PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844311

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844311

Opto Semiconductor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

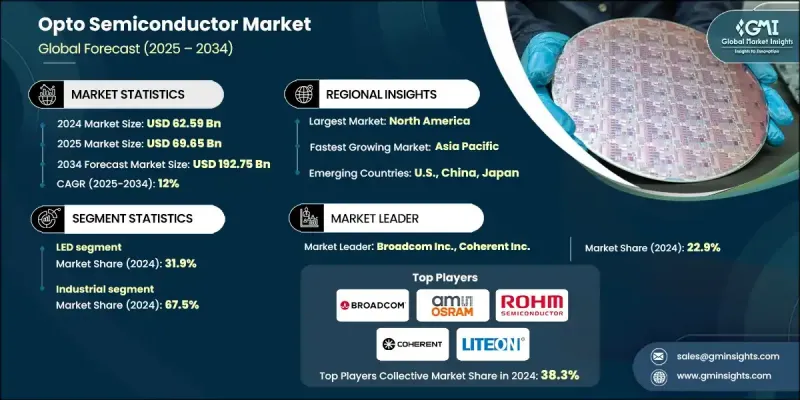

The Global Opto Semiconductor Market was valued at USD 62.59 billion in 2024 and is estimated to grow at a CAGR of 12% to reach USD 192.75 billion by 2034.

The increasing demand for vehicle safety, especially with the shift towards autonomous vehicles, is a key factor fueling growth. Optical sensors, LiDAR, infrared modules, and cameras, which are crucial components of Advanced Driver Assistance Systems (ADAS), are increasingly used in vehicles for real-time data collection and collision avoidance. As government regulations tighten and the automotive industry continues to embrace these technologies, the demand for opto semiconductors is expected to surge. Additionally, the growing popularity of electric and connected vehicles is driving the use of optical components in navigation, monitoring, and protection systems. Beyond the automotive sector, the expanding consumer electronics and IoT market is playing a crucial role. Devices like smartphones, smartwatches, and wearables are increasingly incorporating opto semiconductors for biometric sensing, gesture recognition, and face detection. Furthermore, as IoT ecosystems evolve from smart homes to industrial applications, the need for low-power, high-performance photonic sensors is on the rise, further propelling the market forward.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $62.59 Billion |

| Forecast Value | $192.75 Billion |

| CAGR | 12% |

The LED segment of the opto semiconductor market was valued at USD 19.98 billion in 2024. This growth is mainly attributed to the growing demand for energy-efficient lighting solutions in various sectors, including residential, commercial, and industrial markets. As sustainability initiatives gain traction, the adoption of LED-based opto semiconductors is also increasing, with significant government incentives pushing for the integration of green infrastructure and smart lighting technologies. These solutions offer improved illumination, lower energy consumption, and long-term cost savings.

The residential and commercial segment was valued at USD 20.35 billion in 2024. The rising adoption of energy-efficient LED lighting and the integration of smart home technologies are driving the demand for opto semiconductors in this space. Growing awareness around sustainability and the increasing need for automated lighting, security systems, and IoT-driven devices are boosting the use of these components to enhance energy savings, operational efficiency, and overall convenience in homes and businesses.

U.S. Opto Semiconductor Market held a CAGR of 13% at USD 18.84 billion in 2024, driven by the increased demand for automotive safety technologies, especially in the realm of Advanced Driver Assistance Systems (ADAS). Optical sensors, cameras, and LiDAR are critical in enabling real-time detection, collision prevention, and autonomous driving features. In addition, the U.S. market is witnessing a rise in the need for high-speed optical transceivers and photonic products, especially for data centers, cloud computing, and the growing IoT sector.

Leading players in the Opto Semiconductor Industry include Broadcom Inc., Coherent, Inc., Epistar Corporation, Fairchild Semiconductor International, IPG Photonics, JENOPTIK, LITE-ON Technology Corporation, Littelfuse, Inc., Mitsubishi Electric Corporation, OSRAM, Renesas Electronics Corporation, ROHM Semiconductor, SHARP Corporation, TOSHIBA Corporation, TT Electronics plc, Ushio America, Inc., and Vishay Intertechnology, Inc. To strengthen their market position, companies in the opto semiconductor industry are focusing on several key strategies. These include investing in research and development to advance opto semiconductor technologies, particularly in the areas of miniaturization, energy efficiency, and performance optimization. By enhancing the capabilities of their products, companies are ensuring that they can meet the rising demand for optical components in automotive, consumer electronics, and industrial applications. Additionally, strategic partnerships and collaborations with tech giants in the automotive and IoT sectors are becoming a priority. These alliances enable companies to leverage emerging market trends and expand their customer base.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry snapshot

