PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844288

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844288

South-East Asia Two-wheeler E-Axle Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

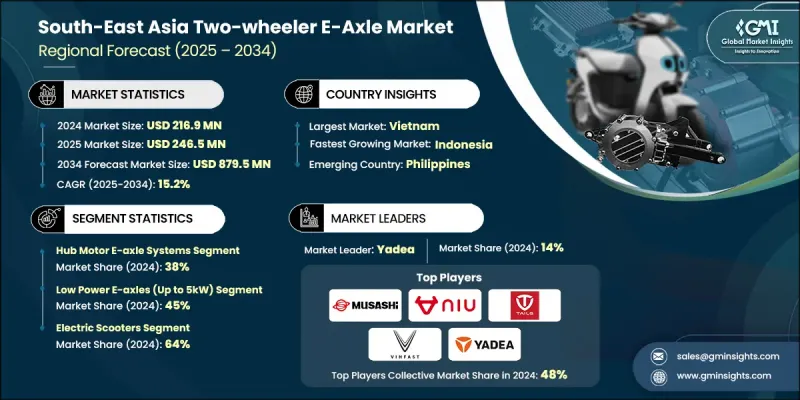

The South-East Asia Two-wheeler E-Axle Market was valued at USD 216.9 million in 2024 and is estimated to grow at a CAGR of 15.2% to reach USD 879.5 million by 2034.

The region's electrification efforts are no longer in the early adoption phase two-wheeler EVs are now becoming part of daily urban transport. Commuters, delivery operators, and mobility service providers are drawn to the benefits of lower operating expenses and minimal downtime. While hub motors remain a cost-effective solution, integrated e-axle systems are increasingly preferred in high-usage applications due to their performance efficiency and durability. Public and private initiatives across the region are pushing for standardized LEV components, which not only support easier maintenance but also speed up the adoption of compact and modular drivetrain systems suited to Southeast Asia's congested urban infrastructure.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $216.9 Million |

| Forecast Value | $879.5 Million |

| CAGR | 15.2% |

Vietnam has taken strong policy steps by offering a first-time registration fee exemption on battery-electric two-wheelers through early 2027. This is easing the transition to EVs for both households and fleet operators. Local governments are also stepping up with regulatory clarity to simplify compliance, financing, and vehicle resale. In Indonesia, ecosystem development is accelerating through direct collaboration between EV tech firms and mobility services. A notable pilot initiative has introduced battery-swapping capabilities to support large-scale rollouts-achieving operational predictability and maximizing fleet uptime through rapid swap cycles and accessible infrastructure at high-traffic locations.

In 2024, the hub motor e-axle systems segment held a 38% share and is expected to grow at a CAGR of 11.3% through 2034. These systems remain the go-to for lightweight scooters and motorcycles due to their affordability, mechanical simplicity, and high efficiency in dense city conditions. Their direct-wheel drive layout eliminates transmission loss, making them ideal for short, frequent trips common across urban centers in Indonesia, Thailand, and Vietnam. This strong compatibility with compact mobility applications continues to make hub motors a dominant solution among local OEMs.

The low-power e-axle segment (up to 5kW) held a 45% share in 2024 and is estimated to grow at a CAGR of 8.4% through 2034. These systems are specifically designed for entry-level scooters and motorcycles that are widely used for commuting across busy metropolitan areas. Their balance between affordability, energy efficiency, and sufficient performance makes them a practical fit for markets where traffic density limits speed and range needs. Manufacturers are integrating these systems to reduce power consumption while delivering adequate torque and performance for day-to-day riding scenarios.

Vietnam South-East Asia Two-wheeler E-Axle Market held 36% share, generating USD 77.2 million in 2024, driven by favorable policies, growing consumer interest, and proactive efforts by local brands to produce key drivetrain components domestically. Companies such as Dat Bike, VinFast, and PEGA are significantly reducing costs by sourcing and manufacturing motors, controllers, and systems in-house. These manufacturers are focusing on affordable and commuter-focused products, aligning well with the needs of Vietnam's expanding urban population and supporting sustained growth in this segment.

