PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844365

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844365

Laser Marking Machine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

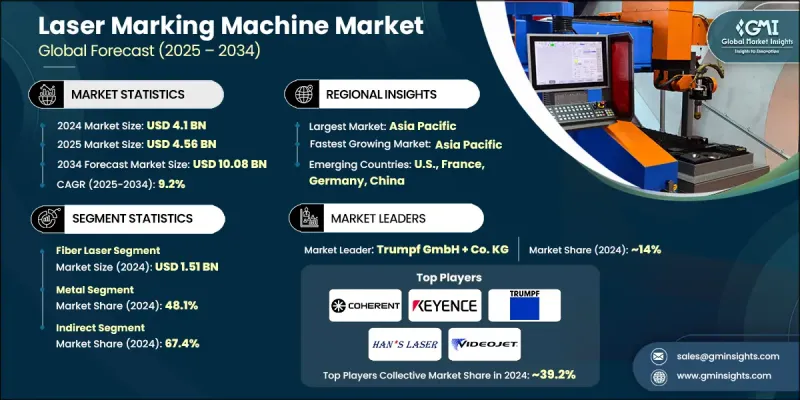

The Global Laser Marking Machine Market was valued at USD 4.1 billion in 2024 and is estimated to grow at a CAGR of 9.2% to reach USD 10.08 billion by 2034.

The growth is driven by the combined impact of rapid technological advancements, evolving industrial demands, and rising domestic manufacturing. One of the main factors fueling this expansion is the growing requirement for traceability and compliance across highly regulated sectors such as electronics, aerospace, pharmaceuticals, medical equipment, and automotive. Traditional ink-based methods or adhesive labels do not meet today's durability and legibility standards, which are increasingly enforced through regulatory frameworks. Laser marking, on the other hand, offers permanent, accurate, and tamper-proof marking essential for safety, quality assurance, and anti-counterfeiting. The transition toward smart manufacturing and automation has further accelerated demand. Fiber laser technologies have emerged as the dominant choice due to their high-speed marking, low maintenance, and compatibility with a wide range of materials. Regionally, Asia-Pacific continues to lead market growth, supported by its large-scale industrial base, policy-driven manufacturing upgrades, and expanding demand in consumer electronics and automotive sectors.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.1 Billion |

| Forecast Value | $10.08 Billion |

| CAGR | 9.2% |

The fiber lasers segment generated USD 1.51 billion in 2024 and is forecast to grow at a CAGR of 10.1% from 2025 to 2034. Their widespread adoption is tied to their operational efficiency, superior beam quality, and the ability to work with multiple substrates. With higher power density and faster processing speeds, fiber laser systems outperform both CO2 and traditional solid-state variants. These characteristics make them particularly suitable for commercial applications involving metals like copper, aluminum, and stainless steel, which require precision, speed, and durability in marking outcomes.

The metals segment accounted for a 48.1% share in 2024 and is projected to grow at a CAGR of 8.5% through 2034. The increasing use of metals across industries, combined with strict traceability standards, has made laser marking a preferred method for identification and quality control. Markings on metals deliver exceptional longevity and resistance to heat, abrasion, and chemicals, making them ideal for high-demand applications. Fiber lasers' strong absorption rate for metals allows for fast, clean, and precise marking with minimal impact on surrounding surfaces, offering both performance and cost-effectiveness.

U.S. Laser Marking Machine Market held an 82.4% share and generated USD 833.6 million in 2024. The country's dominance stems from its advanced industrial ecosystem spanning sectors like medical devices, aerospace, defense, electronics, and automotive. These industries rely heavily on permanent marking systems to meet legal traceability standards and compliance requirements. Advanced laser systems, including UV and ultrafast models, are widely integrated into automated production lines across the region. Regulations around device identification and part labeling have played a central role in driving laser marking machine adoption.

