PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844320

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844320

Pet Accessories Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

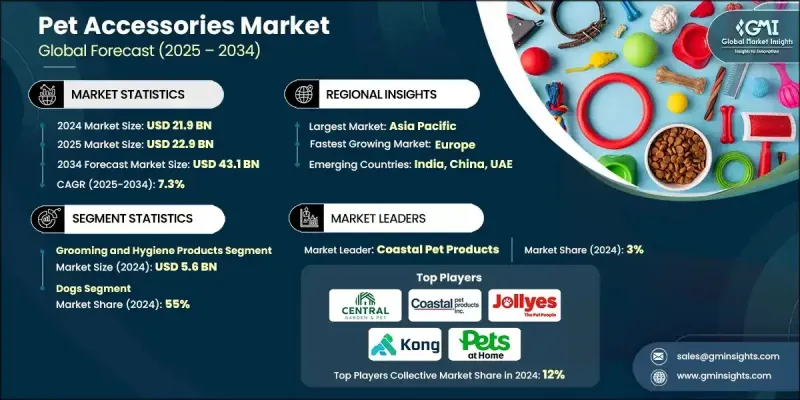

The Global Pet Accessories Market was valued at USD 21.9 billion in 2024 and is estimated to grow at a CAGR of 7.3% to reach USD 43.1 billion by 2034.

The rising rate of pet ownership across urban, rural, and suburban regions continues to shape the future of the market. With more households adopting pets, demand for both essential and niche accessories is surging. This has opened doors for brands to innovate and meet the evolving needs of pet owners. Growing consumer awareness around pet wellness, comfort, and engagement is encouraging manufacturers to explore fresh product categories and improve designs that reflect current lifestyles and values, such as eco-consciousness and personalization.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $21.9 Billion |

| Forecast Value | $43.1 Billion |

| CAGR | 7.3% |

Policy support in several countries encouraging pet adoption, alongside rising disposable income, is further increasing pet ownership. This rising trend has amplified interest in high-end, multifunctional products like smart collars, ergonomic toys, and AI-powered feeders. Enhanced distribution networks, especially through online platforms, are expanding product accessibility. The integration of technology in accessories, from fitness monitors to automated feeding systems, is becoming mainstream, while emerging economies are driving both affordability and innovation. As industry embraces digital commerce and data-driven customization, new growth avenues are constantly unfolding across global markets.

In 2024, the grooming and hygiene-related accessories generated USD 5.6 billion and are projected to grow at a CAGR of 8% through 2034. Pet owners are increasingly opting for interactive toys and hygiene essentials that cater to mental stimulation and physical activity. These toys are now made from biodegradable and recyclable materials to align with environmentally responsible values. The shift toward sustainability is also influencing design decisions and purchase patterns across the pet care space, making green alternatives a driving force in product development.

The dogs segment held a 55% share and is expected to grow at a CAGR of 7.5% from 2025 to 2034. Pet owners are now investing in health-enhancing accessories such as orthopedic bedding, digital health trackers, and supplement packs. Personalized accessories, including custom outfits and engraved tags, are becoming common among dog parents who now prioritize their pet's comfort and individuality as much as their own. As the pet-human bond deepens, spending on specialized accessories continues to rise.

U.S. Pet Accessories Market held a 76% share and generated USD 5.9 billion in 2024. The cultural shift toward treating pets as part of the family continues to influence spending behavior. Consumers in the U.S. are increasingly opting for smart pet accessories, including cameras, GPS trackers, and automated systems. Eco-friendly packaging and sustainable production practices are also gaining importance among American shoppers, reinforcing the demand for responsibly crafted pet products.

