PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844279

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844279

Nanoelectromechanical Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

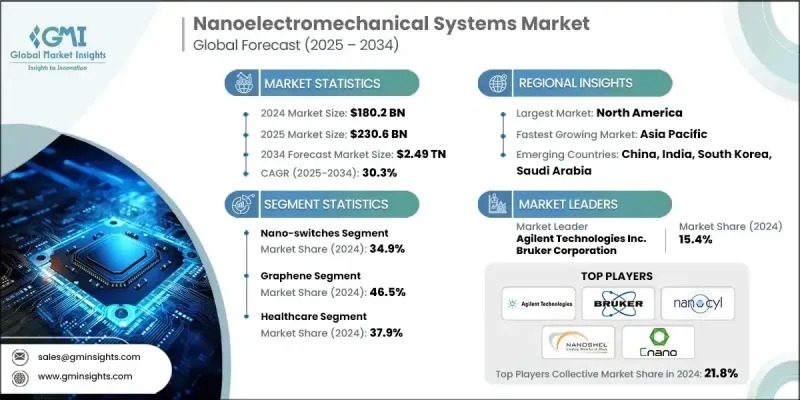

The Global Nanoelectromechanical Systems Market was valued at USD 180.2 billion in 2024 and is estimated to grow at a CAGR of 30.3% to reach USD 2.49 trillion by 2034.

The robust growth is owing to the demand for ultra-miniaturized devices with superior functionality. As electronic components become increasingly compact, NEMS are gaining traction for their unmatched capabilities in nanoscale actuation, sensing, and signal processing. Industries such as consumer electronics, biomedical devices, next-gen wearables, and smart implants are pushing toward reduced form factors, prompting manufacturers to integrate NEMS into their innovations. Their application scope continues to expand as miniaturization remains a driving factor in modern device design and engineering.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $180.2 Billion |

| Forecast Value | $2.49 Trillion |

| CAGR | 30.3% |

Significant strides in materials science, particularly with graphene, carbon nanotubes, and advanced silicon nanostructures, are further enhancing the performance of NEMS technologies. These materials deliver superior mechanical properties, efficient energy utilization, and high electrical performance at the nano scale. With continuous innovation in fabrication techniques and functional design, NEMS are evolving into commercially viable solutions across sectors like medical diagnostics, environmental monitoring, and computing systems. As development scales, demand is surging for systems capable of real-time monitoring, micro-level precision, and autonomous operation.

In 2024, the nano-switches segment generated USD 62.8 billion. Their widespread adoption stems from their ability to function reliably in ultra-small devices while delivering high-speed switching and low-power consumption. Meanwhile, demand for nano-tweezers continues to grow due to their precision handling of nanoscale materials in research fields like molecular biology and nanomedicine. These devices are now critical for manipulating individual molecules and cells, enabling breakthroughs in single-cell diagnostics and targeted therapy delivery.

The graphene segment generated USD 49.8 billion in 2024. Known for its exceptional strength, conductivity, and flexibility, graphene is rapidly becoming essential for manufacturing high-frequency transistors, nanoscale sensors, and efficient nano-switches. It meets the increasing demand for faster, low-power electronics in computing and communication. Additionally, graphene's biocompatibility is propelling its use in biosensing and medical NEMS applications where precision and safety are vital.

U.S. Nanoelectromechanical Systems Market generated USD 56.7 billion in 2024 with a CAGR of 29.4%. This growth is driven by ongoing government support for nanotech research, deep collaboration among tech firms and academic institutions, and the expanding footprint of NEMS across industries like defense, healthcare, aerospace, and consumer electronics. A favorable investment environment and strong IP protections also reinforce U.S. leadership in this space.

Key players shaping the competitive landscape of the Nanoelectromechanical Systems Market include Ubiquiti Inc., Interuniversity Microelectronics Centre, Inframat Advanced Materials LLC, Bruker Corporation, Broadcom Corporation, Showa Denko K.K., Merck KGaA, Sun Innovations, Inc., Fraunhofer-Gesellschaft, Raymor Industries Inc., Nanoshell Company, LLC, onex technologies Inc., Cnano Technology Limited, JBC S.L., and Electron Microscopy Sciences.

