PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844285

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844285

Germany Self-healing Flooring Materials Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

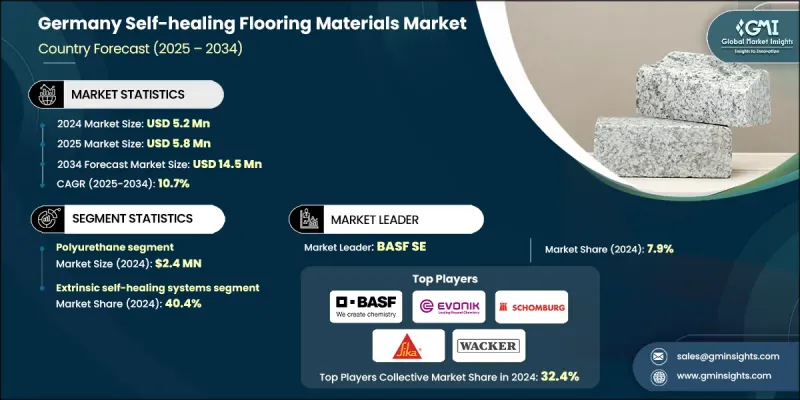

Germany Self-healing Flooring Materials Market was valued at USD 5.2 million in 2024 and is estimated to grow at a CAGR of 10.7% to reach USD 14.5 million by 2034.

The market is experiencing robust momentum as construction and infrastructure stakeholders across the country seek cost-effective and long-lasting flooring solutions. With the rising cost of maintenance and repair, particularly in commercial and industrial facilities, developers and property managers are increasingly turning to self-repairing floor technologies to extend surface longevity and reduce operational expenses. These advanced flooring systems feature embedded capabilities that allow them to automatically repair minor damages such as surface abrasions and cracks, which helps reduce downtime and maintain appearance over time. Regulatory pressure around safety and durability standards in German construction further intensifies the demand for materials that meet strict quality benchmarks. As a result, innovation in self-healing technologies continues to accelerate. Bavaria is rapidly establishing itself as a significant growth zone due to increasing adoption of modern construction practices, while North Rhine-Westphalia maintains a strong foothold in the sector due to its developed industrial base and ongoing infrastructure modernization efforts.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.2 Million |

| Forecast Value | $14.5 Million |

| CAGR | 10.7% |

The polyurethane segment generated USD 2.4 million in 2024, driven by a unique combination of durability and chemical resistance, making it a preferred material in environments exposed to harsh conditions. Its usage is expanding across facilities that demand tough and long-lasting surfaces, including those handling sensitive equipment or industrial machinery. The growing preference for polyurethane-based systems in areas with continuous foot or machinery traffic reflects its rising significance across a wide range of commercial and industrial use cases.

The extrinsic self-healing systems segment accounted for a 40.4% share in 2024. These systems incorporate healing agents that are activated upon impact or damage, making them ideal for applications where structural integrity is crucial. The ability to integrate multiple healing compounds allows for tailored solutions that meet the requirements of demanding workspaces. Due to their design versatility and effectiveness in recovering from significant damage, these systems are gaining traction in operations where durability and safety cannot be compromised.

North Rhine-Westphalia Self-healing Flooring Materials Market generated USD 1.6 million in 2024, reaffirming its leading role in Germany's self-healing flooring materials sector. The region's prominence is fueled by its dense concentration of industrial activity, including sectors that necessitate resilient flooring systems. It continues to benefit from a wave of industrial upgrades and infrastructure investments, driven by digital transformation trends and facility enhancements. As demand for smart and efficient flooring solutions increases, North Rhine-Westphalia remains a key contributor to overall market expansion.

Companies active in the Germany Self-healing Flooring Materials Market, such as BASF SE, Sika, Evonik Industries AG, Wacker Chemie AG, Tarkett Group, HEGGEL GmbH, and SCHOMBURG GmbH, are implementing a range of strategic approaches to secure long-term growth. These include expanding R&D investments to develop advanced self-repairing compounds and forming partnerships with construction firms to integrate solutions directly into large-scale projects. Many are focusing on material innovation to ensure compliance with evolving safety and sustainability regulations. Several players are also targeting region-specific opportunities by launching customized product lines suited for industrial hubs like North Rhine-Westphalia or rapidly modernizing regions like Bavaria. In addition, market leaders are optimizing their distribution channels and investing in digital sales infrastructure to strengthen customer engagement and accelerate market penetration.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Material trends

- 2.2.2 Technology trends

- 2.2.3 Application trends

- 2.2.4 End use industry trends

- 2.2.5 State trends

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By state

- 3.8.2 By material

- 3.9 Future market trends

- 3.10 Technology and Innovation landscape

- 3.10.1 Current technological trends

- 3.10.2 Emerging technologies

- 3.11 Patent Landscape

- 3.12 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.12.1 Major importing countries

- 3.12.2 Major exporting countries

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.14 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By state

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Material, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Polyurethane

- 5.3 Epoxy Resin

- 5.4 Cement

- 5.5 Others

Chapter 6 Market Estimates and Forecast, By Technology, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Extrinsic self-healing systems

- 6.3 Intrinsic self-healing polymers

- 6.4 Others

Chapter 7 Market Estimates and Forecast, By Application, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Industrial flooring

- 7.2.1 Chemical processing facilities

- 7.2.2 Pharmaceutical manufacturing

- 7.2.3 Food processing applications

- 7.2.4 Heavy-duty performance standards

- 7.3 Residential flooring

- 7.3.1 Single-family home applications

- 7.3.2 Multi-family housing projects

- 7.4 Commercial flooring

- 7.4.1 Office buildings & retail spaces

- 7.4.2 Public building applications

- 7.4.3 Healthcare facility requirements

- 7.5 Waterproofing systems

- 7.6 Car park flooring

- 7.6.1 Underground parking facilities

- 7.6.2 Multi-story car park applications

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2021-2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Construction & building

- 8.3 Data centers & IT infrastructure

- 8.4 Manufacturing & industrial

- 8.4.1 Automotive production facilities

- 8.4.2 Chemical processing plants

- 8.4.3 Pharmaceutical manufacturing

- 8.4.4 Food & beverage processing

- 8.5 Healthcare facilities

- 8.5.1 Hospitals & medical centers

- 8.5.2 Laboratory environments

- 8.5.3 Pharmaceutical research facilities

- 8.5.4 Hygiene & safety standards

- 8.6 Transportation infrastructure

- 8.6.1 Airport terminal facilities

- 8.6.2 Railway station applications

- 8.6.3 Public transportation hubs

Chapter 9 Market Estimates and Forecast, By State, 2021-2034 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 North Rhine-Westphalia

- 9.3 Bavaria

- 9.4 Baden-Wurttemberg

- 9.5 Lower Saxony

- 9.6 Bremen

- 9.7 Other Federal States

Chapter 10 Company Profiles

- 10.1 BASF SE

- 10.2 Evonik Industries AG

- 10.3 HEGGEL GmbH

- 10.4 SCHOMBURG GmbH

- 10.5 Sika

- 10.6 Tarkett Group

- 10.7 Wacker Chemie AG