Key players in the South-East Asia Two-wheeler E-Axle Market include Gogoro, Bosch, NIU Technologies, Musashi, Yamaha, Yadea, TAILG, Vitesco Technologies, ZF Friedrichshafen, and VinFast. To enhance their position in the market, companies are focusing on several critical strategies. These include investing in local production to reduce reliance on imports and lower costs, collaborating with governments for regulatory alignment, and developing modular and scalable e-axle systems to support multiple vehicle platforms. Many firms are also entering partnerships with ride-hailing and delivery platforms to scale deployments and test real-world durability. Product innovation around battery-swapping compatibility, integrated thermal management, and simplified maintenance is also helping manufacturers better cater to Southeast Asia's dense, high-usage environments.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 System

- 2.2.3 Power Rating

- 2.2.4 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Electrification of urban two-wheelers

- 3.2.1.2 Government incentives and conversion programs in Indonesia and Vietnam

- 3.2.1.3 Rise in e-commerce and last-mile delivery

- 3.2.1.4 Regional urban mobility policies and city EV pilots

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Limited charging and swapping infrastructure outside Tier-I cities

- 3.2.2.2 High upfront costs of e-axle systems

- 3.2.3 Market opportunities

- 3.2.3.1 Fleet electrification programs

- 3.2.3.2 Battery swapping and modular platform adoption

- 3.2.3.3 Local manufacturing and assembly expansion

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 Brunei

- 3.4.2 Cambodia

- 3.4.3 East Timor

- 3.4.4 Indonesia

- 3.4.5 Laos

- 3.4.6 Malaysia

- 3.4.7 Myanmar

- 3.4.8 Philippines

- 3.4.9 Singapore

- 3.4.10 Thailand

- 3.4.11 Vietnam

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly Initiatives

- 3.12.5 Carbon footprint considerations

- 3.13 Cargo & Delivery Bikes - Commercial Growth

- 3.13.1 Last-mile delivery applications

- 3.13.2 Cargo bike configurations & types

- 3.13.3 Commercial fleet applications

- 3.13.4 SEA market opportunities & growth

- 3.13.5 E-axle requirements for cargo applications

- 3.14 Battery Swapping Integration - SEA Innovation

- 3.14.1 Battery swapping technology & systems

- 3.14.2 E-axle integration with battery swapping

- 3.14.3 Market development & business models

- 3.15 Smart Connectivity & IoT Integration

- 3.15.1 Connected e-axle systems

- 3.15.2 Mobile app integration & user experience

- 3.15.3 Fleet management & telematics

- 3.15.4 Smart city integration & infrastructure

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Brunei

- 4.2.2 Cambodia

- 4.2.3 East Timor

- 4.2.4 Indonesia

- 4.2.5 Laos

- 4.2.6 Malaysia

- 4.2.7 Myanmar

- 4.2.8 Philippines

- 4.2.9 Singapore

- 4.2.10 Thailand

- 4.2.11 Vietnam

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By System, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Hub Motor e-Axle Systems

- 5.3 Mid-Drive e-Axle Systems

- 5.4 Integrated e-Axle Units

- 5.5 Modular e-Axle Systems

Chapter 6 Market Estimates & Forecast, By Power Rating, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Low Power e-Axles (Up to 5kW)

- 6.3 Medium Power e-Axles (5-15kW)

- 6.4 High Power e-Axles (15-30kW)

- 6.5 Ultra-High Performance e-Axles (30kW+)

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Electric scooters

- 7.3 Electric motorcycles

- 7.4 Cargo & delivery bikes

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Brunei

- 8.3 Cambodia

- 8.4 East Timor

- 8.5 Indonesia

- 8.6 Laos

- 8.7 Malaysia

- 8.8 Myanmar

- 8.9 Philippines

- 8.10 Singapore

- 8.11 Thailand

- 8.12 Vietnam

Chapter 9 Company Profiles

- 9.1 Global players

- 9.1.1 AVL List

- 9.1.2 BorgWarner

- 9.1.3 Bosch

- 9.1.4 Continental

- 9.1.5 Cummins

- 9.1.6 Dana

- 9.1.7 Linamar

- 9.1.8 Nidec

- 9.1.9 Vitesco Technologies

- 9.1.10 ZF Friedrichshafen

- 9.2 Regional Players

- 9.2.1 MAHLE Powertrain

- 9.2.2 NIU Technologies

- 9.2.3 T&D

- 9.2.4 TAILG

- 9.2.5 Valeo

- 9.2.6 VinFast

- 9.2.7 Musashi

- 9.2.8 Yamaha Motor

- 9.2.9 Yadea

- 9.2.10 Varcheae Mobility

- 9.3 Emerging Players / Disruptors

- 9.3.1 Ather Energy

- 9.3.2 Ampere Vehicles

- 9.3.3 Etergo

- 9.3.4 Gogoro

- 9.3.5 Horwin

- 9.3.6 Maeving

- 9.3.7 Revolt Motors

- 9.3.8 Super Soco

- 9.3.9 Tork Motors

9.3.10 Ultraviolette Automotive