PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844368

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844368

Electronic Toll Collection (ETC) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

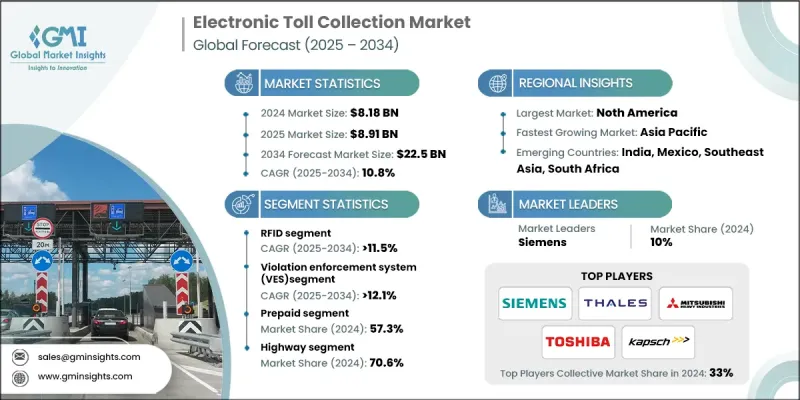

The Global Electronic Toll Collection (ETC) Market was valued at USD 8.18 billion in 2024 and is estimated to grow at a CAGR of 10.8% to reach USD 22.5 billion by 2034.

The surge in urban populations and rising private vehicle ownership has resulted in traffic congestion, particularly across highways and city corridors. ETC systems are designed to reduce traffic delays by automating toll payments, easing congestion, and increasing throughput at tolling points. Governments worldwide are prioritizing the transition to digital tolling frameworks, pushing for interoperability standards, and eliminating manual cash collection. Technological advancements in RFID, artificial intelligence, cloud platforms, and ANPR systems are making modern ETC solutions more accurate, efficient, and secure. These technologies also help cut operational costs and allow for broader deployment. In addition, the widespread use of mobile wallets and digital payment solutions further increases user convenience. ETC systems contribute to environmental sustainability by reducing idling times and fuel consumption, which leads to lower emissions. As nations commit to sustainability initiatives and decarbonization targets, ETC plays an essential role in building cleaner and smarter transportation systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.18 Billion |

| Forecast Value | $22.5 Billion |

| CAGR | 10.8% |

In 2024, the RFID technology segment held a 46% share and is projected to grow at a CAGR of 11.5% through 2034. RFID remains a dominant and cost-effective solution across global tolling networks, particularly in regions across Asia. These systems are highly favored due to their affordability, simplicity, and widespread adoption. Meanwhile, DSRC (Dedicated Short-Range Communication) continues to be used across select regions like Europe and South Korea, primarily in high-speed open-road tolling environments and V2X communications. While RFID leads the global market, DSRC maintains a presence in specific regional ecosystems.

The violation enforcement system (VES) segment is expected to grow at a CAGR of 12.1% from 2025 to 2034. As the shift toward open-road, cashless tolling accelerates, the demand for automated enforcement tools rises significantly. VES technologies utilize cameras, sensor systems, and ANPR to identify toll violators and enforce compliance. These systems help prevent revenue loss and ensure adherence to toll-related legislation by automating violation detection. Enhanced by AI and analytics, modern VES solutions now offer improved detection accuracy, making them indispensable in next-gen toll infrastructure.

United States Electronic Toll Collection (ETC) Market held 87.4% share in 2024. The widespread rollout of All-Electronic Tolling (AET) systems is transforming how toll roads operate, eliminating cash payments and enabling smoother traffic flow. These systems not only reduce operational costs but also support congestion management through dynamic pricing models. Variable toll rates based on real-time traffic data are gaining traction, helping to influence travel behavior by encouraging off-peak travel and improving traffic efficiency.

Major companies leading the Global Electronic Toll Collection (ETC) Market include Siemens, Thales, Conduent, Toshiba, Kapsch TrafficCom, Mitsubishi Heavy Industries, Neology, EFKON, Cubic, and TransCore / ST Engineering. To strengthen their position, ETC market players are focusing on strategic collaborations with transport authorities and governments to roll out integrated tolling infrastructure. Investment in research and development is a priority to enhance accuracy, reduce system costs, and implement AI-driven analytics. Companies are actively expanding their global footprint by securing long-term contracts, particularly in fast-growing regions. Many are also working on interoperability protocols to enable seamless travel across jurisdictions.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Technology

- 2.2.2 Type

- 2.2.3 Payment method

- 2.2.4 Application

- 2.2.5 Regional

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Electronic Toll Collection Value Chain

- 3.1.2 Government-Private Sector Relationships

- 3.1.3 Technology Provider-Operator Dynamics

- 3.1.4 Standards Organization Influence

- 3.1.5 Transportation Authority Integration Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing traffic congestion

