PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844294

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844294

Passive Infrared Sensors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

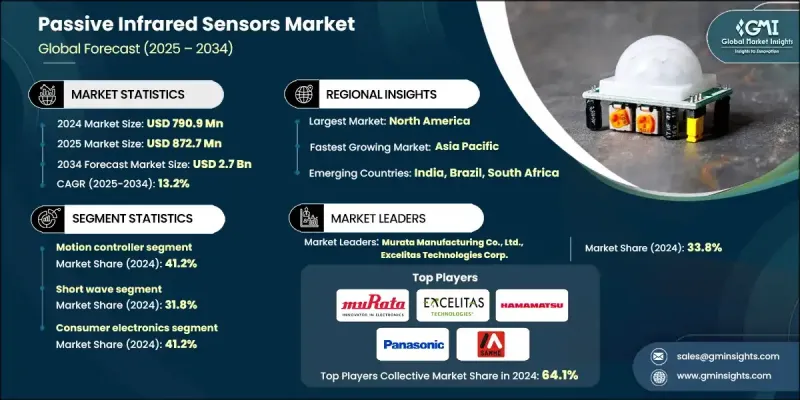

The Global Passive Infrared Sensors Market was valued at USD 790.9 million in 2024 and is estimated to grow at a CAGR of 13.2% to reach USD 2.7 billion by 2034.

The increasing popularity of smart home automation is one of the key factors driving this growth. As consumers invest more in connected devices, the demand for PIR sensors has surged, as these sensors are essential for enabling motion detection in smart lighting systems, security alarms, and HVAC (heating, ventilation, and air conditioning) applications. PIR sensors, known for their low power consumption and reliable motion-detection capabilities, are becoming integral to enhance convenience, security, and energy efficiency. The rise of voice assistants and IoT devices further expands the use of PIR sensors in multifunctional devices that offer seamless automation. Additionally, the global emphasis on sustainability and energy efficiency has promoted the adoption of PIR sensors in energy-saving building solutions. These sensors help optimize the control of lighting, heating, and cooling systems by detecting human presence and reducing unnecessary energy use. This trend is particularly important as governments implement stricter energy efficiency regulations and companies adopt green building certifications.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $790.9 Million |

| Forecast Value | $2.7 Billion |

| CAGR | 13.2% |

The motion controller segment held a 41.2% share and was valued at USD 326 million in 2024. Motion controllers continue to dominate the PIR sensor market due to their crucial role in security systems, lighting control, and energy management solutions. Their affordability, low power usage, and easy integration make them essential in residential, commercial, and industrial applications.

The long-wave PIR sensor segment generated USD 382.3 million in 2024. Long-wave PIR sensors are in high demand for outdoor and large-area applications, such as perimeter security, military surveillance, traffic monitoring, and smart city infrastructure. The growing focus on advanced security systems, public safety, and defense modernization is driving this segment's expansion. Companies looking to maintain leadership in the market should prioritize the development of long-range sensors with enhanced connectivity, reduced false alarms, and higher performance to cater to large-scale infrastructure and defense projects.

United States Passive Infrared Sensors Market generated USD 245.8 million in 2024, with a CAGR of 14% fueled by a surge in home automation, the increasing demand for advanced security systems, and a rise in smart infrastructure projects. The adoption of smart homes, a heightened focus on energy efficiency, and government incentives promoting sustainable building practices are all accelerating the use of PIR sensors in various sectors. Additionally, the strong U.S. defense and aerospace industries contribute to the growing demand for high-performance PIR sensors used in surveillance and monitoring applications.

Key players operating in the Global Passive Infrared Sensors Market include General Dynamics Corporation, Bosch Security Systems, LLC, Honeywell International Inc., Cypress Semiconductor, Elmos Semiconductor, Axis Communications AB, STMicroelectronics N.V., Panasonic Holdings Corporation, Excelitas Technologies Corp., Atmel Corporation, Murata Manufacturing Co., Ltd., Hamamatsu Photonics K.K., Ningbo Sanhe Sensor Co., Ltd., Espon Toyocom Corporation, and Nippon Avionics Co., Ltd. Companies in the Passive Infrared Sensors Market are employing several key strategies to solidify their market position. These strategies include investing in the development of innovative sensor technologies, focusing on improving sensor performance, and enhancing energy efficiency. Firms are also expanding their product portfolios to meet the growing demand for advanced PIR sensors, especially in applications such as smart homes, security, and energy management. Another important strategy is forming strategic partnerships and collaborations to access new markets and share technological expertise.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry snapshot

- 2.2 Key market trends

- 2.2.1 Packaging type trends

- 2.2.2 Material trends

- 2.2.3 Application trends

- 2.2.4 Regional

- 2.3 TAM Analysis, 2025-2034 (USD Billion)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing adoption of smart home automation

- 3.2.1.2 Rising need for energy-efficient building solutions

- 3.2.1.3 Expansion of IoT and connected devices

- 3.2.1.4 Increasing security and surveillance requirements

- 3.2.1.5 Growth in automotive driver assistance systems

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Sensor accuracy issues in harsh environments

- 3.2.2.2 Rising competition from alternative sensing technologies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 Historical price analysis (2021-2024)

- 3.8.2 Price trend drivers

- 3.8.3 Regional price variations

- 3.8.4 Price forecast (2025-2034)

- 3.9 Pricing strategies

- 3.10 Emerging business models

- 3.11 Compliance requirements

- 3.12 Sustainability measures

- 3.12.1 Sustainable materials assessment

- 3.12.2 Carbon footprint analysis

- 3.12.3 Circular economy implementation

- 3.12.4 Sustainability certifications and standards

- 3.12.5 Sustainability ROI analysis

- 3.13 Global consumer sentiment analysis

- 3.14 Patent analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.2 Market Concentration Analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Device, 2021 - 2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Smoke detector

- 5.3 Heat detector

- 5.4 Motion controller

- 5.5 Other devices

Chapter 6 Market Estimates and Forecast, By Range, 2021 - 2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Short wave passive infrared sensor

- 6.3 Mid wave passive infrared sensor

- 6.4 Long wave passive infrared sensor

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Consumer electronics

- 7.2.1 Smartphones and smart mobile devices

- 7.2.2 Cameras

- 7.2.3 Other electronic

- 7.3 Healthcare

- 7.3.1 Patient monitoring systems

- 7.3.2 Fever screening devices

- 7.3.3 Sleep tracking systems

- 7.3.4 Infrared thermometers

- 7.3.5 Others

- 7.4 Industrial

- 7.5 Automotive

- 7.6 Defense and aerospace

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Atmel Corporation

- 9.2 Axis Communications AB

- 9.3 Bosch Security Systems, LLC

- 9.4 Current Corporation

- 9.5 Cypress Semiconductor

- 9.6 Elmos Semiconductor

- 9.7 Epson Toyocom Corporation

- 9.8 Excelitas Technologies Corp.

- 9.9 General Dynamics Corporation

- 9.10 Hamamatsu Photonics K.K.

- 9.11 Honeywell International Inc.

- 9.12 Murata Manufacturing Co., Ltd.

- 9.13 Ningbo Sanhe Sensor Co., Ltd.

- 9.14 Nippon Avionics Co., Ltd

- 9.15 Panasonic Holdings Corporation

- 9.16 STMicroelectronics N.V