PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844328

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844328

E-Bike Drive Unit Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

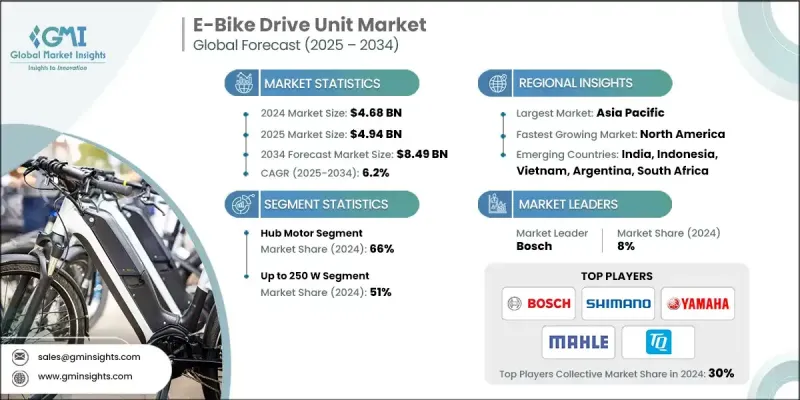

The Global E-Bike Drive Unit Market was valued at USD 4.68 billion in 2024 and is estimated to grow at a CAGR of 6.2% to reach USD 8.49 billion by 2034.

As electric mobility becomes more mainstream, the demand for efficient and intelligent drive systems continues to rise. These drive units combine motors, control systems, and sensors that assist or fully power the e-bike, improving user experience. Over the years, technology has evolved from basic hub motors to sophisticated systems with integrated electronics and software. Drive units often feature torque sensors, regenerative braking, and intelligent connectivity, making them highly efficient and smarter for varied terrains and urban use. Mid-drive units are increasingly popular in trekking, mountain, and cargo bikes due to their balanced weight distribution, better torque, and seamless integration with existing drivetrains. Improvements in modular battery design and connectivity features are driving up the overall value of these systems. OEMs dominate the supply chain, offering complete solutions to bicycle manufacturers and forming critical partnerships during product development. Although the aftermarket for conversion kits and replacement motors exists, it contributes only a small portion to total revenue, with most sales rooted in OEM-led manufacturing channels.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.68 Billion |

| Forecast Value | $8.49 Billion |

| CAGR | 6.2% |

In 2024, the hub motor segment held a 66% share and is projected to grow at a CAGR of 5.5% through 2034. Built into either the front or rear wheel, hub motors offer a simplified design that requires fewer components, lowering both production and maintenance costs. Their independent operation from the bike's drivetrain makes them ideal for urban commuters and entry-level riders. This separation helps reduce wear on chains and cassettes, further improving maintenance cycles. Their affordability and simplicity keep them highly relevant for city-focused applications.

The e-bike drive units up to 250 W segment held a 51% share in 2024 and is expected to grow at a CAGR of 5.2% from 2025 to 2034. These units represent the bulk of e-bike motors globally and align with regulatory standards in key regions. Most markets, especially in North America, Japan, and Europe limit e-bike drive units to a continuous power rating of 250 W. This regulatory alignment encourages mass adoption, ensuring compliance while meeting the power needs of most riders.

Asia Pacific E-Bike Drive Unit Market held 38% share and generated USD 1.78 billion in 2024. Government policies and strategic urban planning across the region are accelerating the shift to e-mobility. In several countries, e-bikes are treated similarly to traditional bicycles, reducing regulatory friction and increasing user adoption. Large-scale public programs aimed at subsidizing e-bike purchases have also played a major role in boosting demand for drive units, especially when supported through wide-reaching retail networks.

Key companies active in the E-Bike Drive Unit Market include Shimano, Yamaha, Bafang, Tongsheng Motor, Bosch, Brose, Dapu Motors, TQ-Group, Valeo, and Mahle. These players are adopting multiple strategies to strengthen their market position. Companies are focusing on R&D to improve torque response, battery efficiency, and intelligent integration. Many have expanded OEM partnerships to ensure their units are adopted in premium and performance e-bikes. Customizable drive systems for different use cases, commuting, trekking, and cargo, are helping brands widen their consumer base. Integration of smart features such as app connectivity and over-the-air updates is becoming a key differentiator in a competitive landscape.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Motor mounting

- 2.2.3 Capacity

- 2.2.4 Application

- 2.2.5 Distribution

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future-outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factors affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Urban congestion and commuting challenges