Companies shaping the Global Laser Marking Machine Market include Lumentum Operations, LaserStar Technologies, FOBA Technology and Services, Keyence, Coherent, Han's Yueming Laser Group, Gravotech Marking, Laser Photonics, Epilog Laser, IPG Photonics, Huagong Tech, Novanta, Danaher, Daheng New Epoch Technology, and Han's Laser Technology Industry Group. These major industry players are deeply invested in R&D, automation, and performance-driven system development to cater to next-generation marking requirements. Leading companies in the laser marking machine market are strengthening their position through sustained investments in R&D to develop high-speed, high-precision systems with minimal maintenance needs. They are focusing on innovations in fiber, UV, and ultrafast laser technologies to meet the specific demands of sectors like electronics, aerospace, and medical devices. Strategic acquisitions and global expansion are being pursued to enhance market penetration and diversify product portfolios. Manufacturers are also integrating their systems with smart factory technologies and automation platforms to offer turnkey solutions.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.3 Data collection methods

- 1.4 Data mining sources

- 1.4.1 Global

- 1.4.2 Regional/Country

- 1.5 Base estimates and calculations

- 1.5.1 Base year calculation

- 1.5.2 Key trends for market estimation

- 1.6 Primary research and validation

- 1.6.1 Primary sources

- 1.7 Forecast model

- 1.8 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Machine type

- 2.2.4 Mobility type

- 2.2.5 Material

- 2.2.6 Application

- 2.2.7 End use industry

- 2.2.8 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Raising electronics miniaturization & precision need

- 3.2.1.2 Automation / Industry 4.0 integration

- 3.2.1.3 Growth in high-demand segments (EV batteries, automotive, medical devices

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Safety & regulatory compliance for laser use

- 3.2.2.2 Material- and application-specific limits

- 3.2.3 Opportunities

- 3.2.3.1 Fiber, picosecond/femtosecond, and UV laser growth

- 3.2.3.2 Integration with machine vision, traceability & IIoT

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By Type

- 3.7 Regulatory landscape (HS code -8456.11)

- 3.7.1 standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Bn, Thousand Units)

- 5.1 Key trends

- 5.2 Fiber laser

- 5.3 Green laser

- 5.4 UV laser

- 5.5 Co2 laser

- 5.6 Mopa laser

- 5.7 Diode-pumped laser

- 5.8 Nd:yag laser

- 5.9 Others

Chapter 6 Market Estimates & Forecast, By Machine Type, 2021 - 2034 ($Bn, Thousand Units)

- 6.1 Key trends

- 6.2 2D

- 6.3 3D

Chapter 7 Market Estimates & Forecast, By Mobility Type, 2021 - 2034 ($Bn, Thousand Units)

- 7.1 Key trends

- 7.2 Fixed

- 7.3 Portable

Chapter 8 Market Estimates & Forecast, By Material, 2021 - 2034 ($Bn, Thousand Units)

- 8.1 Key trends

- 8.2 Metal

- 8.3 Glass

- 8.4 Plastics

- 8.5 Ceramics

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Thousand Units)

- 9.1 Key trends

- 9.2 Ablation

- 9.3 Annealing

- 9.4 Carbonizing

- 9.5 Foaming

- 9.6 Engraving

- 9.7 Others

Chapter 10 Market Estimates & Forecast, By End use Industry, 2021 - 2034 ($Bn, Thousand Units)

- 10.1 Key trends

- 10.2 Automotive

- 10.3 Electronics & semiconductor

- 10.4 Defense & aerospace

- 10.5 Machine tool

- 10.6 Healthcare

- 10.7 Packaging & labeling

- 10.8 Others

Chapter 11 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn, Thousand Units)

- 11.1 Key trends

- 11.2 Direct

- 11.3 Indirect

Chapter 12 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Thousand Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 UK

- 12.3.2 Germany

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.3.6 Russia

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 Australia

- 12.4.5 South Korea

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.6 MEA

- 12.6.1 UAE

- 12.6.2 South Africa

- 12.6.3 Saudi Arabia

Chapter 13 Company Profiles

- 13.1 Coherent

- 13.2 Daheng New Epoch Technology

- 13.3 Danaher

- 13.4 Epilog Laser

- 13.5 FOBA Technology and Services

- 13.6 Gravotech Marking

- 13.7 Han's Laser Technology Industry Group

- 13.8 Han's Yueming Laser Group

- 13.9 Huagong Tech

- 13.10 IPG Photonics

- 13.11 Keyence

- 13.12 Laser Photonics

- 13.13 LaserStar Technologies

- 13.14 Lumentum Operations

- 13.15 Novanta