PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844364

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844364

Compact Construction Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

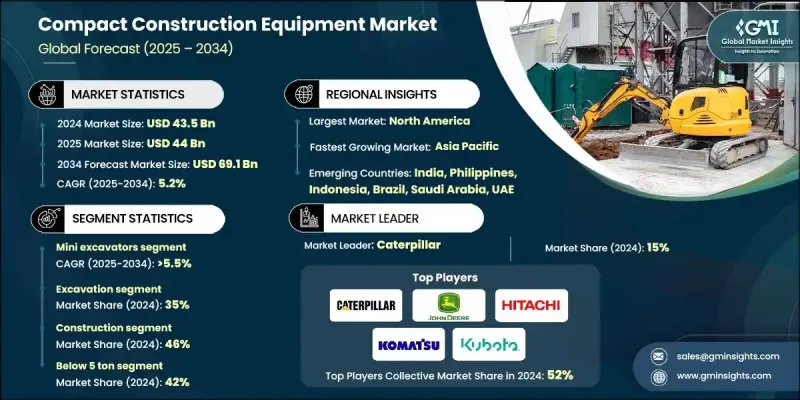

The Global Compact Construction Equipment Market was valued at USD 43.5 billion in 2024 and is estimated to grow at a CAGR of 5.2% to reach USD 69.1 billion by 2034.

The surge in urban development projects, smart city initiatives, and expanding residential construction is reshaping market growth. Compact equipment has become vital for contractors seeking to boost jobsite efficiency, cut labor dependency, and reduce operational costs through fuel-efficient engines and embedded telematics. The rising shift toward cleaner energy and emission reduction is pushing the demand for electric and hybrid models, including compact loaders, mini excavators, and telehandlers. Technologies such as machine learning-based predictive maintenance, virtualization, and telematics are enabling real-time insights that reduce downtime and enhance machine longevity. With increasing demand for smarter, low-emission equipment, investment in fleet intelligence and compact automation continues to gain momentum.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $43.5 Billion |

| Forecast Value | $69.1 Billion |

| CAGR | 5.2% |

The rising adoption of compact track loaders, mini excavators, and backhoe loaders is fueled by large-scale infrastructure expansion, clean energy deployment, and agricultural upgrades. Electrified machines, IoT-based fleet systems, and semi-autonomous equipment remain key areas of innovation and capital deployment. In developed regions such as North America and Europe, market consolidation is supported by continued investments in road upgrades, homebuilding, and sustainability-driven construction practices.

The mini excavators segment held a 38% share in 2024 and is expected to grow at a 5.5% CAGR through 2034. Their dominance stems from their versatility, ease of transport, and cost-effectiveness. Compact in design but powerful in operation, mini excavators are widely utilized in urban development, landscaping, public utilities, and small to mid-size residential and commercial construction. Their adaptability to different attachments increases their utility across a wide range of job-site applications, making them highly valuable to contractors and rental businesses alike.

The excavation segment held a 35% share in 2024 and is forecast to grow at a CAGR of 4.8% from 2025 to 2034. Excavation remains a critical part of modern construction activities, including foundation digging, trenching, roadwork, and utility installations. Compact excavators offer the accuracy and versatility required in space-constrained environments and densely populated cities. Their ability to switch between multiple attachments enables cost savings and increased efficiency, making them indispensable to a wide variety of projects.

US Compact Construction Equipment Market held an 85% share and generated USD 14.5 billion in 2024. Growth in this region is powered by large-scale infrastructure redevelopment, transportation investments, and housing demand. Federal and local initiatives focused on smart construction, along with growing preferences for electric and autonomous machines, are transforming equipment use across the country. Labor shortages and increasingly strict emission rules are also driving contractors and municipalities to deploy smarter, more efficient compact machines across construction and utility sectors.

Key manufacturers shaping the Global Compact Construction Equipment Market include Hitachi Construction Machinery, Volvo Construction Equipment, Deere & Company, Komatsu, Caterpillar, XCMG, Kubota, JCB, Yanmar, and SANY Heavy Industry. Companies in the Compact Construction Equipment Market are focusing on innovation, digital integration, and emission reduction to strengthen their market positions. Strategic priorities include expanding electric and hybrid product portfolios to meet evolving environmental regulations. Leading players are investing in advanced telematics and AI-based predictive analytics to improve equipment efficiency and lifecycle value. Partnerships with rental agencies and smart city developers are helping OEMs reach broader customer bases. Expansion into emerging markets and increased local manufacturing capacity are also critical strategies aimed at cost optimization and regional competitiveness.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Equipment

- 2.2.3 Application

- 2.2.4 End Use

- 2.2.5 Operating Capacity

- 2.2.6 Power Output

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing urbanization and infrastructure projects

- 3.2.1.2 Rise in rental fleet adoption boosting cost-effective equipment utilization.

