PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844363

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844363

Membrane Air Dryers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

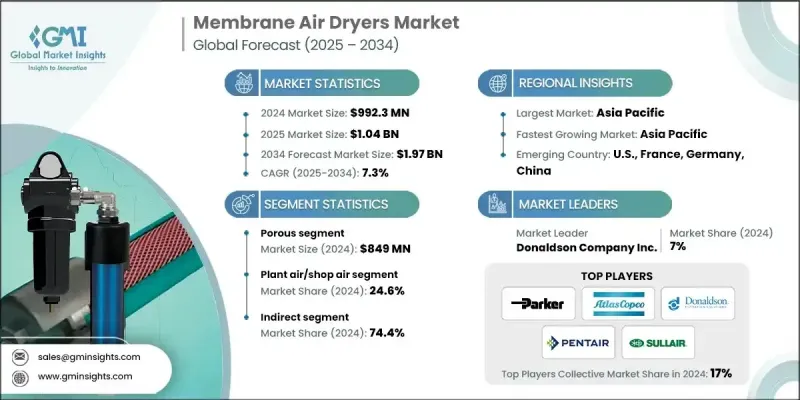

The Global Membrane Air Dryers Market was valued at USD 992.3 million in 2024 and is estimated to grow at a CAGR of 7.3% to reach USD 1.97 billion by 2034.

The upward trajectory is attributed to increasing demand for high-purity compressed air, the growing footprint of industrial automation, and the clear operational advantages membrane systems offer, particularly their energy efficiency and minimal maintenance requirements. Clean, moisture-free compressed air is essential across several industries where even trace humidity can compromise sensitive components, disrupt production, or lead to corrosion. Rising global adherence to air quality benchmarks is pushing more manufacturers to adopt membrane air dryers, which provide reliable air purification without requiring bulky infrastructure. Their compact design and continuous operation give them an edge in space-constrained, high-performance environments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $992.3 Million |

| Forecast Value | $1.97 Billion |

| CAGR | 7.3% |

The automation boom is a critical growth engine. As automated systems become widespread, powering robotics, CNC equipment, and pneumatic tools, the demand for consistently dry air increases. These systems are highly sensitive to contaminants, making membrane dryers vital for maintaining uptime and avoiding system failures. Their modular and compact structure allows easy deployment right at the point of use, making them particularly well-suited to modern industrial setups and Industry 4.0 applications.

In 2024, the porous membrane segment generated USD 849 million and is expected to grow at a CAGR of 7.4% through 2034. These membranes are favored for their effective moisture vapor transfer capabilities while maintaining uninterrupted air flow. Their superior performance in pressure drop and drying efficiency makes them highly adaptable to key industries where air purity is non-negotiable.

The plant air/shop air segment held a 24.6% share in 2024 and is forecasted to grow at a 7.4% CAGR from 2025 to 2034. This segment remains dominant because dry compressed air is a staple across general-purpose industrial applications, from driving tools and actuators to preventing corrosion and improving equipment reliability. Manufacturing, automotive, food processing, and electronics sectors all rely heavily on clean air systems, making this a core use case for membrane dryers.

U.S. Membrane Air Dryers Market held 78.5% share and generated USD 235.1 million in 2024. This leadership stems from a strong industrial foundation and widespread implementation of advanced production technologies. High-performance standards across major sectors, along with stringent efficiency and safety norms, are pushing the adoption of membrane dryers. Additionally, the presence of key manufacturers, a favorable regulatory framework, and continuous innovation in clean compressed air systems keep the U.S. at the forefront of market growth.

