PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844358

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844358

Data Center Networking Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

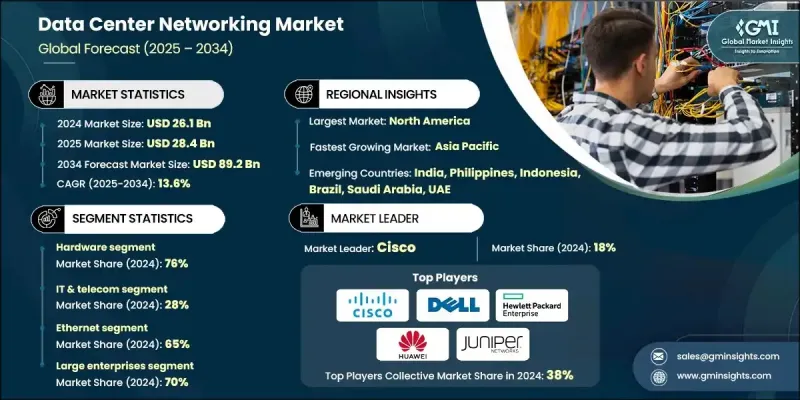

The Global Data Center Networking Market was valued at USD 26.1 billion in 2024 and is estimated to grow at a CAGR of 13.6% to reach USD 89.2 billion by 2034.

As the need to decarbonize IT operations intensifies, operators are adopting energy-efficient switching equipment, software-defined networking (SDN) platforms, and optical interconnects to reduce power consumption and extend equipment lifespan. Virtualization technologies and digital twin models are enabling real-time traffic monitoring, predictive network planning, and proactive congestion management. These advancements are further supported by smart data center initiatives globally that report substantial energy savings and throughput gains. Rising demand for low-latency infrastructure, fueled by emerging technologies such as AI, 5G, and IoT, is significantly shaping the future of data center networking.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $26.1 Billion |

| Forecast Value | $89.2 Billion |

| CAGR | 13.6% |

The COVID-19 pandemic brought increased focus on automation, remote network management, and cloud-based coordination, which accelerated the adoption of zero-trust architectures and AI-powered control systems. Enterprises increased investments in SD-WAN and SASE models to ensure business continuity and secure data traffic. As high-performance computing, edge connectivity, and AI training clusters become more prominent, demand has surged for high-bandwidth, low-latency network solutions such as 400G/800G Ethernet, InfiniBand, and advanced optical technologies. Enhanced automation in network operations is anticipated to reduce downtime costs and improve cloud interoperability, supporting resilient infrastructure deployments.

The hardware segment accounted for a 76% share in 2024 and is estimated to grow at a 13% CAGR through 2034. The segment dominates due to the critical role of physical infrastructure in ensuring seamless connectivity and reliability. Growth in cloud computing, big data, and IoT applications continues to drive demand for high-performance switches, routers, servers, and fiber-optic systems capable of handling heavy workloads and maintaining low latency. Scalable and secure hardware infrastructure is vital for consistent data flow, efficient load balancing, and service continuity in modern enterprise networks.

The IT & telecom sector held the largest share at 28% in 2024 and is expected to grow at a 14% CAGR through 2034. This segment leads the market due to the volume of data generated and the need for robust networking systems. Companies in IT and telecom are accelerating the deployment of 5G, edge computing, and next-gen connectivity, which require advanced networking frameworks. Cloud-native models, AI applications, and data analytics are expanding rapidly, driving the need for scalable and flexible data center networks across these industries.

U.S. Data Center Networking Market held an 85% share, generating USD 7.98 billion in 2024. Strong demand in the region stems from large-scale cloud deployments, digital transformation efforts across industries, and growing government investments in AI and cybersecurity. Widespread use of AI-powered and software-defined networks allows enterprises and public agencies to maintain scalable, secure, and energy-efficient operations at hyperscale levels.

Key players in the Data Center Networking Market include Hewlett Packard Enterprise (HPE), Bosch, ZF Friedrichshafen, Dell, Cisco, Juniper Networks, Huawei Technologies, Continental, Arista Networks, and Extreme Networks. Leading companies in the data center networking space are investing heavily in software-defined architectures, cloud-native solutions, and intelligent automation to strengthen their market presence. Many are focused on enhancing interoperability across multi-cloud environments and offering integrated platforms that combine networking, storage, and compute capabilities. Expansion of high-capacity Ethernet (400G/800G), smart network fabrics, and AI-driven analytics are among the core strategies to meet modern enterprise demands. Partnerships with hyperscale data centers and edge computing providers are also common, enabling tailored solutions for latency-sensitive workloads. Companies are actively acquiring startups with expertise in network virtualization and security to enhance innovation pipelines.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Application

