PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844322

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844322

Exterior Wall System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

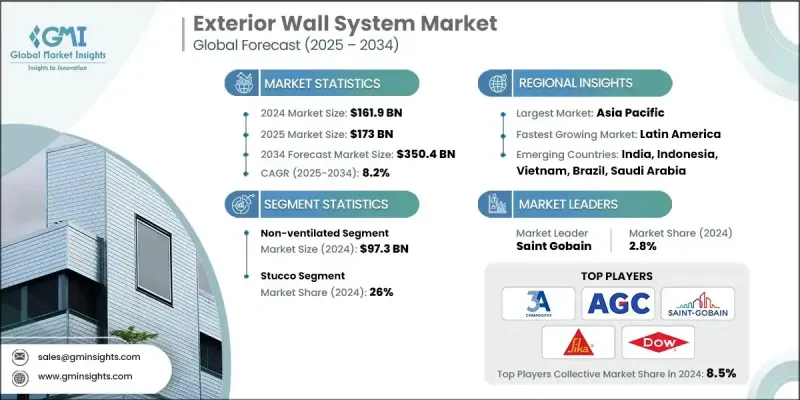

The Global Exterior Wall System Market was valued at USD 161.9 billion in 2024 and is estimated to grow at a CAGR of 8.2% to reach USD 350.4 billion by 2034.

The growth is fueled by rising demand for sustainable construction solutions, energy-efficient building codes, and modular construction techniques. A growing emphasis on environmentally responsible materials and building practices is reshaping procurement decisions across the sector. Developers and contractors now prioritize wall systems that meet green building certifications and align with Scope 3 emissions objectives. As a result, the market is witnessing rapid innovation in insulation integration, fire resistance, and smart material technologies. Increasing urbanization and labor shortages have also led to higher adoption of prefabricated wall systems, which enhance installation speed, ensure better quality control, and reduce construction time. Manufacturers are focusing on prefabricated panels equipped with insulation, cladding, and vapor barriers to meet growing demands for performance and convenience. Additionally, exterior wall systems are evolving to include energy-saving features such as phase-change materials, thermal-resistant coatings, and smart insulation layers. These advancements support a more energy-resilient built environment, particularly in regions investing heavily in infrastructure, including North America, the Middle East, and parts of Asia.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $161.9 Billion |

| Forecast Value | $350.4 Billion |

| CAGR | 8.2% |

In 2024, the non-ventilated exterior wall segment generated USD 97.3 billion and is expected to grow at a CAGR of 7.3% through 2034. The popularity of non-ventilated systems is largely attributed to their lower upfront costs and reduced installation complexity. These wall systems require fewer components and offer a thinner profile, which makes them ideal for space-constrained urban developments. Their simplified design also suits regions with a limited skilled labor pool for facade construction. As a result, developers seeking cost-effective yet efficient wall solutions continue to favor non-ventilated systems across commercial and residential applications.

The stucco segment generated USD 42.1 billion in 2024 and held a 26% share. Its appeal lies in its durability, cost-efficiency, and versatility. Stucco offers long-lasting protection with minimal upkeep and can be applied in various textures, finishes, and colors, giving architects the flexibility to meet a wide range of design goals. It also serves as a natural insulator, contributing to reduced energy consumption and enhanced acoustic performance. Stucco adheres effectively to different structural materials like concrete, masonry, and wood, making it ideal for diverse climates, particularly those with dry or temperate conditions.

U.S. Exterior Wall System Market was valued at USD 40.3 billion in 2024 and is estimated to grow at a CAGR of 7.1% between 2025 and 2034. The continued expansion in residential, commercial, and government construction is fueling this growth. Urban development, foreign investments, and rising demand for energy-efficient structures are key contributors to the country's growing market share. In response, systems designed to reduce HVAC loads are gaining traction, with wall solutions offering integrated thermal insulation becoming a preferred choice across building sectors.

Key companies active in the Global Exterior Wall System Market include JamesHardie, USG Corporation, Fletcher Buildings, Asahi Glass (AGC), Owens Corning, 3A Composites Holding AG, CSR Limited, Saint Gobain, Toray Industries Ltd., Boral Limited, SIKA Group, Kronospan Limited, LafargeHolcim, Nippon Glass Sheet, and The Dow Company. Companies in the exterior wall system market are leveraging a mix of innovation, geographic expansion, and sustainability to strengthen their market positions. Leading firms are investing in R&D to develop modular and energy-efficient wall systems with integrated insulation, vapor control, and fire resistance. Many are also introducing lightweight prefabricated solutions to reduce on-site labor, optimize installation speed, and meet demand in urban environments. Strategic mergers and acquisitions are helping expand product portfolios and reach into emerging markets. Firms are aligning offerings with green building certifications and low-carbon material standards to cater to evolving regulatory norms and sustainability-conscious consumers.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Type

- 2.2.2 Material

- 2.2.3 Application

- 2.2.4 Distribution Channel

- 2.2.5 Regional

- 2.3 CXO perspective: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry Impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region and type

- 3.7 Regulatory framework

- 3.7.1 Standards and certifications

- 3.7.2 Environmental regulations

- 3.7.3 Import export regulations

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 (USD Billion) (Thousand Sq ft)

- 5.1 Key trends

- 5.2 Ventilated

- 5.3 Non-ventilated

Chapter 6 Market Estimates & Forecast, By Material, 2021 - 2034 (USD Billion) (Thousand Sq ft)

- 6.1 Key trends

- 6.2 Vinyl

- 6.3 Fiber cement

- 6.4 Stucco

- 6.5 Masonry

- 6.6 Wood

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Billion) (Thousand Sq ft)

- 7.1 Key trends

- 7.2 Residential

- 7.3 Commercial

- 7.4 Industrial

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Thousand Sq ft)

- 8.1 Key trends

- 8.2 Direct Sales

- 8.3 Indirect Sales

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion) (Thousand Sq ft)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 U.K.

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 10.1 3A Composites Holding AG

- 10.2 Asahi Glass (AGC)

- 10.3 Boral Limited

- 10.4 CSR Limited

- 10.5 Fletcher Buildings

- 10.6 JamesHardie

- 10.7 Lafargeholcim

- 10.8 Kronospan Limited

- 10.9 Nippon Glass Sheet

- 10.10 Owens Corning

- 10.11 Saint Gobain

- 10.12 SIKA Group

- 10.13 The Dow Company

- 10.14 Toray Industries Ltd.

- 10.15 USG Corporation