- 3.2.1.2 Government incentives and subsidies

- 3.2.1.3 Growth in fitness and eco-conscious lifestyles

- 3.2.1.4 Technological advancements in drive systems

- 3.2.1.5 Expansion of e-bike sharing and rental services

- 3.2.1.6 Rising fuel prices and vehicle ownership costs

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced drive units

- 3.2.2.2 Limited charging infrastructure

- 3.2.3 Market opportunities

- 3.2.3.1 Development of lightweight, compact drive units

- 3.2.3.2 Integration of smart and connected technologies

- 3.2.3.3 Expansion in emerging markets

- 3.2.3.4 Growth of cargo and utility e-bikes

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Patent analysis

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Growth potential analysis

- 3.8 Regulatory landscape

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

- 3.11 Technology and innovation landscape

- 3.11.1 Current technological trends

- 3.11.1.1 AI-powered adaptive control systems

- 3.11.1.2 Machine learning integration capabilities

- 3.11.1.3 Predictive maintenance & failure prevention

- 3.11.1.4 Energy optimization & range extension

- 3.11.1.5 Wireless charging integration & infrastructure

- 3.11.1.6 Solid-state battery integration impact

- 3.11.1.7 Vehicle-to-grid integration & energy services

- 3.11.1.8 Autonomous & self-balancing systems

- 3.11.2 Emerging technologies

- 3.11.1 Current technological trends

- 3.12 Price trends

- 3.12.1 By region

- 3.12.2 By product

- 3.13 Investment & funding trends analysis

- 3.14 Security implementation strategies

- 3.14.1 Hardware security module integration

- 3.14.2 Encrypted communication protocols

- 3.14.3 Secure boot & firmware protection

- 3.14.4 Intrusion detection & response systems

- 3.15 Regulatory landscape

- 3.15.1 Data protection regulation compliance

- 3.15.2 Cybersecurity framework requirements

- 3.15.3 Industry-specific security standards

- 3.15.4 Certification & audit requirements

- 3.16 Diagnostic tools & equipment requirements

- 3.16.1 Manufacturer-specific diagnostic systems

- 3.16.2 Service equipment standardization

- 3.17 Sustainability & ESG impact analysis

- 3.17.1 Sustainability & ESG impact analysis

- 3.17.2 Social impact & community relations

- 3.17.3 Governance & corporate responsibility

- 3.18 Warranty service & cost analysis

- 3.18.1 Warranty coverage comparison

- 3.18.2 Warranty claim analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Go-to-market strategies

- 4.7 Customer satisfaction benchmarking

- 4.8 Key developments

- 4.8.1 Mergers & acquisitions

- 4.8.2 Partnerships & collaborations

- 4.8.3 New product launches

- 4.8.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Motor Mounting, 2021 - 2034 (USD Bn, Million Units)

- 5.1 Key trends

- 5.2 Hub motor

- 5.2.1 Rear

- 5.2.2 Front

- 5.3 Mid-drive motor

Chapter 6 Market Estimates & Forecast, By Capacity, 2021 - 2034 (USD Bn, Million Units)

- 6.1 Key trends

- 6.2 Up to 250 W

- 6.3 250 W - 550 W

- 6.4 Above 550 W

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Bn, Million Units)

- 7.1 Key trends

- 7.2 Cargo bike

- 7.2.1 Up to 250W

- 7.2.2 250W - 550W

- 7.2.3 Above 550W

- 7.3 Trekking bike

- 7.3.1 Up to 250W

- 7.3.2 250W - 550W

- 7.3.3 Above 550W

- 7.4 City/urban bike

- 7.4.1 Up to 250W

- 7.4.2 250W - 550W

- 7.4.3 Above 550W

Chapter 8 Market Estimates & Forecast, By Distribution, 2021 - 2034 (USD Bn, Million Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Bn, Million Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Nordics

- 9.3.7 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 Indonesia

- 9.4.6 Philippines

- 9.4.7 Thailand

- 9.4.8 South Korea

- 9.4.9 Singapore

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 Bosch

- 10.1.2 Shimano

- 10.1.3 Brose (Acquired by Yamaha)

- 10.1.4 Yamaha

- 10.1.5 Valeo

- 10.1.6 Mahle

- 10.1.7 Dapu Motors

- 10.2 Regional Players

- 10.2.1 Fazua

- 10.2.2 TQ-Group

- 10.2.3 Pinion

- 10.2.4 Zehus

- 10.2.5 SHINWIN

- 10.2.6 Ananda Drive Technology

- 10.2.7 Bafang

- 10.2.8 Tongsheng Motor

- 10.3 Emerging Players / Disruptors

- 10.3.1. To7 Motor

- 10.3.2 Tamobyke

- 10.3.3 Karmina E-bike

- 10.3.4 GOBAO

- 10.3.5 Suzhou Shengyi Motor

- 10.3.6 SEG Automotive