- 2.2 Key market trends

- 2.2.1 Type trends

- 2.2.2 Application trends

- 2.2.3 Regional

- 2.3 TAM Analysis, 2025-2034 (USD Billion)

- 2.4 CXO perspective: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising adoption of automotive safety and ADAS systems

- 3.2.1.2 Expansion of consumer electronics and IoT devices

- 3.2.1.3 Increasing deployment in industrial automation and robotics

- 3.2.1.4 Demand growth in healthcare imaging and diagnostics

- 3.2.1.5 Advancements in smart lighting and energy-efficient solutions

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High manufacturing costs and complex fabrication processes

- 3.2.2.2 Intense competition and pricing pressure from global players

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 Historical price analysis (2021-2024)

- 3.8.2 Price trend drivers

- 3.8.3 Regional price variations

- 3.8.4 Price forecast (2025-2034)

- 3.9 Pricing strategies

- 3.10 Emerging business models

- 3.11 Compliance requirements

- 3.12 Sustainability measures

- 3.12.1 Sustainable materials assessment

- 3.12.2 Carbon footprint analysis

- 3.12.3 Circular economy implementation

- 3.12.4 Sustainability certifications and standards

- 3.12.5 Sustainability ROI analysis

- 3.13 Global consumer sentiment analysis

- 3.14 Patent analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.2 Market Concentration Analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Billion)

- 5.1 Key trends

- 5.2 LED

- 5.2.1 General lighting LEDs

- 5.2.2 Automotive LEDs

- 5.2.3 Display LEDs

- 5.2.4 Signage & indicators

- 5.2.5 UV LEDs

- 5.2.6 OLEDs

- 5.2.7 Others

- 5.3 Image Sensors

- 5.3.1 CMOS image sensors

- 5.3.2 CCD image sensors

- 5.3.3 3D/depth sensors

- 5.3.4 Specialized sensors

- 5.4 Infrared component

- 5.4.1 IR emitters

- 5.4.2 IR detectors

- 5.4.3 IR receiver modules

- 5.4.4 Thermal imaging components

- 5.4.5 Others

- 5.5 Optocouplers

- 5.6 Laser diode

- 5.7 Others

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Residential and commercial

- 6.3 Industrial

- 6.3.1 Automotive

- 6.3.1.1 Lighting systems

- 6.3.1.2 Advanced Driver Assistance Systems (ADAS)

- 6.3.1.3 In-cabin monitoring

- 6.3.1.4 Others

- 6.3.2 Consumer electronics

- 6.3.2.1 Smartphones & tablets

- 6.3.2.2 Wearables

- 6.3.2.3 Smart home devices

- 6.3.2.4 Others

- 6.3.3 Telecommunication

- 6.3.3.1 Optical communication systems

- 6.3.3.2 Data centers & networking

- 6.3.3.3 Others

- 6.3.4 Healthcare

- 6.3.4.1 Medical imaging

- 6.3.4.2 Diagnostics & monitoring

- 6.3.4.3 Biophotonics & life sciences

- 6.3.4.4 Others

- 6.3.5 Energy & power

- 6.3.6 Others

- 6.3.1 Automotive

Chapter 7 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 UAE

- 7.6.2 Saudi Arabia

- 7.6.3 South Africa

Chapter 8 Company Profiles

- 8.1 Global Players:

- 8.1.1 Broadcom Inc

- 8.1.2 Coherent, Inc.

- 8.1.3 Fairchild Semiconductor International

- 8.1.4 IPG Photonics

- 8.1.5 OSRAM

- 8.1.6 Renesas Electronics Corporation

- 8.1.7 SHARP CORPORATION

- 8.1.8 TOSHIBA Corporation

- 8.2 Regional Players:

- 8.2.1 Epistar Corporation

- 8.2.2 JENOPTIK

- 8.2.3 LITE-ON Technology Corporation

- 8.2.4 Littelfuse, Inc.

- 8.2.5 Mitsubishi Electric Corporation

- 8.3 Emerging Players:

- 8.3.1 ROHM Semiconductor

- 8.3.2 TT Electronics plc

- 8.3.3 Ushio America, Inc.

- 8.3.4 Vishay Intertechnology, Inc.