PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844349

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844349

Autoimmune Disease Diagnostics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

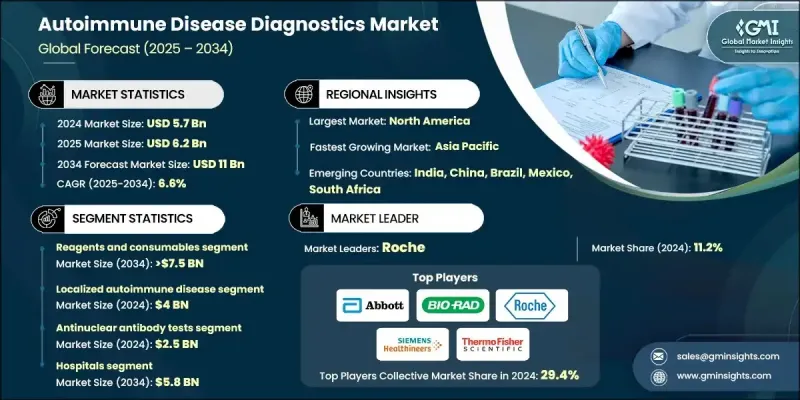

The Global Autoimmune Disease Diagnostics Market was valued at USD 5.7 billion in 2024 and is estimated to grow at a CAGR of 6.6% to reach USD 11 billion by 2034.

Rising incidence rates of autoimmune conditions, higher awareness about early diagnosis, ongoing screening programs, and steady advancements in diagnostic technologies are fueling market expansion. Improved healthcare spending and the introduction of innovative tools for early detection have also strengthened the demand for accurate and rapid testing. From molecular assays to immunoassays and biomarker-based detection, diagnostic capabilities are evolving to meet growing clinical needs. Patient education campaigns, led by both governments and healthcare organizations, are significantly raising testing volumes. At the same time, precision diagnostics utilizing specific biomarkers are seeing greater adoption, improving outcomes through early disease detection and patient-specific monitoring. Portable and rapid testing solutions for autoimmune disorders are also gaining popularity, offering quicker results in various care settings and further driving market momentum.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.7 Billion |

| Forecast Value | $11 Billion |

| CAGR | 6.6% |

In 2024, the reagents and consumables segment held 67% share owing to their recurring use in autoimmune testing procedures. The constant need for assay kits, antibodies, and buffers across diagnostic applications is contributing to the segment's consistent growth. As testing becomes more frequent for both diagnosis and long-term disease monitoring, the demand for these materials continues to rise. Laboratories and clinics rely heavily on consumables to perform accurate and efficient diagnostics, creating a steady revenue stream within the segment.

The localized autoimmune disease segment generated USD 4 billion in 2024 and is expected to grow at a CAGR of 6.4% through 2034. This segment includes conditions such as thyroid disorders, inflammatory bowel diseases, and Type 1 diabetes diseases targeting specific organs and increasingly being diagnosed worldwide. The rise in these organ-specific conditions fuels the need for highly sensitive and precise diagnostics tailored to localized disease detection. Continued growth in this area is supported by the need for early intervention and consistent monitoring to avoid long-term complications.

North America Autoimmune Disease Diagnostics Market held 36.6% share in 2024. The region reports one of the highest rates of autoimmune disorders globally, including multiple sclerosis, lupus, rheumatoid arthritis, and Type 1 diabetes. This growing patient population drives significant demand for advanced diagnostic testing. With a strong healthcare infrastructure and widespread screening initiatives, the region continues to support both routine and advanced autoimmune testing. The emphasis on early diagnosis and personalized care further sustains market growth.

Major players active in the Global Autoimmune Disease Diagnostics Market include Euroimmun, Thermo Fisher Scientific, Roche, Quest Diagnostics, Inova Diagnostics (Werfen), DIAsource, Trinity Biotech, Revvity, Labcorp, Siemens Healthineers, GRIFOLS, Hemagen Diagnostics, BIO-RAD, BIOMERIEUX, and Abbott. Companies in the autoimmune disease diagnostics market are expanding their portfolios through strategic collaborations, acquisitions, and investments in advanced technologies. Many are focusing on developing biomarker-based diagnostics and next-generation molecular tools to improve sensitivity and speed. Increased investment in R&D is enabling firms to introduce more precise and user-friendly diagnostic platforms, including point-of-care testing kits. Companies are also prioritizing automation to streamline lab workflows and enhance throughput.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Disease Type trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 High incidence and prevalence of autoimmune diseases

- 3.2.1.2 Growing awareness about autoimmune diseases

- 3.2.1.3 Supportive government policies for research activities on autoimmune diseases

- 3.2.1.4 Technological advancements and increasing adoption of lab automation technologies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced diagnostic tests

- 3.2.2.2 Slow turnaround time for test results and need for multiple diagnostic tests

- 3.2.3 Market opportunities

- 3.2.3.1 Increasing adoption of AI and machine learning in diagnostics

- 3.2.3.2 Growth in home-based and self-diagnostic kits

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Gap analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 LAMEA

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Reagents and consumables

- 5.3 Instruments

Chapter 6 Market Estimates and Forecast, By Disease Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Localized autoimmune disease

- 6.2.1 Type 1 diabetes

- 6.2.2 Inflammatory bowel disease

- 6.2.3 Thyroid

- 6.2.4 Other localized autoimmune diseases

- 6.3 Systemic autoimmune disease

- 6.3.1 Rheumatoid arthritis

- 6.3.2 Systemic lupus erythematosus (SLE)

- 6.3.3 Multiple sclerosis

- 6.3.4 Psoriasis

- 6.3.5 Other systemic autoimmune diseases

Chapter 7 Market Estimates and Forecast, By Test Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Antinuclear antibody tests

- 7.3 Autoantibody tests

- 7.4 Complete blood count (CBC)

- 7.5 C-reactive protein (CRP)

- 7.6 Urinalysis

- 7.7 Other test types

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Diagnostics centers

- 8.4 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Abbott

- 10.2 BIOMERIEUX

- 10.3 BIO-RAD

- 10.4 DIAsource

- 10.5 Euroimmun

- 10.6 GRIFOLS

- 10.7 Hemagen Diagnostics

- 10.8 Inova Diagnostics (Werfen)

- 10.9 Labcorp

- 10.10 Quest Diagnostics

- 10.11 Revvity

- 10.12 Roche

- 10.13 SIEMENS Healthineers

- 10.14 Thermo Fisher Scientific

- 10.15 Trinity Biotech