PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844318

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844318

Nicotine Replacement Therapy Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

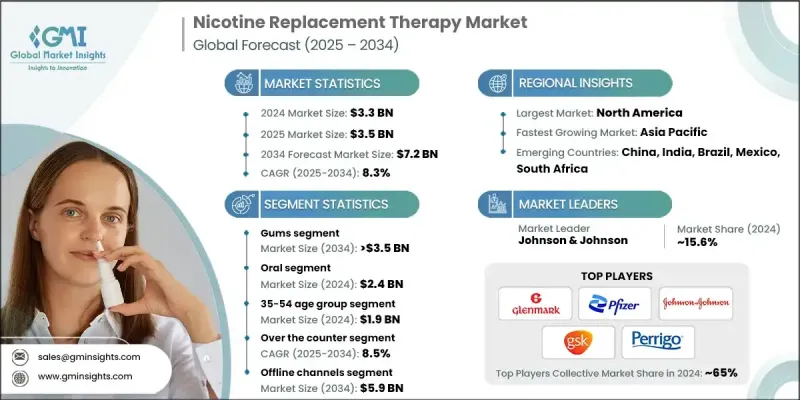

The Global Nicotine Replacement Therapy Market was valued at USD 3.3 billion in 2024 and is estimated to grow at a CAGR of 8.3% to reach USD 7.2 billion by 2034.

The growth is driven by the increasing prevalence of smoking worldwide, stronger government regulations, tobacco control initiatives, and technological advancements in NRT products. The integration of digital health tools, including mobile applications, telemedicine, and AI-powered platforms, is enabling real-time monitoring of cravings and withdrawal symptoms. These innovations help improve treatment adherence and allow healthcare providers to tailor plans remotely, which is especially valuable in rural regions. The growing adoption of such technologies is further accelerating the market. Nicotine replacement therapy addresses the challenges smokers face when quitting, as abrupt cessation often causes intense cravings and withdrawal symptoms. Public health campaigns, taxation policies, and smoking bans are also propelling demand for NRT products. Additionally, new devices such as Bluetooth-enabled inhalers with feedback systems, fast-dissolving oral films, synthetic nicotine formulations, and AI-driven cessation apps are revolutionizing the market by enhancing bioavailability, user engagement, and treatment outcomes.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.3 Billion |

| Forecast Value | $7.2 Billion |

| CAGR | 8.3% |

The gum segment held 49.6% share, and is anticipated to reach USD 3.5 billion by 2034, growing at an 8.2% CAGR. Nicotine gum remains a trusted and accessible option for managing withdrawal symptoms, making it highly favored by health-conscious consumers. As smoking is increasingly recognized as a chronic addiction, demand for long-term cessation aids like nicotine gum continues to rise. Healthcare professionals frequently recommend nicotine gum as part of comprehensive quitting plans due to its rapid absorption and effectiveness in easing withdrawal.

The oral segment generated USD 2.4 billion in 2024. This category includes lozenges, gums, and dissolvable films, which offer discreet and convenient solutions to control nicotine cravings. Their portability and non-invasive nature make them especially popular in public spaces such as workplaces and social environments. The convenience of these products enhances user compliance, particularly among younger and urban consumers who prefer subtle, on-demand options.

North America Nicotine Replacement Therapy Market held a 48.3% share in 2024. The region's well-informed population is highly aware of the health dangers related to smoking, including cancer, heart disease, and respiratory issues. Ongoing public health efforts, educational programs, and media coverage have significantly influenced consumer behavior, driving demand for safer quitting methods like NRT. The high burden of tobacco-related diseases in North America strengthens the need for effective cessation solutions. Additionally, strict government policies, including advertising restrictions, elevated tobacco taxes, and public smoking bans, support market growth.

Key industry players active in the Global Nicotine Replacement Therapy Market include Glenmark, Johnson & Johnson, Cipla, Fertin Pharma, Dr. Reddy's Laboratories, Pfizer, Rubicon Research, Sparsh Pharma, Niconovum, Pierre Fabre Group, Perrigo Company, Rusan Pharma, and GlaxoSmithKline. To fortify their presence, companies in the Nicotine Replacement Therapy Market are focusing on innovation by developing next-generation products that offer enhanced efficacy, improved user experience, and faster relief. Many are investing in digital health integrations such as mobile apps and AI tools to provide personalized treatment and remote monitoring, increasing patient adherence. Strategic collaborations with healthcare providers and pharmacies help broaden distribution channels. Marketing efforts highlight safety and convenience to appeal to a wider audience, including younger users and rural populations.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product type trends

- 2.2.3 Route of administration trends

- 2.2.4 Mode trends

- 2.2.5 Age group trends

- 2.2.6 Distribution channel trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing cases of cancer globally

- 3.2.1.2 Increasing smoking cessation initiatives

- 3.2.1.3 Rising health awareness and education

- 3.2.1.4 Expansion of over the counter (OTC) access of NRT products

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Associated side-effects

- 3.2.2.2 Stringent regulation and restrictions

- 3.2.3 Market opportunities

- 3.2.3.1 Integration with digital health platforms

- 3.2.3.2 Growing global aging population

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S.

- 3.4.1.2 Canada

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.1 North America

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Pricing analysis

- 3.8 Clinical trial analysis

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Gums

- 5.3 Lozenges

- 5.4 Transdermal patches

- 5.5 Inhaler

- 5.6 Nasal spray

- 5.7 Sublingual tablets

Chapter 6 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Oral

- 6.3 Transdermal

- 6.4 Nasal

Chapter 7 Market Estimates and Forecast, By Mode, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Over the counter (OTC)

- 7.3 Prescription

Chapter 8 Market Estimates and Forecast, By Age Group, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 18-34

- 8.3 35-54

- 8.4 55+

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Offline channels

- 9.2.1 Hospital pharmacies

- 9.2.2 Retail pharmacies

- 9.2.3 Other offline distribution channels

- 9.3 Online channels

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Cipla

- 11.2 Dr. Reddy’s Laboratories

- 11.3 Fertin Pharma

- 11.4 Glenmark

- 11.5 GlaxoSmithKline

- 11.6 Johnson & Johnson

- 11.7 Niconovum

- 11.8 Pfizer

- 11.9 Rubicon Research

- 11.10 Rusan Pharma

- 11.11 Sparsh Pharma

- 11.12 Perrigo Company

- 11.13 Pierre Fabre Group