PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844327

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844327

Mechanical Ventilators Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

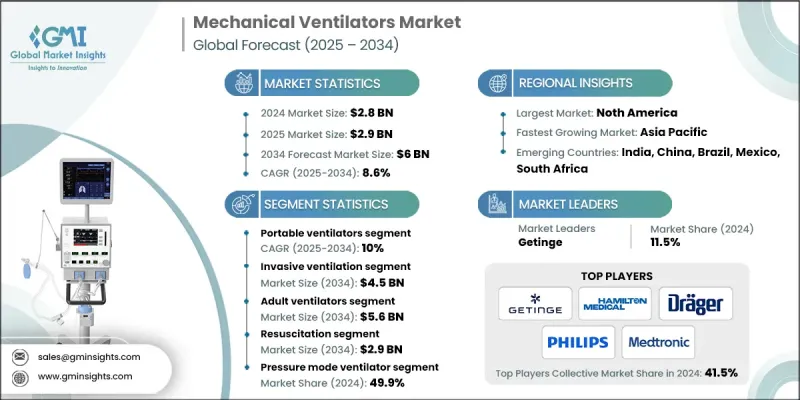

The Global Mechanical Ventilators Market was valued at USD 2.8 billion in 2024 and is estimated to grow at a CAGR of 8.6% to reach USD 6 billion by 2034.

Growth is driven by increasing ICU admissions, a rising burden of respiratory disorders, rapid medical advancements, and a higher demand for intensive care services worldwide. Healthcare providers and life sciences firms are turning to mechanical ventilation systems that offer not only critical respiratory support but also help improve regulatory compliance, operational efficiency, and overall patient outcomes. These systems include a wide variety of solutions, ranging from portable and critical care units to invasive and non-invasive models, equipped with digital respiratory monitoring for enhanced treatment delivery and patient safety.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.8 Billion |

| Forecast Value | $6 Billion |

| CAGR | 8.6% |

The growing incidence of long-term respiratory conditions such as sleep apnea, asthma, and chronic obstructive pulmonary disease is contributing heavily to the demand for ventilators. Market growth is also being fueled by advanced technologies like smart monitoring, integrated AI, and user-friendly ventilator interfaces that are elevating care standards. As hospitals and home care environments adopt more cost-effective and patient-centered care models, the shift toward portable and remote-use ventilators continues to accelerate. Rising healthcare infrastructure investments especially in developing economies are increasing accessibility and broadening market penetration across both hospital and surgical care segments.

In 2024, the portable ventilators segment generated USD 472.4 million and is expected to grow at a 10% CAGR through 2034. Demand is rising significantly as more patients require ongoing respiratory care in home-based or emergency scenarios. Chronic respiratory illnesses are prompting the use of mobile solutions that offer long-term support with increased mobility and ease of use for both patients and caregivers, reinforcing the relevance of compact, transportable units in the market.

The invasive ventilators segment held a 77.5% share in 2024 and is estimated to reach USD 4.5 billion by 2034. These systems are essential for managing severe respiratory conditions and life-threatening complications, particularly in intensive care settings. Growth in this segment is backed by a surge in ICU facilities worldwide and the rise in acute respiratory conditions. The ability of invasive ventilators to offer high levels of respiratory support is driving continued investment from hospitals and trauma care units.

North America Mechanical Ventilators Market held 36.7% share in 2024, supported by a mature healthcare system, significant spending on medical technologies, and a strong infrastructure for critical care. The aging population and growing respiratory health burden have elevated demand for both hospital-based and home-based ventilatory systems. Investments in research, access to advanced healthcare, and higher diagnosis rates have enabled rapid technology adoption across the region.

