PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844312

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844312

Automotive Predictive Analytics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

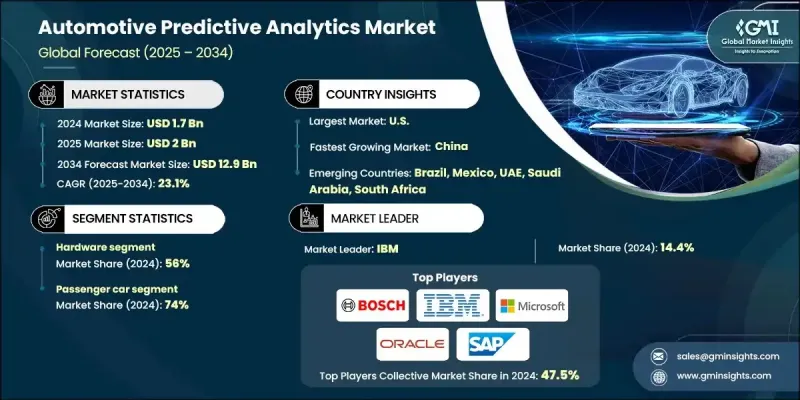

The Global Automotive Predictive Analytics Market was valued at USD 1.7 billion in 2024 and is estimated to grow at a CAGR of 23.1% to reach USD 12.9 billion by 2034.

The market is poised for rapid expansion, driven by the increasing adoption of connected cars and the extensive data generated by IoT devices such as sensors, GPS, and infotainment systems. Automakers are leveraging predictive analytics to anticipate component failures, optimize performance, and offer tailored services. The growing deployment of 5G-based telematics and Vehicle-to-Everything (V2X) communication further accelerates predictive opportunities, fueling widespread adoption across original equipment manufacturers (OEMs), fleet operators, and aftermarket service providers. Predictive analytics help in preventing unexpected vehicle breakdowns, providing real-time insights into vehicle health and performance, thereby reducing costs and extending the lifecycle of fleet assets. Additionally, the increasing popularity of predictive maintenance software for both passenger and commercial vehicles is a key growth driver for the market worldwide.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.7 Billion |

| Forecast Value | $12.9 Billion |

| CAGR | 23.1% |

The hardware segment held a 56% share in 2024 and is expected to grow at a CAGR of 23.5% between 2025 and 2034. Sensors such as LiDAR, radar, cameras, and telematics systems are fundamental to predictive analytics, offering real-time data on vehicle behavior, driver habits, and environmental conditions. As safety requirements increase and the adoption of advanced driver-assistance systems (ADAS) rises, demand for these hardware components will continue to soar.

The passenger vehicle segment held a 74% share in 2024. OEMs are increasingly focusing on delivering personalized features, including infotainment recommendations and predictive maintenance alerts. By analyzing data such as driving habits, weather, and historical vehicle usage, automakers can offer customized services that enhance customer satisfaction, improve brand loyalty, and promote data-driven ownership experiences.

U.S. Automotive Predictive Analytics Market held 89% share and was valued at USD 525.9 million in 2024. The U.S. leads the global autonomous vehicle research and development (R&D) sector, with significant contributions from Silicon Valley, Detroit, and numerous tech-OEM partnerships. These innovations rely heavily on predictive analytics to enable accident avoidance, real-time decision-making, and traffic forecasting.

Leading companies in the Global Automotive Predictive Analytics Market include Bosch, Continental, IBM, Microsoft, NXP, Oracle, PTC, SAP, SAS, and ZF. These market players are driving innovation and market expansion through a variety of strategies, such as mergers and acquisitions, partnerships, and the development of new products. These approaches help companies stay competitive, enhance their technological capabilities, and meet the growing demand for advanced predictive solutions in the automotive sector. Key strategies employed by companies to strengthen their position in the automotive predictive analytics market include forming strategic partnerships and mergers with other industry leaders to leverage shared technologies and expand their reach. These companies are also heavily investing in the development of next-generation solutions, such as advanced sensors, real-time analytics software, and cloud-based platforms, to enhance the predictive capabilities of their offerings.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Vehicle

- 2.2.4 Propulsion

- 2.2.5 Application

- 2.2.6 End use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook

- 2.5.1 Technology Roadmap & Innovation Trends

- 2.5.2 Emerging Use Cases & Applications

- 2.5.3 Market Expansion Opportunities

- 2.5.4 Investment & Funding Landscape

- 2.5.5 Regulatory Evolution & Policy Impact

- 2.5.6 Sustainability & Environmental Considerations

- 2.5.7 Risk Assessment & Mitigation Strategies

- 2.6 Strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Urbanization and infrastructure development

