PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844367

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844367

Ringworm Treatment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

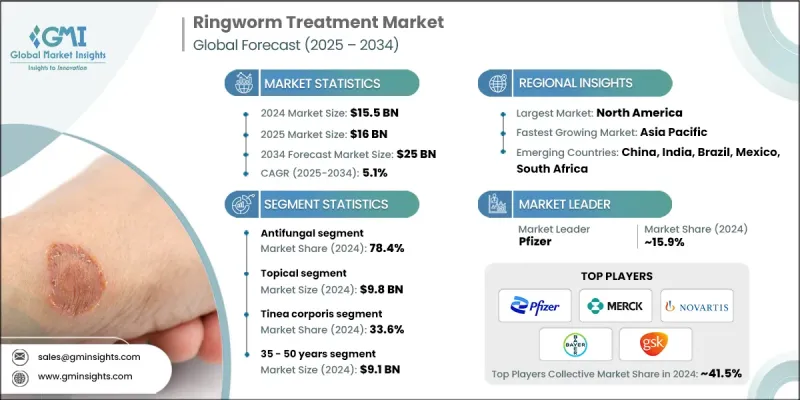

The Global Ringworm Treatment Market was valued at USD 15.5 billion in 2024 and is estimated to grow at a CAGR of 5.1% to reach USD 25 billion by 2034.

The increasing prevalence of superficial fungal infections like dermatophytosis across both developed and emerging nations is significantly driving the demand for effective treatment options. A key contributor to this growth is the rising adoption of over-the-counter (OTC) medications, making treatments more accessible for consumers. These formulations are commonly used in self-care routines, especially for mild to moderate infections, thanks to their availability across retail pharmacies and digital platforms. Urbanization and better healthcare access have also played a role, encouraging faster treatment adoption. The growing expansion of organized retail and online pharmacies is further fueling market momentum. Consumers are showing a strong preference for convenience, privacy, and affordable solutions, prompting pharmaceutical companies to enhance their presence in e-commerce channels. This shift also supports the introduction of bundled treatment kits and direct-to-consumer engagement strategies. Infections typically appear on the arms, legs, or scalp, and depending on severity, require either topical application or oral antifungal therapies. Advancements in formulation technology and broader distribution networks have made ringworm treatments more effective and accessible across all demographics.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $15.5 Billion |

| Forecast Value | $25 Billion |

| CAGR | 5.1% |

In 2024, the antifungal drugs segment accounted for 78.4% share, reflecting their widespread usage as the frontline treatment for various types of dermatophytosis. Products containing active ingredients like miconazole, clotrimazole, terbinafine, and ketoconazole are widely utilized due to their proven ability to stop fungal growth and relieve symptoms quickly. Their affordability, broad-spectrum efficacy, and availability in multiple formats contribute to their dominance in the treatment landscape. These antifungals are frequently prescribed or self-administered for common conditions like tinea corporis, tinea pedis, tinea capitis, tinea cruris, and tinea unguium.

The topical treatments segment held a 63% share and generated USD 9.8 billion in 2024. Their leadership position stems from the growing trend of self-treatment, which has made OTC topical products a preferred option. These are easily accessible via both physical and online pharmacies, especially for uncomplicated infections. Pharmaceutical companies are increasingly focused on launching new and more user-friendly topical formulations like foams, sprays, creams, powders, gels, and medicated wipes. This innovation, coupled with increased awareness around early intervention, is significantly driving global demand for topical antifungals.

North America Ringworm Treatment Market held 40.3% share in 2024, due to its well-established healthcare infrastructure and the presence of leading pharmaceutical companies. Widespread access to both prescription and OTC medications, coupled with growing awareness and self-care trends, supports the region's dominance. Consumers in this market increasingly opt for at-home solutions, leveraging convenient access to trusted treatment options. Retail drugstores and e-commerce platforms continue to make a strong impact on product availability and consumer behavior in this region.

Key companies operating in the Global Ringworm Treatment Market include Johnson and Johnson, Mankind Pharma, Sun Pharmaceuticals, AbbVie, Pfizer, Sanofi, Novartis, Glenmark Pharmaceuticals, Cipla, Biofield Pharma, Gilead Sciences, Teva Pharmaceutical Industries, Bayer, Merck, Perrigo Company, GlaxoSmithKline, and Eli Lilly and Company. To maintain a competitive edge, companies in the ringworm treatment space are focusing on multi-channel distribution, including e-commerce and organized retail pharmacies, to increase product accessibility. Many are investing in the development of novel topical formulations that enhance user compliance and effectiveness. Strategic partnerships with digital health platforms and pharmacy chains allow for broader outreach, while marketing initiatives target awareness campaigns around fungal infections and early intervention.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Drug class trends

- 2.2.3 Route of administration trends

- 2.2.4 Infection type trends

- 2.2.5 Age group trends

- 2.2.6 Medication type trends

- 2.2.7 Distribution channel trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of ringworm infections

- 3.2.1.2 Easy availability of over-the-counter antifungal medications

- 3.2.1.3 Increased awareness about ringworm infections and their symptoms

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Increasing drug resistance to common antifungal medications

- 3.2.2.2 Lack of patient compliance with treatment

- 3.2.3 Market opportunities

- 3.2.3.1 Development of novel drug formulations

- 3.2.3.2 Rising adoption of combination drugs

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Epidemiology analysis of ringworm infection

- 3.6 Pipeline analysis

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Drug Class, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Antifungal

- 5.3 Combination drugs

Chapter 6 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Topical

- 6.3 Oral

- 6.4 Parenteral

Chapter 7 Market Estimates and Forecast, By Infection Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Tinea corporis

- 7.3 Tinea pedis

- 7.4 Tinea cruris

- 7.5 Tinea capitis

- 7.6 Tinea manuum

- 7.7 Other types

Chapter 8 Market Estimates and Forecast, By Age Group, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Below 18 years

- 8.3 18 - 35 years

- 8.4 35 - 50 years

- 8.5 50 years and above

Chapter 9 Market Estimates and Forecast, By Medication Type, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Prescription

- 9.3 OTC

Chapter 10 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 Hospital pharmacies

- 10.3 Retail pharmacies

- 10.4 Online pharmacies

Chapter 11 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 Japan

- 11.4.2 China

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 AbbVie

- 12.2 Biofield Pharma

- 12.3 Bayer

- 12.4 Cipla

- 12.5 Eli Lilly and Company

- 12.6 Gilead Sciences

- 12.7 GlaxoSmithKline

- 12.8 Glenmark Pharmaceuticals

- 12.9 Johnson and Johnson

- 12.10 Mankind Pharma

- 12.11 Merck

- 12.12 Novartis

- 12.13 Perrigo Company

- 12.14 Pfizer

- 12.15 Sanofi

- 12.16 Sun Pharmaceuticals

- 12.17 Teva Pharmaceutical Industries