- 3.2.1.2 Government policies & regulations

- 3.2.1.3 Technological advancements

- 3.2.1.4 Environmental sustainability goals

- 3.2.1.5 Rising demand for seamless travel

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High implementation costs

- 3.2.2.2 Privacy and data security concerns

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion in emerging markets

- 3.2.3.2 Integration with smart mobility & its

- 3.2.3.3 Adoption of ai and analytics

- 3.2.3.4 Environmental & sustainability initiatives

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 FHWA electronic toll collection standards

- 3.4.2 DOT intelligent transportation system guidelines

- 3.4.3 FCC spectrum allocation for DSRC

- 3.4.4 International Standards (ISO, CEN, ETSI)

- 3.4.5 Regional transportation authority regulations

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Patent analysis

- 3.9 Price Trends Analysis

- 3.9.1 Operational Cost Comparison

- 3.9.2 Total Cost of Ownership Analysis

- 3.10 Cost Breakdown Analysis

- 3.10.1 Infrastructure development costs

- 3.10.2 Technology implementation expenses

- 3.10.3 System integration & customization

- 3.11 Sustainability and Environmental Aspects

- 3.11.1 Sustainable Practices

- 3.11.2 Waste Reduction Strategies

- 3.11.3 Energy Efficiency in Production

- 3.11.4 Eco-friendly Initiatives

- 3.11.5 Carbon Footprint Considerations

- 3.12 Market Deployment Statistics

- 3.12.1 ETC system installation rates

- 3.12.2 Transponder adoption metrics

- 3.12.3 Traffic volume processing analysis

- 3.13 Investment Landscape Analysis

- 3.13.1 Government infrastructure investment

- 3.13.2 Private sector toll road investment

- 3.13.3 PPP project funding analysis

- 3.14 Competitive Intelligence

- 3.14.1 Technology Leadership Assessment

- 3.14.2 Market Share by Solution Category

- 3.14.3 Contract Win/Loss Analysis

- 3.15 Customer Behavior Analysis

- 3.16 Business Model Evolution

- 3.16.1 Traditional system integration models

- 3.16.2 Build-Operate-Transfer (BOT) Models

- 3.17 Performance & Quality Standards

- 3.17.1 Transaction accuracy requirements

- 3.17.2 System availability standards

- 3.18 Risk Assessment Framework

- 3.19 Implementation Timeline Analysis

- 3.19.1 System design & planning phase

- 3.19.2 Infrastructure installation timeline

- 3.20 Interoperability & Standards Framework

- 3.20.1 Technical interoperability requirements

- 3.20.2 Business rule harmonization

- 3.21 Privacy & Data Security

- 3.22 Traffic Management Integration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Market Entry Barriers

- 4.7 Key news and initiatives

- 4.7.1 Mergers & acquisitions

- 4.7.2 Partnerships & collaborations

- 4.7.3 New Product Launches

- 4.7.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 RFID

- 5.3 DSRC

- 5.4 GPS/GNSS

- 5.5 Video analytics

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Type, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Automatic Vehicle Classification (AVC)

- 6.3 Violation Enforcement System (VES)

- 6.4 Automatic Vehicle Identification System (AVIS)

- 6.5 Others (Back office & services)

Chapter 7 Market Estimates & Forecast, By Payment method, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Prepaid

- 7.3 Hybrid

- 7.4 Postpaid

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Urban zones

- 8.3 Highways

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Nordics

- 9.3.7 Netherlands

- 9.3.8 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Top Global Players

- 10.1.1 Kapsch TrafficCom

- 10.1.2 TransCore (Roper Technologies)

- 10.1.3 Cubic Transportation Systems

- 10.1.4 Siemens Mobility

- 10.1.5 Thales

- 10.1.6 EFKON

- 10.1.7 Q-Free

- 10.1.8 Conduent

- 10.1.9 Neology

- 10.1.10 Toshiba

- 10.2 Regional Champions

- 10.2.1 TagMaster

- 10.2.2 TOLL COLLECT

- 10.2.3 Autostrade Tech

- 10.2.4 VINCI Highways

- 10.2.5 Mitsubishi Heavy Industries

- 10.2.6 DENSO

- 10.2.7 Huawei Technologies

- 10.2.8 Dahua Technology

- 10.2.9 International Road Dynamics

- 10.3 Emerging Players & Innovators

- 10.3.1 Genetec

- 10.3.2 Raytheon Technologies

- 10.3.3 Bosch Mobility Solutions

- 10.3.4 Continental

- 10.3.5 Atos

- 10.3.6 NEC

- 10.3.7 Hitachi Vantara

- 10.3.8 Accenture

- 10.3.9 Cognizant Technology Solutions

- 10.3.10 Tata Consultancy Services