Key players shaping the Global Membrane Air Dryers Market include Zeks Compressed Air Solutions, Norgren, Atlas Copco, SMC Corporation, Mikropor, Donaldson Company, Ingersoll Rand, Kaeser Compressors, Wilkerson Corporation, AIRPAX, SPX FLOW, Hankison International, Graco, Gardner Denver, and Parker Hannifin Corporation. To strengthen their market foothold, companies in the Membrane Air Dryers Market are focusing on technology upgrades, product innovation, and market expansion. Many are investing in R&D to develop more compact, energy-efficient, and high-performance membrane systems tailored to diverse industrial requirements. Strategic partnerships with automation and pneumatic system providers allow these manufacturers to integrate their products into larger industrial ecosystems. Several players are also working on modular and customizable solutions to serve niche applications in space-constrained environments.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.3 Data collection methods

- 1.4 Data mining sources

- 1.4.1 Global

- 1.4.2 Regional/Country

- 1.5 Base estimates and calculations

- 1.5.1 Base year calculation

- 1.5.2 Key trends for market estimation

- 1.6 Primary research and validation

- 1.6.1 Primary sources

- 1.7 Forecast model

- 1.8 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Technology type

- 2.2.4 Capacity

- 2.2.5 Operating pressure

- 2.2.6 Application

- 2.2.7 End use

- 2.2.8 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for clean and dry compressed air

- 3.2.1.2 Growth of industrial automation

- 3.2.1.3 Energy efficiency and maintenance advantages

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial capital investment

- 3.2.2.2 Limited dew point range

- 3.2.3 Opportunities

- 3.2.3.1 Integration with smart & IoT-enabled compressed air systems

- 3.2.3.2 Eco-friendly & energy-saving solutions

- 3.2.3.3 Customized & high-capacity solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 ($Bn, Thousand Units)

- 5.1 Key trends

- 5.2 Porous

- 5.3 Non-Porous

Chapter 6 Market Estimates & Forecast, By Technology Type, 2021 - 2034 ($Bn, Thousand Units)

- 6.1 Key trends

- 6.2 Hollow fiber membrane dryers

- 6.3 Polymeric/composite membrane dryers

- 6.4 Hybrid membrane dryers

Chapter 7 Market Estimates & Forecast, By Capacity, 2021 - 2034 ($Bn, Thousand Units)

- 7.1 Key trends

- 7.2 Low capacity (<100 cfm / 170 m³/h)

- 7.3 Medium-capacity (100-500 cfm / 170-850 m³/h)

- 7.4 High capacity (>500 cfm / 850 m³/h)

Chapter 8 Market Estimates & Forecast, By Operating Pressure, 2021 - 2034 ($Bn, Thousand Units)

- 8.1 Key trends

- 8.2 Low pressure (<10 bar / 145 psi)

- 8.3 Medium pressure (10-20 bar / 145-290 psi)

- 8.4 High pressure (>20 bar / 290 psi)

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Thousand Units)

- 9.1 Key trends

- 9.2 Plant air/ Shop air

- 9.3 Instrument air

- 9.4 Process air

- 9.5 Breathing air

- 9.6 Others

Chapter 10 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Thousand Units)

- 10.1 Key trends

- 10.2 Chemical

- 10.3 Oil & gas

- 10.4 Medical

- 10.5 Food and beverage

- 10.6 Electronics

- 10.7 General manufacturing

- 10.8 Others

Chapter 11 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn, Thousand Units)

- 11.1 Key trends

- 11.2 Direct

- 11.3 Indirect

Chapter 12 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Thousand Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 UK

- 12.3.2 Germany

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.3.6 Russia

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 Australia

- 12.4.5 South Korea

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.6 MEA

- 12.6.1 UAE

- 12.6.2 South Africa

- 12.6.3 Saudi Arabia

Chapter 13 Company Profiles

- 13.1 AIRPAX

- 13.2 Atlas Copco

- 13.3 Donaldson Company

- 13.4 Gardner Denver

- 13.5 Graco

- 13.6 Hankison International

- 13.7 Ingersoll Rand

- 13.8 Kaeser Compressors

- 13.9 Mikropor

- 13.10 Norgren

- 13.11 Parker Hannifin Corporation

- 13.12 SMC Corporation

- 13.13 SPX FLOW

- 13.14 Wilkerson Corporation

- 13.15 Zeks Compressed Air Solutions