PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844343

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844343

LTE and 5G NR-based CBRS Networks Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

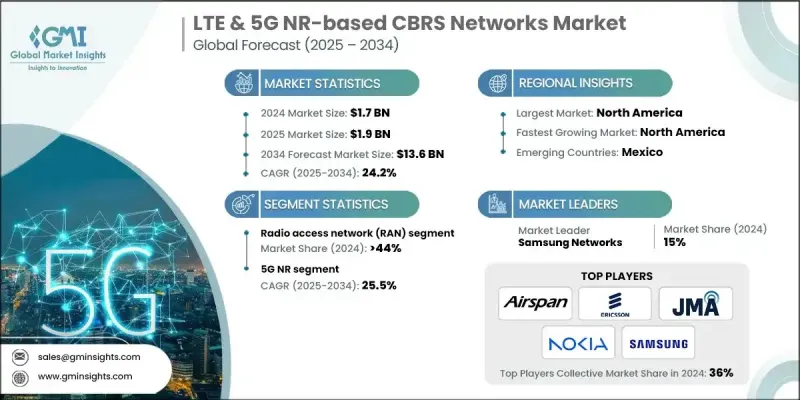

The Global LTE & 5G NR-based CBRS Networks Market was valued at USD 1.7 billion in 2024 and is estimated to grow at a CAGR of 24.2% to reach USD 13.6 billion by 2034.

Enterprises across manufacturing, logistics, ports, and large campuses are increasingly turning to private LTE and 5G NR networks to meet the growing need for high-speed, low-latency, secure communication. CBRS offers access to mid-band spectrum in the 3.5 GHz range (3550 to 3700 MHz), giving organizations an affordable alternative to costly licensed spectrum. As digital transformation accelerates, the use of private cellular networks over CBRS continues to expand. Businesses see clear benefits in deploying tailored wireless networks for campus mobility, industrial automation, and fixed wireless access. Trials and live deployments are underway across industries, validating use cases and proving the cost-efficiency of CBRS networks. Market momentum is further supported by the evolution of neutral-host solutions, indoor coverage applications, and shared spectrum access managed by SAS providers. Despite challenges around federal coordination, interference risks, and cost, the market outlook remains strong. Industry and regulatory efforts continue to address these barriers, while advancements in technology are enabling faster rollouts and broader enterprise adoption.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.7 Billion |

| Forecast Value | $13.6 Billion |

| CAGR | 24.2% |

In 2024, the radio access network (RAN) segment held a 44% share. RAN components, including small and macro cell radios, are essential for connecting user devices to the core network while delivering consistent indoor and outdoor coverage. With support for features like beamforming and dynamic spectrum allocation, hardware from vendors such as Samsung, Nokia, and Ericsson enhances network performance while reducing latency. Enterprises utilize RAN systems to build scalable and secure networks capable of handling intensive traffic and low-latency applications.

The 5G NR segment is forecast to grow at a CAGR of 25.5% through 2034. The segment's strong performance is attributed to its ability to deliver ultra-low latency, higher capacity, and support for network slicing. Enterprises increasingly favor 5G NR over LTE for emerging technologies such as autonomous systems, augmented reality, robotics, and smart automation. 5G NR also supports efficient spectrum use and seamless scaling across multiple sites with centralized management. This makes it particularly attractive to industries seeking performance-driven networks with future-ready architecture.

United States LTE & 5G NR-based CBRS Networks Market generated USD 725.5 million in 2024. The FCC's structured spectrum-sharing framework has allowed the coexistence of federal and commercial users under three access tiers: Incumbent, Priority Access License (PAL), and General Authorized Access (GAA). This model fosters innovation by enabling enterprises to use spectrum more flexibly while maintaining protection for critical users. Major operators continue to invest in expanding CBRS-based infrastructure to improve network coverage, enhance service flexibility, and offload mobile traffic in high-demand areas where shared spectrum is readily available.

Key companies shaping the LTE & 5G NR-based CBRS Networks Market include Commscope, Nokia, Airspan, Comcast, JMA Wireless, Amazon Web Services, Cisco, Radisys, Samsung, and Ericsson. These players are using targeted strategies to strengthen their market position, such as launching turnkey private network solutions, integrating edge computing and AI capabilities, and expanding ecosystem partnerships. They are investing in software-defined platforms that offer centralized management and seamless interoperability with enterprise IT systems. Some companies are also engaging in regulatory collaborations to influence spectrum policy and improve SAS coordination, aiming to minimize interference and streamline deployments. Their focus remains on developing robust, scalable, and application-agnostic CBRS solutions that can meet the evolving demands of enterprise connectivity.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Infrastructure submarkets

