PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844300

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844300

Off-road Vehicle Braking System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

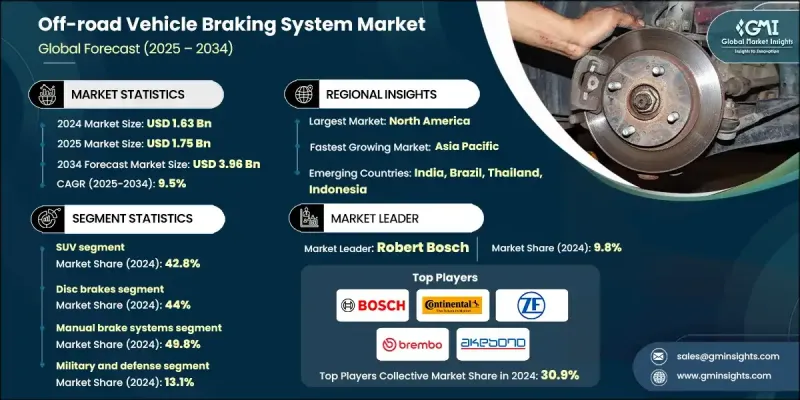

The Global Off-road Vehicle Braking System Market was valued at USD 1.63 billion in 2024 and is estimated to grow at a CAGR of 9.5% to reach USD 3.96 billion by 2034.

The demand for high-performance braking systems in off-road vehicles continues to grow due to the diverse terrains these vehicles encounter, including steep inclines, loose rocks, sand, and mud. Unlike conventional braking systems, off-road braking mechanisms must deliver adaptive responsiveness to varying surface conditions while maintaining traction and control. Drivers depend on braking systems to offer precise modulation, particularly when navigating rugged terrain or managing heavy payloads. As off-road vehicles frequently carry added equipment or passengers, their braking systems must handle weight distribution shifts while effectively dissipating heat and regulating fluid temperature. These systems must also resist brake fade, ensuring reliability under extreme conditions and during prolonged operation. Advancements in braking technology continue to focus on improving stability, control, and responsiveness, making it possible to maintain optimal stopping power even when vehicles are fully loaded or maneuvering through harsh, unpredictable environments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.63 Billion |

| Forecast Value | $3.96 Billion |

| CAGR | 9.5% |

The SUV segment held 42.8% in 2024 and is forecasted to grow at a CAGR of 10.3% through 2034. SUVs today are increasingly equipped with braking systems that adapt to changing surfaces, enhancing traction and vehicle control across uneven terrains. These technologies are often paired with electronic stability and traction control systems to support safety and off-road maneuverability in a wide range of driving conditions.

In 2024, the disc brake segment held a 44% share and will grow at a CAGR of 9.9% from 2025 to 2034. Disc brakes, particularly those constructed from carbon-carbon composites, are gaining popularity due to their ability to withstand extreme temperatures while reducing overall vehicle weight. Their superior strength-to-weight ratio and heat resistance make them ideal for off-road applications where both performance and durability are critical.

U.S. Off-road Vehicle Braking System Market will grow at a CAGR of 10.1% between 2025 and 2034. An extensive network of off-road trails, dedicated parks, dealerships, and service infrastructure is driving domestic demand. The rise of electric off-road vehicles is also boosting market potential. Manufacturers are rolling out electric variants that deliver greater torque, quieter performance, and lower emissions all without compromising the vehicle's rugged capabilities. U.S. consumers are increasingly favoring off-road vehicles equipped with advanced features like GPS, telematics, onboard computers, and electronic power steering, further elevating the demand for precision-engineered braking systems.

Key players dominating the Off-road Vehicle Braking System Market include ZF Friedrichshafen, Knorr-Bremse, Mando, Advics, Robert Bosch, Continental, Brembo, Akebono Brake Industry, and Nissin Kogyo. To strengthen their position, companies in the off-road vehicle braking system sector are focusing on innovation and strategic collaboration. Many are investing in lightweight, high-performance brake materials that enhance thermal resistance and durability, particularly for electric and hybrid off-road platforms. Manufacturers are also integrating electronic braking solutions with advanced driver-assist technologies to enhance safety and control. Expanding partnerships with OEMs and customizing braking systems for terrain-specific needs are helping companies offer more specialized, value-driven solutions. In parallel, expanding manufacturing capabilities and leveraging data from vehicle telematics are helping manufacturers provide predictive maintenance and performance optimization, securing long-term customer loyalty.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Vehicle

- 2.2.3 Brake

- 2.2.4 Brake system operations

- 2.2.5 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook

- 2.6 Strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Electrification & regenerative braking