Leading companies in the Mechanical Ventilators Market include ZOLL Medical, Medtronic, ResMed, Philips, Mindray, Noccarc Robotics, Bio-Med Devices, Baxter, Fisher & Paykel, Hamilton Medical, Getinge, Drager, ICU Medical, GE Healthcare, Nihon Kohden, ACOMA Medical, Carl Reiner, Aeonmed, Breas Medical, Air Liquide Medical Systems, Allied Medical, Foremost Meditech, and Skanray Technologies. To strengthen their position in the Mechanical Ventilators Market, manufacturers are focusing on technological innovation, product diversification, and strategic partnerships. Companies are developing AI-integrated and IoT-enabled ventilators to deliver real-time patient monitoring and data-driven insights. They are also expanding their offerings to include both hospital-grade and portable devices to meet growing demand across care settings. Localization of manufacturing and after-sales service centers is helping reduce lead times and improve market responsiveness. Additionally, mergers, acquisitions, and collaborations with healthcare providers are enhancing distribution networks and fostering R&D capabilities.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Interface trends

- 2.2.4 Ventilator type trends

- 2.2.5 Application trends

- 2.2.6 Mode trends

- 2.2.7 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of chronic respiratory diseases

- 3.2.1.2 Rise in healthcare expenditure

- 3.2.1.3 Increase in number of ICU beds/critical care beds

- 3.2.1.4 Technological advancements

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Risks associated with the use of ventilators

- 3.2.2.2 High cost of mechanical ventilators

- 3.2.3 Market opportunities

- 3.2.3.1 Growth of homecare and non-invasive ventilation

- 3.2.3.2 Integration of AI and remote monitoring

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 MEA

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.1.1 Growth of portable and home-based mechanical ventilators

- 3.5.1.2 Digital health platforms enabling remote monitoring

- 3.5.1.3 Advanced patient-ventilator interfaces

- 3.5.2 Emerging technologies

- 3.5.2.1 AI-powered ventilators and predictive analytics

- 3.5.2.2 Wearable and connected ventilator systems

- 3.5.2.3 Smart ventilators with integrated IoT and cloud capabilities

- 3.5.1 Current technological trends

- 3.6 Gap analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Future market trends

- 3.9.1 Expansion of homecare and portable ventilators

- 3.9.2 Remote monitoring and telehealth adoption

- 3.9.3 Miniaturization and wearable ventilators

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 Latin America

- 4.3.6 MEA

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New service type launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn, Units)

- 5.1 Key trends

- 5.2 Intensive care ventilators

- 5.2.1 High-end

- 5.2.2 Mid-end

- 5.2.3 Basic-end

- 5.3 Portable ventilators

Chapter 6 Market Estimates and Forecast, By Interface, 2021 - 2034 ($ Mn, Units)

- 6.1 Key trends

- 6.2 Invasive ventilation

- 6.2.1 CPAP

- 6.2.2 BiPAP

- 6.2.3 APAP

- 6.2.4 Other non-invasive ventilation

- 6.3 Non-invasive ventilation

Chapter 7 Market Estimates and Forecast, By Ventilator Type, 2021 - 2034 ($ Mn, Units)

- 7.1 Key trends

- 7.2 Adult ventilators

- 7.3 Neonatal ventilators

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn, Units)

- 8.1 Key trends

- 8.2 Resuscitation

- 8.3 Emergency/Transport

- 8.4 Anesthesiology

- 8.5 Clinical applications

- 8.6 Homecare applications

- 8.7 Sleep apnea therapy

- 8.8 Other applications

Chapter 9 Market Estimates and Forecast, By Mode, 2021 - 2034 ($ Mn, Units)

- 9.1 Key trends

- 9.2 Pressure mode ventilator

- 9.3 Control mode ventilator

- 9.4 Combined mode ventilator

Chapter 10 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn, Units)

- 10.1 Key trends

- 10.2 Hospitals

- 10.3 Ambulatory surgical centers

- 10.4 Homecare

- 10.5 Other end use

Chapter 11 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn, Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 ACOMA Medical

- 12.2 Aeonmed

- 12.3 Air Liquide Medical Systems

- 12.4 Allied Medical

- 12.5 Baxter

- 12.6 Bio-Med Devices

- 12.7 Breas Medical

- 12.8 Carl Reiner

- 12.9 Drager

- 12.10 Foremost Meditech

- 12.11 Fisher & Paykel

- 12.12 GE Healthcare

- 12.13 Getinge

- 12.14 Hamilton Medical

- 12.15 ICU Medical

- 12.16 Medtronic

- 12.17 Mindray

- 12.18 Nihon Kohden

- 12.19 Noccarc Robotics

- 12.20 Philips

- 12.21 ResMed

- 12.22 Skanray Technologies

- 12.23 ZOLL Medical