- 3.2.1.3 Surge in technological advancements such as telematics, automation, and AI.

- 3.2.1.4 Surging electrification of compact construction equipment.

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Increasingly stringent emission regulations

- 3.2.2.2 Intense competition from larger equipment

- 3.2.3 Market opportunities

- 3.2.3.1 Growing electrification trend with battery, hybrid, and hydrogen-powered equipment.

- 3.2.3.2 Rise in adoption of smart and autonomous compact construction solutions.

- 3.2.3.3 Surge in demand for aftermarket services and multi-purpose attachments.

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 Cost breakdown analysis

- 3.7 PESTEL analysis

- 3.8 Technology and Innovation landscape

- 3.8.1 Current technological trends

- 3.8.1.1 Engine & hydraulic system advances

- 3.8.1.2 Telematics, IOT & operator assistance technologies

- 3.8.1.3 Attachment technology innovation

- 3.8.1.4 R&D investment patterns

- 3.8.2 Emerging technologies

- 3.8.2.1 Electric, hybrid, and autonomous operations

- 3.8.2.2 Predictive maintenance & remote diagnostics

- 3.8.1 Current technological trends

- 3.9 Price trends

- 3.9.1 By region

- 3.9.2 By product

- 3.10 Production statistics

- 3.10.1 Production hubs

- 3.10.2 Consumption hubs

- 3.10.3 Export and import

- 3.11 Patent analysis

- 3.12 Sustainability and environmental impact analysis

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

- 3.13 Market adoption statistics

- 3.13.1 Equipment sales & rental penetration

- 3.13.2 Technology feature adoption

- 3.13.3 Regional market share & customer metrics

- 3.13.4 Equipment utilization & replacement cycles

- 3.14 Customer Behavior & Decision-Making Analysis

- 3.14.1 Purchase vs. rental decision factors

- 3.14.2 Equipment selection criteria by End use segment

- 3.14.3 Brand loyalty patterns and switching behavior

- 3.15 Aftermarket Revenue Streams

- 3.15.1 Parts and service revenue potential

- 3.15.2 Warranty and extended service offerings

- 3.15.3 Refurbishment and remanufacturing opportunities

- 3.15.4 Attachment and accessory market dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Equipment, 2021-2034 ($Bn, Units)

- 5.1 Key trends

- 5.1.1 Mini excavators

- 5.1.2 Compact wheel loaders

- 5.1.3 Skid steer loaders

- 5.1.4 Compact track loaders

- 5.1.5 Backhoe loaders

- 5.1.6 Others

Chapter 6 Market Estimates & Forecast, By Application, 2021-2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Loading

- 6.3 Excavation

- 6.4 Material handling

- 6.5 Lifting & hoisting

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By End Use, 2021-2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Construction

- 7.3 Agriculture

- 7.4 Mining

- 7.5 Utility works

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Operating Capacity, 2021-2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Below 5 Ton

- 8.3 6 to 8 Ton

- 8.4 Above 8 ton

Chapter 9 Market Estimates & Forecast, By Power Output, 2021-2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Less than 100 HP

- 9.3 101-200 HP

- 9.4 201-400 HP

- 9.5 More than 400 HP

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Philippines

- 10.4.7 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 Bobcat Company

- 11.1.2 Caterpillar

- 11.1.3 Deere & Company

- 11.1.4 Hitachi Construction Machinery

- 11.1.5 JCB

- 11.1.6 Komatsu

- 11.1.7 Kubota

- 11.1.8 SANY Heavy Industry

- 11.1.9 Sumitomo

- 11.1.10 Terex

- 11.1.11 Volvo Construction Equipment

- 11.1.12 XCMG

- 11.1.13 Yanmar

- 11.2 Regional Players

- 11.2.1 Doosan Infracore

- 11.2.2 Hyundai Construction Equipment

- 11.2.3 King Machinery

- 11.2.4 Kobelco Construction Machinery

- 11.2.5 Manitou

- 11.2.6 Mecalac

- 11.2.7 Wacker Neuson

- 11.2.8 Zoomlion Heavy Industry Science & Technology

- 11.3 Emerging Players

- 11.3.1 ASV

- 11.3.2 Avant Tecno

- 11.3.3 Boxer Equipment

- 11.3.4 Ditch Witch

- 11.3.5 Elematic

- 11.3.6 Eurocomach

- 11.3.7 Multione

- 11.3.8 Rhinox

- 11.3.9 Toro Company

- 11.3.10 Vermeer