- 3.2.1.2 Safety regulations & standards

- 3.2.1.3 Harsh environmental exposure

- 3.2.1.4 Vehicle load & weight

- 3.2.1.5 Terrain variability

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High development & maintenance costs

- 3.2.2.2 Limited awareness in emerging markets

- 3.2.3 Market opportunities

- 3.2.3.1 Growth of electric off-road vehicles

- 3.2.3.2 Advanced safety integration

- 3.2.3.3 Demand in agriculture & defense sectors

- 3.2.3.4 Smart & connected braking systems

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology & innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Cost breakdown analysis

- 3.9 Patent analysis

- 3.10 Price trends

- 3.10.1 By region

- 3.10.2 By Vehicle

- 3.11 Production statistics

- 3.11.1 Production hubs

- 3.11.2 Consumption hubs

- 3.11.3 Export and import

- 3.12 Cost Structure & Economics Analysis

- 3.12.1 Manufacturing Cost Breakdown (Materials, Labor, Overhead)

- 3.12.2 R&D Investment Requirements & Amortization

- 3.12.3 Economies of Scale Analysis

- 3.12.4 Total Cost of Ownership (TCO) Models

- 3.12.5 Price Elasticity of Demand Analysis

- 3.13 Import-Export Trade Analysis

- 3.13.1 Global Trade Flow Mapping (HS Code Analysis)

- 3.13.2 Top Importing & Exporting Countries

- 3.13.3 Trade Balance Analysis by Region

- 3.13.4 Tariff Structure & Trade Barriers Impact

- 3.13.5 Supply Chain Vulnerability Assessment

- 3.14 Sustainability and environmental aspects

- 3.14.1 Sustainable practices

- 3.14.2 Waste reduction strategies

- 3.14.3 Energy efficiency in production

- 3.14.4 Eco-friendly initiatives

- 3.14.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key news and initiatives

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.1.1 SUV

- 5.1.2 UTV

- 5.1.3 ATV

- 5.1.4 Snowmobile

- 5.1.5 Off-road Motorcycle

Chapter 6 Market Estimates & Forecast, By Brake, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Disc Brakes

- 6.3 Drum Brakes

- 6.4 Hydraulic Brakes

- 6.5 Pneumatic Brakes

- 6.6 Electromechanical Brakes

Chapter 7 Market Estimates & Forecast, By Brake System Operations, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.1.1 Manual Brake Systems

- 7.1.2 Automatic Brake Systems

- 7.1.3 Anti-lock Braking Systems (ABS)

- 7.1.4 Electronic Stability Control (ESC)

- 7.1.5 Traction Control Systems (TCS)

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Recreational

- 8.3 Commercial

- 8.4 Agricultural

- 8.5 Military and Defense

- 8.6 Mining and Extraction

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Nordics

- 9.3.7 Netherlands

- 9.3.8 Russia

- 9.4 Asia Pacific

- 9.4.1 Australia

- 9.4.2 China

- 9.4.3 India

- 9.4.4 Indonesia

- 9.4.5 Japan

- 9.4.6 Singapore

- 9.4.7 South Korea

- 9.4.8 Thailand

- 9.4.9 Vietnam

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1.1.1 Top Global Players

- 10.1.1.1.1 Brembo

- 10.1.1.1.2 ZF Friedrichshafen

- 10.1.1.1.3 Continental

- 10.1.1.1.4 Robert Bosch

- 10.1.1.1.5 Akebono Brake Industry

- 10.1.1.1.6 AISIN

- 10.1.1.1.7 Tenneco

- 10.1.1.1.8 Mando

- 10.1.1.1.9 Nissin Kogyo

- 10.1.1.2 Regional Players

- 10.1.1.2.1 Caterpillar

- 10.1.1.2.2 Komatsu

- 10.1.1.2.3 KNORR-BREMSE

- 10.1.1.2.4 Haldex

- 10.1.1.2.5 Hitachi Astemo

- 10.1.1.2.6 Technology Specialists

- 10.1.1.2.7 ADVICS

- 10.1.1.2.8 Hayes Performance Systems

- 10.1.1.2.9 Wilwood Engineering

- 10.1.1.3 Emerging Players & Disruptors

- 10.1.1.3.1 Yamaha

- 10.1.1.3.2 Rivian Automotive

- 10.1.1.3.3 OEM Integration Partners

- 10.1.1.3.4 John Deere

- 10.1.1.3.5 Volvo Construction Equipment

- 10.1.1.3.6 Liebherr

- 10.1.1.3.7 CNH Industrial