- 2.2.4 Network

- 2.2.5 Organization Size

- 2.2.6 Data Center

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing adoption of cloud computing and IoT

- 3.2.1.2 Development of broadband and internet infrastructure

- 3.2.1.3 Increase in the establishment of new data centers

- 3.2.1.4 Rapid urbanization and proliferation of smart technologies

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High maintenance & start-up costs

- 3.2.2.2 Stringent government regulations and policies

- 3.2.3 Market opportunities

- 3.2.3.1 Increase in adoption of 800GbE and beyond

- 3.2.3.2 Surge in demand for SDN and automation

- 3.2.3.3 Rise in focus on sustainability and energy efficiency

- 3.2.3.4 Expansion of open compute and disaggregated hardware models

- 3.2.1 Growth drivers

- 3.3 Regulatory landscape

- 3.3.1 North America

- 3.3.2 Europe

- 3.3.3 Asia Pacific

- 3.3.4 Latin America

- 3.3.5 Middle East & Africa

- 3.4 Porter’s analysis

- 3.5 Cost breakdown analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Patent analysis

- 3.9 Sustainability and environmental impact analysis

- 3.9.1 Sustainable practices

- 3.9.2 Waste reduction strategies

- 3.9.3 Energy efficiency in production

- 3.9.4 Eco-friendly initiatives

- 3.9.5 Carbon footprint considerations

- 3.10 Use cases

- 3.11 Best-case scenario

- 3.12 Pricing Dynamics & Cost Structure Analysis

- 3.12.1 Hardware pricing trends & commoditization impact

- 3.12.2 Software licensing models & subscription trends

- 3.12.3 Service & support cost structures

- 3.12.4 Volume Discounting & Enterprise Pricing Strategies

- 3.13 AI/ML Infrastructure Impact Analysis

- 3.14 Edge Computing and Distributed Architecture

- 3.15 Network Automation and Orchestration

- 3.16 Security and Zero Trust Architecture

- 3.17 Performance and Scalability Analysis

- 3.18 Total Cost of Ownership (TCO) Analysis

- 3.19 ROI and Business Case Development

- 3.19.1 Network modernization business drivers

- 3.19.2 Performance improvement quantification

- 3.19.3 Risk mitigation value assessment

- 3.19.4 Competitive advantage metrics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021-2032 ($Mn)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Ethernet switches

- 5.2.2 Routers

- 5.2.3 Servers

- 5.2.4 Application Delivery Controller (ADC)

- 5.2.5 Others

- 5.3 Service

- 5.3.1 Managed services

- 5.3.2 Professional services

Chapter 6 Market Estimates & Forecast, By Application, 2021-2034 ($Bn)

- 6.1 Key trends

- 6.2 BFSI

- 6.3 Colocation

- 6.4 Energy

- 6.5 Government

- 6.6 Healthcare

- 6.7 Manufacturing

- 6.8 IT & Telecom

- 6.9 Others

Chapter 7 Market Estimates & Forecast, By Network, 2021-2034 ($Bn)

- 7.1 Key trends

- 7.2 Ethernet

- 7.3 Fibre Channel

- 7.4 InfiniBand

Chapter 8 Market Estimates & Forecast, By Organization Size, 2021-2034 ($Bn)

- 8.1 Key trends

- 8.2 Small and Medium-sized Enterprises (SME)

- 8.3 Large Enterprises

Chapter 9 Market Estimates & Forecast, By Data Center, 2021-2032 ($Bn)

- 9.1 Key trends

- 9.2 Enterprise

- 9.3 Hyperscale

- 9.4 Edge

- 9.5 Colocation

- 9.6 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Philippines

- 10.4.7 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 Arista Networks

- 11.1.2 Bosch

- 11.1.3 Broadcom

- 11.1.4 Cisco

- 11.1.5 Continental

- 11.1.6 Dell

- 11.1.7 Extreme Networks

- 11.1.8 Fortinet

- 11.1.9 Hewlett Packard Enterprise (HPE)

- 11.1.10 Huawei Technologies

- 11.1.11 IBM

- 11.1.12 Intel

- 11.1.13 Juniper Networks

- 11.1.14 Marvell Technology

- 11.1.15 NVIDIA

- 11.1.16 Schneider Electric

- 11.1.17 Siemens

- 11.1.18 ZF Friedrichshafen

- 11.2 Regional Players

11.2.1. H3 C Technologies

- 11.2.2 Nokia

- 11.2.3 Alcatel-Lucent Enterprise

- 11.2.4 ZTE

11.2.5. New H3 C

- 11.2.6 Ruijie Networks

- 11.2.7 Allied Telesis

- 11.2.8 D-Link

- 11.3 Emerging Players

- 11.3.1 Edgecore Networks

- 11.3.2 Pica8

- 11.3.3 Pluribus Networks