PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844301

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844301

Feather Processing Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

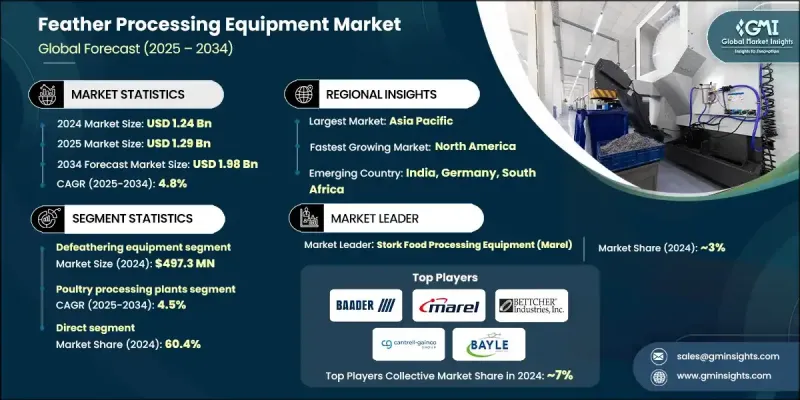

The Global Feather Processing Equipment Market was valued at USD 1.24 billion in 2024 and is estimated to grow at a CAGR of 4.8% to reach USD 1.98 billion by 2034.

Growing emphasis on eco-friendly waste management practices is significantly driving the adoption of feather recycling technologies. According to estimates, around 8 million metric tons of poultry feathers are generated each year, presenting a major opportunity for sustainable utilization. These feathers, once discarded as waste, are now being repurposed into profitable products such as fertilizers, textiles, and animal feed. This shift is helping to cut down environmental impact while opening new revenue streams for businesses. As sustainability targets and stricter environmental compliance standards become more prominent, manufacturers are increasing investments in next-gen feather processing equipment. These developments are reshaping the market landscape, making sustainability a central driver of growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.24 Billion |

| Forecast Value | $1.98 Billion |

| CAGR | 4.8% |

Ongoing technological improvements are transforming how feather processing is carried out. Enhanced automation and energy-efficient machinery are boosting productivity, improving hygiene standards, and streamlining operations. Tighter regulations related to waste disposal are prompting poultry processors to adopt more effective and environmentally conscious solutions. A growing number of poultry processing plants are now integrating feather processing units with broader rendering systems. This shift is fueling demand for modular, easy-to-install machines that seamlessly fit into existing workflows, boosting operational flexibility and efficiency.

The defeathering equipment segment was valued at USD 497.3 million in 2024 and is forecasted to grow at a CAGR of 4.4% between 2025 and 2034. Surging demand for poultry products, particularly in emerging economies, is prompting processing facilities to automate their operations and reduce their reliance on manual labor. Defeathering machines play a critical role in achieving high throughput, maintaining cleanliness, and ensuring uniformity during the early stages of poultry processing. As production scales up, the need for fast and hygienic defeathering solutions becomes more essential.

The poultry processing facilities segment held a 52.9% share in 2024 and is projected to grow at a CAGR of 4.5% through 2034. With poultry meat consumption continuing to rise globally, processors are expanding capacity and upgrading existing systems to manage feather by-products in a cost-effective, sanitary, and sustainable manner. Integrated systems that can clean, defeather, dry, and package feathers are seeing rising demand as plants aim to optimize every step of the operation.

United States Feather Processing Equipment Market was valued at USD 266.4 million in 2024 and is expected to grow at a CAGR of 4.7% from 2025 to 2034. The U.S. feather processing industry benefits from a strong domestic poultry sector supported by high consumption rates and stringent regulatory frameworks. Companies are investing heavily in advanced, energy-efficient, and automated equipment to align with food safety mandates, environmental policies, and productivity goals. These developments are positioning the U.S. as a frontrunner in the adoption of modern feather processing technologies.

Key players shaping the competitive landscape of the Feather Processing Equipment Market include Kuiper & Zonen, Taizy Machinery, Bayle, TALSA, Bettcher Industries, Cantrell-Gainco, MAJA, LINCO, Baader Group, Meyn, Scott Automation, Banss, Stork (Marel), Hubbard Systems, and Ruvii. Companies in the Feather Processing Equipment Market are adopting several strategies to reinforce their market position. A primary focus is on product innovation through automation and energy efficiency to meet evolving sustainability and regulatory standards. Many players are expanding their product lines with modular, plug-and-play solutions that integrate easily into existing processing systems. Collaborations with poultry processing plants and long-term service agreements are helping companies secure recurring revenue streams. Strategic mergers and acquisitions are also being used to strengthen technical capabilities and broaden geographic reach.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Equipment type

- 2.2.3 Usage

- 2.2.4 Capacity

- 2.2.5 Application

- 2.2.6 End use industry

- 2.2.7 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rapid expansion of poultry industry

- 3.2.1.2 Increased demand for sustainable waste management

- 3.2.1.3 Rising demand for feather-based by-products

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment costs

- 3.2.2.2 Maintenance and technical expertise

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By Equipment type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Equipment Type, 2021 - 2034, (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Defeathering equipment

- 5.3 Cleaning and drying equipment

- 5.4 Grinding & cutting equipment

- 5.5 Sorting & grading equipment

- 5.6 Pressing & bunching equipment

- 5.7 Drying and dehydration systems

- 5.8 Packaging and handling equipment

- 5.9 Others (sterilization and disinfection systems, blowers, dusting, etc.)

Chapter 6 Market Estimates & Forecast, By Usage, 2021 - 2034, (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Recycling feathers

- 6.3 Virgin feathers

Chapter 7 Market Estimates & Forecast, By Capacity, 2021 - 2034, (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Upto 500 kg/hr

- 7.3 500-2,500 kg/hr

- 7.4 Above 2.500 kg/hr

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034, (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Poultry

- 8.3 Chicken

- 8.4 Goose

- 8.5 Duck

- 8.6 Others

- 8.7 Peacock

- 8.8 Others (ostrich, etc.)

Chapter 9 Market Estimates & Forecast, By End Use Industry, 2021 - 2034, (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 Poultry processing plants

- 9.3 Poultry rearing

- 9.4 Slaughtering

- 9.5 Down & feather

- 9.6 Clothing

- 9.7 Bedding products

- 9.8 Feather meal producers

- 9.9 Arts & crafts

- 9.10 Others (fertilizer, construction insulation, filtration system, etc.)

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Million) (Thousand Units)

- 10.1 Key trends

- 10.2 Direct

- 10.3 Indirect

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Million) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.4.6 Indonesia

- 11.4.7 Malaysia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 Saudi Arabia

- 11.6.2 UAE

- 11.6.3 South Africa

Chapter 12 Company Profiles

- 12.1 Baader Group

- 12.2 Banss

- 12.3 Bayle

- 12.4 Bettcher Industries

- 12.5 Cantrell-Gainco

- 12.6 Hubbard Systems

- 12.7 Kuiper & Zonen

- 12.8 LINCO

- 12.9 MAJA

- 12.10 Meyn

- 12.11 Ruvii

- 12.12 Scott Automation

- 12.13 Stork (Marel)

- 12.14 TALSA

- 12.15 Taizy Machinery