PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844330

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844330

Dermatology Drugs Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

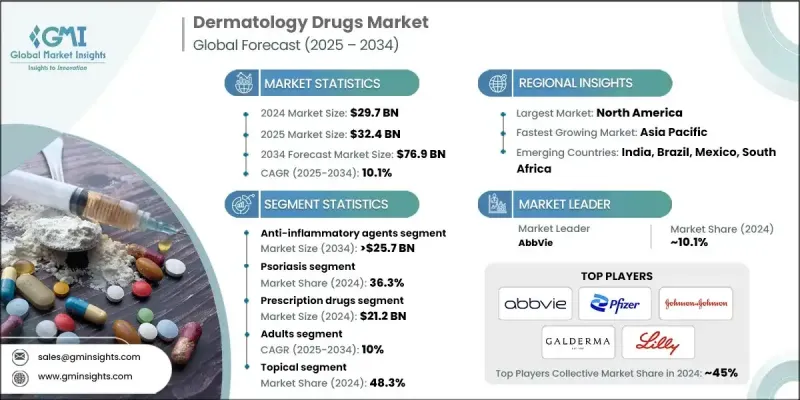

The Global Dermatology Drugs Market was valued at USD 29.7 billion in 2024 and is estimated to grow at a CAGR of 10.1% to reach USD 76.9 billion by 2034.

This upward trend is driven by the increasing prevalence of chronic and acute skin conditions such as acne, eczema, and psoriasis, along with a growing focus on rare dermatological disorders. The market is witnessing strong momentum due to technological advances in targeted therapies, including monoclonal antibodies and small molecule inhibitors, which are delivering more effective and patient-friendly outcomes. Demand is also rising for treatments addressing drug-resistant skin diseases, which is creating space for new formulations designed to control symptoms and slow disease progression. The expanding access to care across hospitals, dermatology clinics, and home-based healthcare continues to boost drug adoption, particularly in both developed and emerging regions. Rising patient awareness, coupled with evolving consumer preference for personalized medicine, is also shaping growth. Leading pharmaceutical players are investing heavily in R&D to secure regulatory approvals and launch therapies that act on specific inflammatory or immune pathways. These efforts have strengthened the shift toward precision dermatology and optimized drug delivery platforms aimed at minimizing side effects and improving long-term patient adherence.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $29.7 Billion |

| Forecast Value | $76.9 Billion |

| CAGR | 10.1% |

The anti-inflammatory therapies segment held a 32.6% share in 2024 and is projected to reach USD 25.7 billion by 2034, growing at a CAGR of 10.4%. This dominance is supported by the high efficacy of corticosteroids and non-steroidal agents in addressing a wide range of inflammatory skin disorders. These formulations offer quick relief, making them the standard approach in managing both acute and persistent conditions. As skin disorders such as atopic dermatitis and psoriasis continue to rise, the adoption of these medications increases, with most being first-line therapies in clinical practice.

The prescription drugs segment generated USD 21.2 billion in 2024. Their continued use is supported by strong clinical evidence, consistent innovation, and the development of targeted branded drugs. These therapies are central in managing moderate to severe skin conditions, especially those that require long-term treatment using biologics, corticosteroids, and antifungals. Regulatory approvals and enhanced formulations are fueling their market penetration, particularly in segments where patients require customized, ongoing medical care.

North America Dermatology Drugs Market held a 40.4% share in 2024, driven by high awareness levels, better access to advanced medical care, and an increasing number of individuals affected by chronic skin conditions. The region's growth is also being influenced by the adoption of personalized dermatological treatments, such as biomarker-based drug development and genetic profiling. Countries across the region, including Canada and the U.S., are enhancing their healthcare frameworks to improve dermatological access, aided by favorable reimbursement policies and public health outreach programs.

Key players shaping the landscape of the Global Dermatology Drugs Industry include Galderma, Pfizer, Incyte, Sanofi, Eli Lilly and Company, AstraZeneca, AbbVie, GlaxoSmithKline, Leo Pharma, Bausch Health, Dermavant Sciences, Novartis, Amgen, Johnson & Johnson, F. Hoffmann La Roche, Almirall, and Merck KGaA. To expand their presence, leading dermatology drug manufacturers are embracing multi-pronged strategies. Many are investing in next-generation biologics and gene-targeted therapies to diversify their portfolios and meet evolving treatment needs. Strategic collaborations with biotech firms and research institutions help accelerate drug discovery and pipeline development. Companies are also prioritizing geographic expansion, particularly into emerging markets with growing healthcare infrastructure.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumption and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Drug class trends

- 2.2.3 Indication trends

- 2.2.4 Mode trends

- 2.2.5 Age group trends

- 2.2.6 Route of administration

- 2.2.7 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of chronic skin conditions

- 3.2.1.2 Demographic shifts and lifestyle factors

- 3.2.1.3 Advancements in biologics and small molecule drugs

- 3.2.1.4 Growing awareness of skin health and aesthetics

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Adverse effects and drug resistance

- 3.2.2.2 Limited access in low-resource settings

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of personalized dermatology

- 3.2.3.2 Integration of AI and telehealth dermatology

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Future market trends

- 3.6 Technological landscape

- 3.7 Investment and funding landscape

- 3.8 Patent analysis

- 3.9 Reimbursement scenario

- 3.10 Pipeline analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Drug Class, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Immunomodulators

- 5.3 Retinoids

- 5.4 Antibiotics

- 5.5 Anti-inflammatory agents

- 5.6 Antifungal drugs

- 5.7 Other drug classes

Chapter 6 Market Estimates and Forecast, By Indication, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Psoriasis

- 6.3 Atopic dermatitis

- 6.4 Acne

- 6.5 Skin cancer

- 6.6 Other indications

Chapter 7 Market Estimates and Forecast, By Mode, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Prescription drugs

- 7.3 Over the counter drugs

Chapter 8 Market Estimates and Forecast, By Age Group, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Paediatric

- 8.3 Adults

- 8.4 Geriatric

Chapter 9 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Parenteral

- 9.3 Topical

- 9.4 Oral

Chapter 10 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 Hospitals

- 10.3 Dermatologist clinics

- 10.4 Homecare settings

- 10.5 Other end use

Chapter 11 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 AbbVie

- 12.2 Almirall

- 12.3 Amgen

- 12.4 AstraZeneca

- 12.5 Bausch Health

- 12.6 Dermavant Sciences

- 12.7 Eli Lilly and Company

- 12.8 F. Hoffmann La Roche

- 12.9 Galderma

- 12.10 GlaxoSmithKline

- 12.11 Incyte

- 12.12 Johnson & Johnson

- 12.13 Leo Pharma

- 12.14 Merck KGaA

- 12.15 Novartis

- 12.16 Pfizer

- 12.17 Sanofi