PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844337

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844337

Compartment Syndrome Monitoring Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

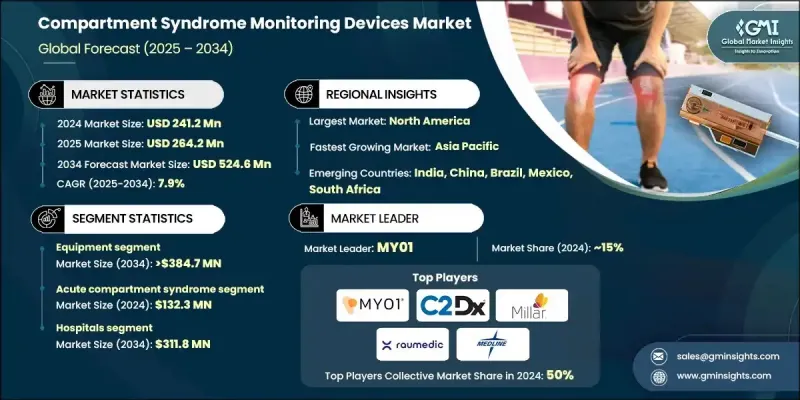

The Global Compartment Syndrome Monitoring Devices Market was valued at USD 241.2 million in 2024 and is estimated to grow at a CAGR of 7.9% to reach USD 524.6 million by 2034.

This robust growth is fueled by rising cases of trauma-related injuries, a growing push for early and accurate diagnosis, technological breakthroughs in pressure monitoring systems, and expanding healthcare infrastructure. Compartment syndrome monitoring devices are designed to measure intracompartmental pressure in muscles, helping clinicians detect both acute and chronic forms of the condition. These devices are crucial in preventing irreversible tissue damage caused by restricted blood flow within muscle compartments. Increasing awareness among medical professionals, coupled with improvements in diagnostic precision and user-friendly device design, is contributing to market expansion. The shift from traditional invasive methods to smart, minimally invasive monitoring systems also plays a significant role in driving device adoption across trauma care and surgical settings. Rising investment in R&D by manufacturers is further enabling the rollout of compact, wireless, and continuous monitoring technologies, ensuring better patient safety and clinical accuracy. With growing emphasis on faster diagnosis and patient-specific treatment protocols, the demand for reliable monitoring devices is accelerating across global healthcare systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $241.2 Million |

| Forecast Value | $524.6 Million |

| CAGR | 7.9% |

The equipment segment accounted for 74.4% share in 2024, driven by rising adoption of advanced hospital monitoring systems and increasing demand for disposable kits that support ongoing use. Healthcare facilities focus on equipment that offers consistent and accurate intracompartmental pressure measurement to reduce clinical errors and improve patient outcomes. Medical professionals increasingly prefer dedicated monitoring systems over manual tools for their ability to deliver reliable readings and support critical decision-making.

In 2024, the abdominal compartment syndrome accounted for a significant share and is projected to grow at a CAGR of 8.5% through 2034. An uptick in trauma cases, increased occurrence of post-surgical complications, and growing ICU admissions are contributing to higher demand for intra-abdominal pressure monitoring solutions. As awareness rises around the dangers of delayed diagnosis, clinicians are relying more heavily on advanced monitoring systems that can detect elevated pressure early and help guide timely intervention. This increasing focus on early detection and clinical efficiency is pushing the segment's growth.

North America Compartment Syndrome Monitoring Devices Market held a 55.7% share in 2024. The region's dominance can be attributed to the strong presence of major manufacturers, rapid adoption of new technologies, and robust distribution networks. The availability of advanced healthcare facilities, along with consistent investment in trauma and critical care services, continues to support regional growth.

Some of the key companies active in the Global Compartment Syndrome Monitoring Devices Market include C2DX, Accuryn, Spiegelberg, RAUMEDIC, Sentinel Medical Technologies, Millar, Biometrix, MY01, Medline, DELTAMED, and ConvaTec. Leading companies in the compartment syndrome monitoring devices market are prioritizing innovation through continuous R&D to launch next-generation monitoring systems. Many are introducing wireless and minimally invasive devices that offer real-time data and improved usability. To maintain market competitiveness, manufacturers are expanding their global presence through strategic partnerships with hospitals, trauma centers, and medical distributors. Some firms are also enhancing device affordability and increasing access in emerging markets. Focused efforts on regulatory approvals, clinical trial validation, and integrating digital health features like data tracking and connectivity are helping strengthen market positioning. Moreover, firms are investing in marketing campaigns and medical education to raise awareness about early detection and diagnosis, ensuring deeper market penetration and higher adoption rates among healthcare providers.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Syndrome type trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising incidence of traumatic injuries and fractures

- 3.2.1.2 Technological advancements

- 3.2.1.3 Increasing prevalence of intra-abdominal hypertension

- 3.2.1.4 Growing awareness of compartment syndrome among clinicians

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Risk associated with invasive measurement

- 3.2.3 Market opportunities

- 3.2.3.1 Integration with hospital EMR and remote monitoring platforms

- 3.2.3.2 Growth in emerging markets with expanding trauma care capacity

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Reimbursement scenario

- 3.5 Regulatory landscape

- 3.5.1 North America

- 3.5.2 Europe

- 3.5.3 Asia Pacific

- 3.6 Technology landscape

- 3.6.1 Current technological trends

- 3.6.2 Emerging technologies

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 LAMEA

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Equipment

- 5.3 Accessories and disposables

Chapter 6 Market Estimates and Forecast, By Syndrome Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Acute compartment syndrome

- 6.3 Abdominal compartment syndrome

- 6.4 Chronic compartment syndrome

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Specialty clinics

- 7.4 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Accuryn

- 9.2 Biometrix

- 9.3 C2DX

- 9.4 ConvaTec

- 9.5 DELTAMED

- 9.6 Medline

- 9.7 Millar

- 9.8 MY01

- 9.9 RAUMEDIC

- 9.10 Sentinel Medical Technologies

- 9.11 Spiegelberg