- 2.2.3 Air interface technology

- 2.2.4 Cells

- 2.2.5 Application

- 2.2.6 Frequency band

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising adoption of private LTE and 5G NR networks

- 3.2.1.2 Increasing CBRS small cell deployments by cable operators

- 3.2.1.3 Investment in portable private 5G solutions

- 3.2.1.4 Advancements in SAS and CBRS 2.0

- 3.2.1.5 Growing enterprise interest in private wireless networks

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Interference near federal incumbents

- 3.2.2.2 Coordination complexity and operational costs

- 3.2.3 Market opportunities

- 3.2.3.1 Growing industrial IoT and enterprise campus networks

- 3.2.3.2 MVNO offload and secondary carrier aggregation

- 3.2.3.3 Integration with private 5G solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology maturity assessment framework

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Cost structure analysis

- 3.9 Patent analysis

- 3.9.1 Patent applications by region (2021-2025)

- 3.9.2 CBRS-Specific SEP categories

- 3.10 Key News and Initiatives

- 3.11 Sustainability and ESG impact assessment

- 3.11.1 Environmental impact analysis and metrics

- 3.11.2 Social impact considerations and metrics

- 3.11.3 Governance and compliance framework

- 3.11.4 ESG investment implications and financial impact

- 3.12 Use cases and applications

- 3.13 Best-case scenario

- 3.14 Investment and funding landscape

- 3.14.1. Venture capital and private equity investments in CBRS/Private 5 G

- 3.14.2 Government grants, incentives, and subsidies

- 3.14.3 Impact of funding on deployment speed and innovation

- 3.15 Go-to-market and commercial strategies

- 3.15.1 Service bundling strategies (FWA, IoT, Enterprise Packages)

- 3.15.2 Marketing & customer acquisition strategies

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Infrastructure Submarkets, 2021 - 2034 ($Mn)

- 5.1 Key trends

- 5.2 Radio Access Network (RAN)

- 5.3 Mobile core

- 5.4 Transport network

- 5.5 Small Cell RUs (Radio Units)

- 5.6 Distributed & Centralized Baseband Units (DUs/CUs)

Chapter 6 Market Estimates & Forecast, By Air Interface Technology, 2021 - 2034 ($Mn)

- 6.1 Key trends

- 6.2 LTE

- 6.3 5G NR

Chapter 7 Market Estimates & Forecast, By Cells, 2021 - 2034 ($Mn)

- 7.1 Key trends

- 7.2 Indoor small cells

- 7.3 Outdoor small cells

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn)

- 8.1 Key trends

- 8.2 Mobile network densification

- 8.3 Fixed Wireless Access (FWA)

- 8.4 Cable operators & new entrants

- 8.5 Neutral hosts

- 8.6 Private cellular networks

- 8.6.1 Education

- 8.6.2 Governments & municipalities

- 8.6.3 Healthcare

- 8.6.4 Manufacturing

- 8.6.5 Military

- 8.6.6 Mining

- 8.6.7 Oil & gas

- 8.6.8 Retail & hospitality

- 8.6.9 Others

Chapter 9 Market Estimates & Forecast, By Frequency Band, 2021 - 2034 ($Mn)

- 9.1 Key trends

- 9.2 Below 2.3 GHz

- 9.3 2.3-2.6 GHz

- 9.4 3.3-3.6 GHz

- 9.5 3.55-3.7 GHz

- 9.6 3.7-3.8 GHz

- 9.7 3.8-4.2 GHz

- 9.8 4.6-4.9 GHz

- 9.9 Above 20 GHz

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Nordics

- 10.3.7 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 Airspan

- 11.1.2 Amazon Web Services

- 11.1.3 AT&T

- 11.1.4 Charter Communications

- 11.1.5 Cisco Systems

- 11.1.6 Comcast

- 11.1.7 CommScope

- 11.1.8 Ericsson

- 11.1.9 Google

- 11.1.10 HPE

- 11.1.11 Huawei

- 11.1.12 Intel

- 11.1.13 JMA Wireless

- 11.1.14 Microsoft Azure

- 11.1.15 NEC

- 11.1.16 Nokia

- 11.1.17 Qualcomm

- 11.1.18 Samsung

- 11.1.19 Sony

- 11.1.20 T-Mobile

- 11.1.21 Verizon Communications

- 11.2 Regional Players

- 11.2.1 ZTE

- 11.2.2 Baicells

- 11.2.3 Fujitsu

- 11.3 Emerging Players / Disruptors

- 11.3.1 Altiostar

- 11.3.2 Federated Wireless

- 11.3.3 Mavenir

- 11.3.4 Radisys