PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844281

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844281

Cartridge and Pen Materials Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

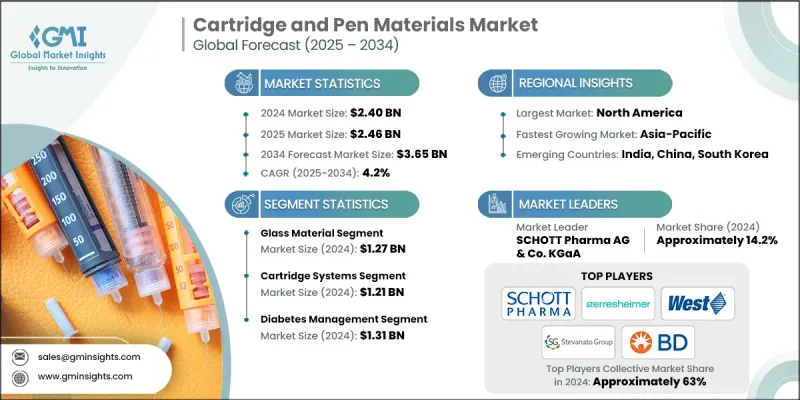

The Global Cartridge and Pen Materials Market was valued at USD 2.40 billion in 2024 and is estimated to grow at a CAGR of 4.2% to reach USD 3.65 billion by 2034.

This evolving market is undergoing a shift from high-volume insulin delivery systems to more sophisticated designs focused on improved usability for patients. As more therapies move from hospital-based administration to home-based injectable formats, material innovation has become a core priority. The focus is increasingly on developing durable, safe, and regulatory-compliant materials that enhance device performance and patient experience. Manufacturers across the supply chain are investing in materials tailored for complex drug formulations, particularly in biologics and combination therapies. As demand for patient-friendly, self-administered systems rises, materials must offer superior compatibility, reduced reactivity, and enhanced mechanical properties. The growing popularity of GLP-1s and multi-drug regimens is pushing the market toward advanced polymers and hybrid materials that support long-term usability and compliance. Additionally, the growing preference for at-home care and digital monitoring is driving demand for smart delivery devices, adding another layer of complexity to component manufacturing and material selection in pens and cartridges.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.40 Billion |

| Forecast Value | $3.65 Billion |

| CAGR | 4.2% |

In 2024, the glass materials segment held a 52.4% share. Glasses continue to be widely used in legacy injectable therapies and traditional insulin cartridges. The market is moving away from glass because of its susceptibility to breakage, higher weight, and lower compatibility with sensitive compounds, especially in modern therapies. Manufacturers are progressively adopting advanced plastics that provide improved safety, reduced contamination risk, and greater flexibility during assembly.

The pen components segment held a 28.5% share in 2024. The rising use of ergonomic, smart, and reusable pen systems is driving the need for high-performance materials that support reusability, connectivity, and user comfort. With the increasing focus on therapy adherence and convenience, particularly in chronic treatments, demand is rising for pen designs that support complex delivery mechanisms. The expansion of GLP-1 use, combination injectables, and self-administration protocols has significantly influenced the way pen components are designed and manufactured, shifting emphasis toward precision, tactile feedback, and high durability.

United States Cartridge and Pen Materials Market generated USD 670 million in 2024. The US market is shaped by growing demand for both refillable and disposable pen products across medical and consumer use cases. Demand for writing instruments like gel and ballpoint pens remains steady, with consumers valuing smooth performance and long-lasting durability. Manufacturers are blending advanced plastic polymers and lightweight alloys to meet evolving preferences in comfort, design, and function. Additionally, promotional pens continue to see high demand, especially for branding and marketing activities. As e-commerce channels gain strength, personalization and specialty materials are gaining more traction among buyers, supporting steady growth in material demand across this segment.