To build a stronger foothold in the evolving Nanoelectromechanical Systems Market, companies are prioritizing R&D investments in material innovation, focusing particularly on nanomaterials like graphene and carbon-based composites. They are also expanding partnerships with academic research labs and public institutions to accelerate technology development and commercialization. Strategies include diversifying application portfolios into sectors like aerospace, bioscience, and smart infrastructure, while also improving manufacturing scalability. Some players are focusing on precision nanofabrication methods to enhance device sensitivity and durability, while others aim to reduce energy consumption for high-efficiency solutions.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry snapshot

- 2.2 Key market trends

- 2.2.1 Packaging type trends

- 2.2.2 Material trends

- 2.2.3 Application trends

- 2.2.4 Regional

- 2.3 TAM Analysis, 2025-2034 (USD Billion)

- 2.4 CXO perspective: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Miniaturization of electronic devices

- 3.2.1.2 Advancements in nanotechnology and materials science

- 3.2.1.3 Emerging applications in biomedical and biosensing

- 3.2.1.4 Integration with IoT and smart devices

- 3.2.1.5 Growing demand from defense and aerospace sectors

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Complex and costly manufacturing processes

- 3.2.2.2 Reliability and standardization concerns

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 Historical price analysis (2021-2024)

- 3.8.2 Price trend drivers

- 3.8.3 Regional price variations

- 3.8.4 Price forecast (2025-2034)

- 3.9 Pricing strategies

- 3.10 Emerging business models

- 3.11 Compliance requirements

- 3.12 Sustainability measures

- 3.12.1 Sustainable materials assessment

- 3.12.2 Carbon footprint analysis

- 3.12.3 Circular economy implementation

- 3.12.4 Sustainability certifications and standards

- 3.12.5 Sustainability ROI analysis

- 3.13 Global consumer sentiment analysis

- 3.14 Patent analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.2 Market Concentration Analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Nano-tweezers

- 5.3 Nano-cantilevers

- 5.4 Nano-switches

- 5.5 Nano-accelerometers

- 5.6 Nano-fluidic modules

Chapter 6 Market Estimates and Forecast, By Material Type, 2021 - 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Graphene

- 6.3 Carbon Nanotubes (CNTs)

- 6.4 Silicon Carbide (SiC)

- 6.5 Silicon Dioxide (SiO2)

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By Fabrication Technology, 2021 - 2034 (USD Billion)

- 7.1 Key trends

- 7.2 Surface micromachining

- 7.3 Silicon on Insulator (SOI) technology

- 7.4 LIGA (Lithography, Electroplating, and Molding)

- 7.5 Bulk micromachining

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion)

- 8.1 Key trends

- 8.2 Sensing & control applications

- 8.3 Tools & equipment

- 8.4 Solid-state electronics

- 8.5 Biomedical devices

- 8.6 Consumer electronics

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Billion)

- 9.1 Key trends

- 9.2 Automotive

- 9.3 Consumer electronics

- 9.4 Industrial

- 9.5 Healthcare

- 9.6 Others

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Aeotec Limited

- 11.2 Agilent Technologies

- 11.3 Amprius Technologies

- 11.4 Analog Devices, Inc.

- 11.5 Applied Nanotools Inc.

- 11.6 Asylum Research Corporation

- 11.7 Broadcom Corporation

- 11.8 Bruker Corporation

- 11.9 Cnano Technology Limited

- 11.10 Electron Microscopy Sciences

- 11.11 Fraunhofer-Gesellschaft

- 11.12 Inframat Advanced Materials LLC

- 11.13 Interuniversity Microelectronics Centre

- 11.14 JBC S.L

- 11.15 Merck KGaA

- 11.16 Nanoshell Company, LLC

- 11.17 onex technologies inc

- 11.18 Raymor Industries Inc.

- 11.19 Showa Denko K.K.

- 11.20 Sun Innovations, Inc.

- 11.21 Ubiquiti Inc.

- 11.22 Vistec Electron Beam GmbH