PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844280

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844280

Ballistic Missiles Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

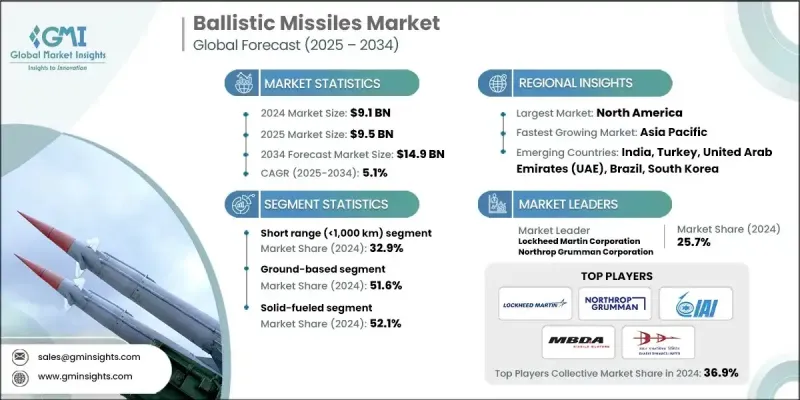

The Global Ballistic Missiles Market was valued at USD 9.1 billion in 2024 and is estimated to grow at a CAGR of 5.1% to reach USD 14.9 billion by 2034.

Key drivers contributing to this growth include rising global defense expenditures, the modernization of outdated missile arsenals, technological advancements in propulsion and targeting systems, and intensifying regional and international conflicts. Countries across the world are significantly increasing their investment in missile capabilities, aiming to strengthen both their strategic deterrence and rapid response frameworks. Upgrades to legacy platforms are shifting the focus toward more sophisticated propulsion systems, enhanced re-entry technologies, and precision targeting. The evolving threat is pushing the transition from conventional missile classes to more advanced types such as hypersonic, maneuverable reentry vehicles (MaRVs), and precision-guided systems. This development reflects both national security priorities and the growing complexity of modern warfare.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.1 billion |

| Forecast Value | $14.9 billion |

| CAGR | 5.1% |

The short-range ballistic missile (SRBM) segment held a 32.9% share in 2024 owing to its tactical advantages in regional conflict scenarios, rapid deployment capabilities, and cost-efficiency. Nations with limited budgets and high-threat environments are adopting these systems to meet fast-response needs and strengthen deterrent postures. Market players should prioritize innovation in compact propulsion, scalable warhead configurations, and enhanced targeting to align with emerging regional requirements and modernization mandates.

In 2024, the ground-based missile segment held a 51.6% share. Its appeal lies in broader payload options, extended strike range, and lower cost relative to sea or air-based systems. It also supports both tactical and long-range defense strategies. To remain competitive, manufacturers are encouraged to develop next-generation hypersonic and solid-propelled systems, integrate advanced precision technologies, and increase collaboration with expanding defense programs in newer markets.

U.S. Ballistic Missile Market reached USD 3.1 billion in 2024, driven by sustained investment in both strategic and tactical missile capabilities. Defense firms should focus on boosting the accuracy, reliability, and performance of missiles while working closely with federal agencies to align with current military modernization strategies. Providing cost-effective, scalable systems remains crucial in securing long-term defense contracts.

Major participants shaping the industry include Roketsan, Northrop Grumman Corporation, BAE Systems plc, RAFAEL Advanced Defense Systems Ltd., MBDA, Lockheed Martin Corporation, Bharat Dynamics Limited, BrahMos Aerospace, Israel Aerospace Industries Ltd. (IAI), and NPO Mashinostroyeniya. To secure their market position, leading companies are investing in cutting-edge propulsion technologies, advanced guidance systems, and lightweight composite materials that enhance performance. They're also actively partnering with national defense organizations to align product development with long-term military modernization goals. Emphasis is being placed on expanding portfolios with multi-range missile systems capable of both deterrence and offensive capability.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Range trends

- 2.2.2 Launch platform trends

- 2.2.3 Propulsion trends

- 2.2.4 Guidance system trends

- 2.2.5 Speed trends

- 2.2.6 Regional trends

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Expansion of defense budgets globally

- 3.2.1.2 Rising geopolitical tensions and regional conflicts

- 3.2.1.3 Modernization and replacement of aging missile systems

- 3.2.1.4 Advancements in missile guidance and propulsion technology

- 3.2.1.5 Increased focus on strategic deterrence and nuclear capabilities

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High R&D and production costs of ballistic missiles

- 3.2.2.2 Stringent arms control treaties and export regulations

- 3.2.3 Market opportunities

- 3.2.3.1 Development of hypersonic and maneuverable re-entry vehicles (HGV/MaRV)

- 3.2.3.2 Collaborative defense programs and joint development initiatives

- 3.2.3.3 Growth in emerging defense markets (Asia-Pacific, Middle East)

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Emerging business models

- 3.9 Compliance requirements

- 3.10 Defense budget analysis

- 3.11 Global defense spending trends

- 3.12 Regional defense budget allocation

- 3.12.1 North America

- 3.12.2 Europe

- 3.12.3 Asia Pacific

- 3.12.4 Middle East and Africa

- 3.12.5 Latin America

- 3.13 Key defense modernization programs

- 3.14 Budget forecast (2025-2034)

- 3.14.1 Impact on industry growth

- 3.14.2 Defense budgets by country

- 3.15 Supply chain resilience

- 3.16 Geopolitical analysis

- 3.17 Workforce analysis

- 3.18 Digital transformation

- 3.19 Mergers, acquisitions, and strategic partnerships landscape

- 3.20 Risk assessment and management

- 3.21 Major contract awards (2021-2024)

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Range, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Short range (<1,000 km)

- 5.3 Medium range (1,000-3,000 km)

- 5.4 Intermediate range (3,000-5,500 km)

- 5.5 Intercontinental range (>5,500 km)

Chapter 6 Market Estimates and Forecast, By Launch Platform, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Ground-based

- 6.3 Airborne

- 6.4 Naval

- 6.5 Space-enabled

Chapter 7 Market Estimates and Forecast, By Propulsion, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Liquid-fueled

- 7.3 Solid-fueled

- 7.4 Hybrid

Chapter 8 Market Estimates and Forecast, By Guidance System, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 Inertial navigation systems (INS)

- 8.3 Satellite-aided

- 8.4 Advanced seekers

- 8.5 TERCOM / DSMAC

Chapter 9 Market Estimates and Forecast, By Speed, 2021 - 2034 (USD Million)

- 9.1 Key trends

- 9.2 Supersonic

- 9.3 Hypersonic

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Key Players

- 11.1.1 BAE Systems plc

- 11.1.2 MBDA

- 11.1.3 Israel Aerospace Industries Ltd. (IAI)

- 11.2 Regional Key Players

- 11.2.1 North America

- 11.2.1.1 Lockheed Martin Corporation

- 11.2.1.2 Northrop Grumman Corporation

- 11.2.2 Europe

- 11.2.2.1 Avibras

- 11.2.2.2 Elbit Systems

- 11.2.3 Asia Pacific

- 11.2.3.1 Bharat Dynamics Limited

- 11.2.3.2 BrahMos Aerospace

- 11.2.3.3 China Aerospace Science and Technology Corporation (CASC)

- 11.2.3.4 Hanwha Aerospace

- 11.2.3.5 Roketsan

- 11.2.1 North America

- 11.3 Niche Players / Disruptors

- 11.3.1 Makeyev Rocket Design Bureau (GRTs Makeyeva)

- 11.3.2 NPO Mashinostroyeniya

- 11.3.3 RAFAEL Advanced Defense Systems Ltd.