Key companies shaping the Global Pet Accessories Market include KONG Company, Red Dingo, Outward Hound, Pets at Home Group, Jollyes Pet Superstores, ZippyPaws, Coastal Pet Products, Central Garden & Pet, Ferplast, Merrick Pet Care, Rogz Pet Gear, Hartz Mountain, Nestle Purina PetCare, MidWest Homes for Pets, and Furhaven Pet Products. Leading players in the Pet Accessories Market are prioritizing product innovation, premiumization, and sustainability to stay competitive. Many brands are introducing smart pet products powered by connected technologies like GPS, health monitoring, and automation to cater to modern lifestyles. Customized offerings such as bespoke collars or tailored apparel are being introduced to appeal to pet owners seeking personalization. Companies are also investing in sustainable materials and recyclable packaging to align with growing environmental awareness. Strategic collaborations with retail chains and expanding their digital presence through e-commerce platforms allow firms to reach wider audiences.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Application

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing number of pet owners

- 3.2.1.2 Growing trend of pet humanization

- 3.2.1.3 Higher consumer spending on pet care

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Seasonality in pet clothing & accessories

- 3.2.2.2 Supply chain disruptions

- 3.2.2.3 Intense market competition

- 3.2.3 Opportunities

- 3.2.3.1 Eco-conscious & sustainable

- 3.2.3.2 Smart/tech-enabled accessories

- 3.2.3.3 Multi-functional and space-saving designs

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade Statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

- 3.11 Consumer behavior analysis

- 3.11.1 Purchasing patterns

- 3.11.2 Preference analysis

- 3.11.3 Regional variations in consumer behavior

- 3.11.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 ($Billion, Thousand Units)

- 5.1 Key trends

- 5.2 Feeding & watering systems

- 5.2.1 Automated feeders & smart dispensers

- 5.2.2 Traditional bowls & water fountains

- 5.2.3 Travel & portable feeding solutions

- 5.2.4 Specialized dietary support accessories

- 5.3 Grooming & hygiene products

- 5.3.1 Brushes, combs & grooming tools

- 5.3.2 Shampoos & cleaning products

- 5.3.3 Nail care & dental hygiene

- 5.3.4 Professional grooming equipment

- 5.4 Housing & carriers

- 5.4.1 Indoor housing solutions (cages, kennels)

- 5.4.2 Transport carriers & travel crates

- 5.4.3 Bedding & comfort accessories

- 5.4.4 Outdoor shelters & weather protection

- 5.5 Toys & enrichment products

- 5.5.1 Interactive & puzzle toys

- 5.5.2 Chew toys & dental health products

- 5.5.3 Exercise & activity equipment

- 5.5.4 Species-specific enrichment solutions

- 5.6 Collars, leashes & harnesses

- 5.6.1 Traditional collars & identification tags

- 5.6.2 Smart collars & GPS tracking devices

- 5.6.3 Leashes & retractable systems

- 5.6.4 Harnesses & safety equipment

- 5.7 Others (health & safety products, etc.)

Chapter 6 Market Estimates & Forecast, By Pet Type, 2021 - 2034 ($Billion, Thousand Units)

- 6.1 Key trends

- 6.2 Dogs

- 6.3 Cats

- 6.4 Birds

- 6.5 Fish & aquatic pets

- 6.6 Reptiles

- 6.7 Others (mammals, rabbits, hamsters, etc.)

Chapter 7 Market Estimates & Forecast, By Price range, 2021 - 2034 ($Billion, Thousand Units)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Billion, Thousand Units)

- 8.1 Key trends

- 8.2 Online

- 8.2.1 E-commerce

- 8.2.2 Company website

- 8.3 Offline

- 8.3.1 Supermarkets and hypermarkets

- 8.3.2 Pet specialty stores

- 8.3.3 Other retail stores (pet hospitals, etc.)

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Billion, Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Central Garden & Pet Company

- 10.2 Coastal Pet Products

- 10.3 Ferplast

- 10.4 Furhaven Pet Products

- 10.5 Hartz Mountain

- 10.6 Jollyes Pet Superstores

- 10.7 KONG Company

- 10.8 Merrick Pet Care

- 10.9 MidWest Homes for Pets

- 10.10 Nestle Purina PetCare

- 10.11 Outward Hound

- 10.12 Pets at Home Group

- 10.13 Red Dingo

- 10.14 Rogz Pet Gear

- 10.15 ZippyPaws