PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844324

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844324

Asia Pacific AC Electric Vehicle Charging Station Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

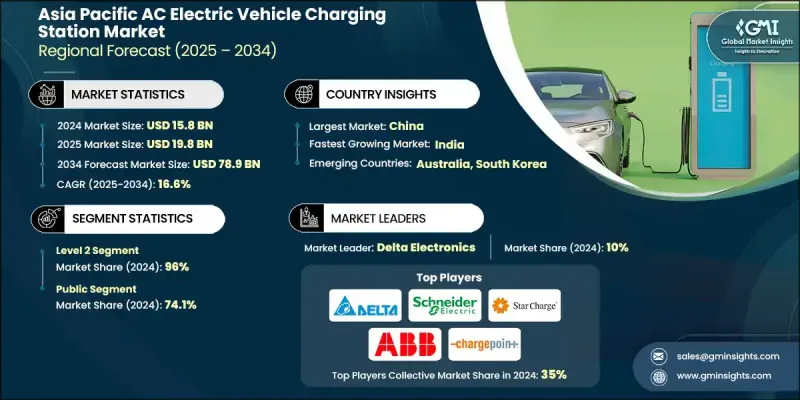

Asia Pacific AC Electric Vehicle Charging Station Market was valued at USD 15.8 billion in 2024 and is estimated to grow at a CAGR of 16.6% to reach USD 78.9 billion by 2034.

The upward trajectory is shaped by favorable regional policies, increasing investments, and a sharp focus on electric mobility. Government-led initiatives aimed at EV adoption are significantly boosting the deployment of AC charging infrastructure across both urban and rural areas. These supportive regulatory frameworks are accelerating private and public partnerships to expand access and modernize networks. In addition, rising awareness among consumers about EVs, combined with improvements in charging technology, is pushing the demand for user-friendly, cost-effective, and energy-efficient AC stations. The integration of these systems with clean energy sources like solar is further amplifying their sustainability appeal. As nations across the Asia Pacific target large-scale electrification, smart grid compatibility, and long-term cost benefits, AC chargers are becoming a central component of national energy and transportation strategies. Education campaigns and nationwide EV-friendly policies are improving accessibility and acceptance, contributing to a more connected and low-emission mobility ecosystem across the region.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $15.8 Billion |

| Forecast Value | $78.9 Billion |

| CAGR | 16.6% |

The Level 1 AC charging stations segment is projected to grow at a CAGR of 15.9% through 2034, fueled by the steady expansion of home-based and community EV charging solutions. Governments in the region are actively backing deployment in suburban and rural areas, where Level 1 options offer an affordable and easy-to-install solution. This aligns with broader policy goals to ensure equitable infrastructure access and encourage EV use beyond major cities.

The public charging installations segment held a 74.1% share in 2024 and is anticipated to grow at a CAGR of 17% through 2034. National investments, electrification targets, and long-term infrastructure plans are supporting the widespread rollout of publicly accessible charging stations. Countries across Asia Pacific are advancing renewable-powered public charging points using solar and wind energy to lower operating costs and enhance station viability over time, while boosting sustainability goals.

China AC Electric Vehicle Charging Station Market held a 97% share and generated USD 15.4 billion in 2024. The country's aggressive expansion of EV infrastructure and integration of smart grids and clean energy is driving robust growth. The shift toward multi-functional stations-combining services such as dining, entertainment, and retail-enhances user engagement and improves utilization. Authorities are incentivizing operators to maintain high uptime rates and adopt intelligent monitoring systems to ensure consistent performance.

Leading players in the Asia Pacific AC Electric Vehicle Charging Station Market include: TELD, EVBox, ABB, Enphase Energy, Delta Electronics, Exicom, LG Electronics Inc., Schneider Electric, Webasto Group, EVSE Australia Pty Ltd., Leviton Industries, Volta Industries Inc., Starcharge, SIGNET EV, Blink Charging Co., Vinfast, Siemens, Eaton, ChargePoint, Inc., Efacec, and Elli. Companies in the Asia Pacific AC Electric Vehicle Charging Station Market are prioritizing strategic collaborations, R&D investments, and localization of manufacturing to strengthen their market position. Several players are expanding their regional footprint by forming partnerships with utilities, governments, and private developers to ensure scalable infrastructure deployment. A strong emphasis is placed on integrating charging systems with renewable power and smart energy management platforms to meet clean mobility targets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technology factors

- 3.6.5 environmental factors

- 3.6.6 Legal factors

- 3.7 Emerging opportunities & trends

- 3.7.1 Digitalization and IoT integration

- 3.7.2 Emerging market penetration

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024, by country

- 4.2.1 China

- 4.2.2 Australia

- 4.2.3 India

- 4.2.4 Japan

- 4.2.5 South Korea

- 4.3 Strategic initiatives

- 4.4 Competitive benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Product, 2021 - 2034 (USD Million, Units)

- 5.1 Key trends

- 5.2 Level 1

- 5.3 Level 2

Chapter 6 Market Size and Forecast, By Charging Site, 2021 - 2034 (USD Million, Units)

- 6.1 Key trends

- 6.2 Private

- 6.3 Public

Chapter 7 Market Size and Forecast, By Country, 2021 - 2034 (USD Million, Units)

- 7.1 Key trends

- 7.2 China

- 7.3 Australia

- 7.4 India

- 7.5 Japan

- 7.6 South Korea

Chapter 8 Company Profiles

- 8.1 ABB

- 8.2 Blink Charging Co.

- 8.3 ChargePoint, Inc.

- 8.4 Delta Electronics

- 8.5 Eaton

- 8.6 Efacec

- 8.7 Elli

- 8.8 Enphase Energy

- 8.9 EVBox

- 8.10 EVSE Australia Pty Ltd.

- 8.11 Exicom

- 8.12 Leviton Industries

- 8.13 LG Electronics Inc.

- 8.14 Schneider Electric

- 8.15 Siemens

- 8.16 Starcharge

- 8.17 Vinfast

- 8.18 Volta Industries Inc.

- 8.19 Webasto Group

- 8.20 TELD