Major players in the Global Cartridge and Pen Materials Market include Gerresheimer AG, SCHOTT Pharma AG, West Pharmaceutical Services, Inc., Becton, Dickinson and Company (BD), and Stevanato Group S.p.A. Leading companies in Cartridge and Pen Materials Market are expanding their material portfolios by developing advanced polymers that offer chemical resistance, low reactivity, and regulatory alignment with evolving global standards. SCHOTT Pharma AG and Gerresheimer AG are heavily investing in manufacturing capabilities to support hybrid material development, combining traditional glass and high-grade polymers for next-gen cartridges and pens. Firms like BD and Stevanato Group are integrating smart technology compatibility into their pen platforms, enabling digital connectivity. To improve supply chain resilience and regional presence, many companies are localizing production facilities. Collaborations with drug developers to co-design customized delivery devices are also on the rise. Emphasis on sustainability, with recyclable and eco-friendly material options, is another key tactic adopted to future-proof product lines and gain a competitive advantage.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Material Type

- 2.2.3 Product Type

- 2.2.4 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rise in biologics and biosimilars

- 3.2.1.2 Self-administration & home care

- 3.2.1.3 Regulatory push for syringe safety

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Glass delamination & breakage

- 3.2.2.2 Stringent regulatory testing

- 3.2.2.3 Supply chain complexity

- 3.2.3 Market opportunities

- 3.2.3.1 Polymer material innovation

- 3.2.3.2 Smart/connected syringe systems

- 3.2.3.3 Demand in APAC emerging markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Material Type, 2025 - 2034 (USD Million, Units)

- 5.1 Key trends

- 5.2 Glass materials

- 5.2.1 Borosilicate glass

- 5.2.2 Soda-lime glass

- 5.2.3 Coated glass solutions

- 5.3 Polymer materials

- 5.3.1 Cyclic olefin copolymer (COC)

- 5.3.2 Cyclic olefin polymer (COP)

- 5.3.3 Other polymers (polypropylene, polyethylene)

- 5.3.4 Specialty polymers

- 5.4 Metal components

- 5.4.1 Stainless steel

- 5.4.2 Aluminum alloys

- 5.4.3 Coated/plated metals

- 5.5 Elastomer components

- 5.5.1 Rubber seals

- 5.5.2 Silicone elastomers

- 5.5.3 Thermoplastic elastomers (TPEs)

Chapter 6 Market Estimates and Forecast, By Product Type, 2025 - 2034 (USD Million, Units)

- 6.1 Key trends

- 6.2 Cartridge systems

- 6.2.1 Insulin cartridges

- 6.2.2 Biologics cartridges

- 6.2.3 Specialty drug cartridges

- 6.3 Pen components

- 6.3.1 Pen bodies

- 6.3.2 Injection mechanisms

- 6.3.3 Needle assemblies

- 6.4 Closure & sealing systems

- 6.4.1 Plunger stoppers

- 6.4.2 Needle shields

- 6.4.3 Cap and locking systems.

Chapter 7 Market Estimates and Forecast, By Application type, 2025 - 2034 (USD Million, Units)

- 7.1 Key trends

- 7.2 Diabetes management

- 7.2.1 Insulin pens

- 7.2.2 GLP-1 agonists

- 7.2.3 Combination injectors

- 7.3 Biologics and biosimilars

- 7.3.1 Monoclonal antibodies

- 7.3.2 Growth hormones

- 7.3.3 Vaccine injectors

- 7.4 Specialty therapeutics

- 7.4.1 Autoimmune disease therapies

- 7.4.2 Oncology treatments

- 7.4.3 Rare disease drug delivery

Chapter 8 Market Estimates and Forecast, By Region, 2025 - 2034 (USD Million, Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East & Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East & Africa

Chapter 9 Company Profiles

- 9.1 SCHOTT Pharma AG & Co. KGaA

- 9.2 Gerresheimer AG

- 9.3 Stevanato Group S.p.A.

- 9.4 West Pharmaceutical Services, Inc.

- 9.5 Becton, Dickinson and Company (BD)

- 9.6 Ypsomed AG

- 9.7 Owen Mumford Ltd.

- 9.8 SHL Medical AG

- 9.9 Haselmeier GmbH

- 9.10 Phillips-Medisize (a Molex company)

- 9.11 Nemera

- 9.12 Credence MedSystems, Inc.

- 9.13 Terumo Corporation

- 9.14 Kraton Corporation

- 9.15 Datwyler Holding Inc.