige, Conair Corp., BERNDES Kuchen, and Heritage Steel. To strengthen their market position, companies in the premium cookware market are focusing on product innovation, sustainable materials, and expanding their brand presence. Many manufacturers are developing cookware with advanced non-toxic coatings and multi-layer constructions to appeal to health-conscious consumers. Partnerships with well-known chefs and influencers, along with increasing visibility in online and offline retail spaces, have helped these brands enhance their reach. Several companies are also investing in eco-friendly production methods and introducing products made from recycled materials to cater to environmentally conscious consumers.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Material

- 2.2.4 Coating type

- 2.2.5 End Use

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Premiumization of kitchenware in urban middle-class segments

- 3.2.1.2 Sustainability-driven product innovation

- 3.2.1.3 Smart & multifunctional cookware adoption

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Regulatory scrutiny on safety claims

- 3.2.2.2 Price elasticity in emerging markets

- 3.2.3 Opportunities

- 3.2.3.1 Direct-to-consumer (DTC) expansion via e-commerce ecosystems

- 3.2.3.2 Localized premium SKUs for emerging markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product

- 3.7 Regulatory framework

- 3.7.1 Standards and certifications

- 3.7.2 Environmental regulations

- 3.7.3 Import export regulations

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's five forces analysis

- 3.10 PESTEL analysis

- 3.11 Consumer behaviour analysis

- 3.11.1 Purchasing patterns

- 3.11.2 Preference analysis

- 3.11.3 Regional variations in consumer behaviour

- 3.11.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034, (USD Million) (Million Units)

- 5.1 Key trends

- 5.2 Pan

- 5.2.2 Fry pan

- 5.2.3 Saute pan

- 5.2.4 Saucepan

- 5.2.5 Roasting pan

- 5.2.6 Others (cooking racks, cooking tools, bakeware, pressure cookers)

- 5.3 Pots

- 5.3.1 Brazier

- 5.3.2 Sauce pot

- 5.3.3 Fryer pot

- 5.3.4 Dutch oven/ cocotte pots

- 5.3.5 Others

- 5.4 Bakeware

- 5.4.1 Bread and loaf pan

- 5.4.2 Sheet pan

- 5.4.3 Cake pans

- 5.4.4 Muffin pans

- 5.4.5 Others

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Material, 2021 - 2034, (USD Million) (Million Units)

- 6.1 Key trends

- 6.2 Stainless steel

- 6.3 Cast & enameled cast iron

- 6.4 Aluminum & anodized aluminum

- 6.5 Carbon steel

- 6.6 Non-stick

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By Coating Type, 2021 - 2034, (USD Million) (Million Units)

- 7.1 Key trends

- 7.2 Nonstick (PTFE)

- 7.3 Ceramic coated

- 7.4 Hard-anodized aluminum

- 7.5 Uncoated / natural finish

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034, (USD Million) (Million Units)

- 8.1 Key trends

- 8.2 Residential

- 8.3 Commercial

- 8.3.1 HoReCa

- 8.3.2 Bakery

- 8.3.3 Catering services

- 8.3.4 Others

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Online

- 9.2.1 E-commerce sites

- 9.2.2 Company websites

- 9.3 Offline

- 9.3.1 Specialty stores

- 9.3.2 Mega retail stores

- 9.3.3 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Million) (Million Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Groupe SEB

- 11.2 Meyer Corporation

- 11.3 Zwilling J.A. Henckels

- 11.4 Newell Brands

- 11.5 Le Creuset

- 11.6 Demeyere

- 11.7 Made In Cookware

- 11.8 Fissler GmbH

- 11.9 Mauviel

- 11.10 The Cookware Company

- 11.11 Tramontina

- 11.12 TTK Prestige

- 11.13 Conair Corp.

- 11.14 BERNDES Kuchen

- 11.15 Heritage Steel

- 11.16 Zwilling