- 3.2.1.2 Rising government investments in smart cities & public works

- 3.2.1.3 Technological advancements

- 3.2.1.4 Shift toward electric and hybrid automotive predictive analytics

- 3.2.1.5 Rental and leasing boom

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High capital and maintenance costs

- 3.2.2.2 Volatility in raw material prices

- 3.2.2.3 Shortage of skilled operators

- 3.2.2.4 Regulatory and emission compliance requirements

- 3.2.3 Market opportunities

- 3.2.3.1 Electrification and battery-powered machinery

- 3.2.3.2 Strategic partnerships between OEMs and rental firms

- 3.2.3.3 Integration of AI, automation & robotics

- 3.2.3.4 Growth in emerging APAC & African markets

- 3.2.3.5 Digital platforms for equipment rental & fleet management

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Major market trends and disruptions

- 3.5 Future market trends

- 3.6 Regulatory landscape

- 3.6.1 Global Regulatory Landscape Overview

- 3.6.2 North American Regulatory Environment

- 3.6.2.1 NHTSA Connected Vehicle Regulations NHTSA

- 3.6.2.2 Federal Fleet Management Requirements GSA

- 3.6.2.3 DOT V2X Communication Standards USDOT

- 3.6.3 European Regulatory Framework

- 3.6.3.1 UNECE Vehicle Regulations & WP.29 Standards UNECE

- 3.6.3.2 GDPR Impact on Automotive Data Analytics

- 3.6.3.3 EU Cybersecurity Act & Automotive Applications

- 3.6.4 Asia Pacific Regulatory Developments

- 3.6.4.1 China's National Standards for Connected Vehicles

- 3.6.4.2 Japan's Society 5.0 & Automotive Integration

- 3.6.4.3 India's Automotive Mission Plan 2026 Analytics Requirements

- 3.6.5 Emerging Regulatory Trends & Future Compliance Requirements

- 3.6.6 Cross-Border Data Transfer Regulations & Impact

- 3.7 Porter’s analysis

- 3.8 PESTEL analysis

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent analysis

- 3.11 Cost breakdown analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Onboard computing units

- 5.2.2 Telematics devices

- 5.2.3 Diagnostics tools

- 5.3 Software

- 5.3.1 Predictive maintenance platforms

- 5.3.2 Fleet management software

- 5.3.3 Connected vehicle & ADAS software

- 5.3.4 Ai/ml analytics engines

- 5.4 Services

- 5.4.1 Professional

- 5.4.2 Managed

Chapter 6 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Gasoline

- 6.3 Diesel

- 6.4 All-electric

- 6.5 HEV

- 6.6 PHEV

- 6.7 FCEV

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Predictive maintenance

- 7.3 Vehicle telematics

- 7.4 Driver & behavior analytics

- 7.5 Fleet management

- 7.6 Warranty analytics

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Fleet operators

- 8.4 Insurance providers

- 8.5 Others

Chapter 9 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 Passenger car

- 9.2.1 Hatchback

- 9.2.2 Sedan

- 9.2.3 SUV

- 9.3 Commercial Vehicle

- 9.3.1 Light duty

- 9.3.2 Medium duty

- 9.3.3 Heavy-duty

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 ($Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 AWS

- 11.1.2 Bosch

- 11.1.3 Google

- 11.1.4 IBM

- 11.1.5 Intel

- 11.1.6 Microsoft

- 11.1.7 Nvidia

- 11.1.8 Oracle

- 11.1.9 Qualcomm

- 11.1.10 SAP

- 11.2 Regional Champions

- 11.2.1 Continental

- 11.2.2 Denso

- 11.2.3 Hitachi

- 11.2.4 John Deere

- 11.2.5 Komatsu

- 11.2.6 Liebherr

- 11.2.7 Mitsubishi

- 11.2.8 NXP

- 11.2.9 Volvo

- 11.2.10 ZF

- 11.3 Emerging Players & Service Providers

- 11.3.1 Fleet Complete

- 11.3.2 Geotab

- 11.3.3 Masternaut

- 11.3.4 Mix Telematics

- 11.3.5 Omnitracs

- 11.3.6 PTC

- 11.3.7 SAS

- 11.3.8 Teletrac

- 11.3.9 Trimble

- 11.3.10 XCMG