PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844370

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844370

Left Atrial Appendage Closure Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

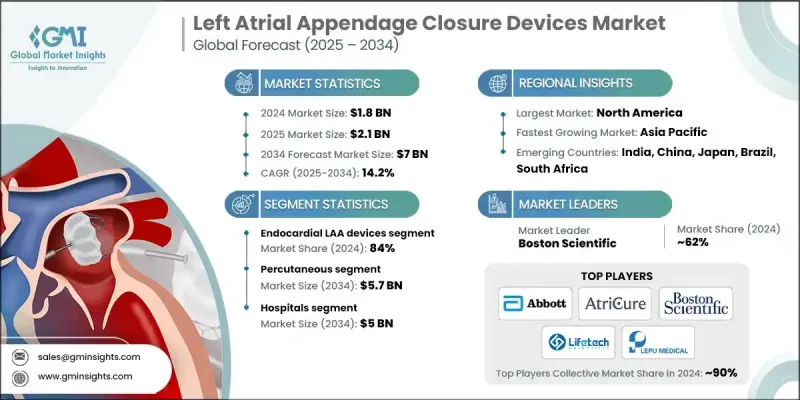

The Global Left Atrial Appendage Closure Devices Market was valued at USD 1.8 billion in 2024 and is estimated to grow at a CAGR of 14.2% to reach USD 7 billion by 2034.

Market expansion is driven by the rising incidence of atrial fibrillation, the growing preference for minimally invasive cardiovascular procedures, and the increasing scope of reimbursement policies across healthcare systems. LAA closure devices are used to reduce stroke risk in individuals diagnosed with non-valvular atrial fibrillation by sealing off the left atrial appendage, a common site for clot formation in such patients. As atrial fibrillation becomes more common, especially in aging populations, demand for these stroke prevention solutions is climbing. Governments around the world are investing more in cardiovascular care to mitigate long-term healthcare costs tied to AF-related complications. Increased funding also supports public awareness campaigns and research into more advanced treatment technologies, including next-generation closure devices. The emphasis on early diagnosis and innovative device-based therapy options is shaping a promising outlook for the LAA closure devices industry on a global scale.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.8 Billion |

| Forecast Value | $7 Billion |

| CAGR | 14.2% |

In 2024, the endocardial LAA closure device segment held an 84% share. These devices are widely chosen for their minimally invasive approach, backed by strong clinical trial performance, broad physician confidence, and successful real-world applications. Their design allows physicians to seal off the LAA through catheter-based procedures, lowering stroke risk in atrial fibrillation patients without the need for open-heart surgery. The segment continues to benefit from rising demand for procedures that offer shorter recovery times and proven long-term outcomes.

The percutaneous segment is projected to reach USD 5.7 billion by 2034, driven by its adaptability and the growing availability of interventional cardiology infrastructure. This method allows the procedure to be performed in a range of settings, including hospitals and cardiac care centers, supported by experienced clinicians and modern cath lab technology. Its widespread accessibility and procedural safety are helping to cement its position as the dominant technique in the market.

North America Left Atrial Appendage Closure Devices Market held 46.2% share in 2024. The region is a leader in structural heart care innovation, supported by advanced healthcare infrastructure, robust R&D, and consistent clinical trial activity. The presence of highly specialized medical centers and widespread access to training in cardiac procedures supports procedural growth. In addition, technological advancements such as AI-assisted preoperative planning and digital monitoring tools further reinforce North America's leadership in the LAA closure space.

Prominent companies actively competing in the Left Atrial Appendage Closure Devices Market include MicroPort, Medtronic, LEPU MEDICAL, Abbott, AtriCure, Boston Scientific, and Lifetech. Companies in the left atrial appendage closure devices market are implementing strategic initiatives to strengthen their foothold. Many are heavily investing in R&D to develop next-generation devices that improve ease of implantation, procedural safety, and long-term efficacy. Firms are expanding clinical trial pipelines to gain faster regulatory approvals and enhance clinical validation. Strategic partnerships with hospitals and research centers are being pursued to broaden physician adoption through hands-on training and data sharing.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Procedure trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of atrial fibrillation

- 3.2.1.2 Technological advancements

- 3.2.1.3 Growing adoption of minimally invasive procedures

- 3.2.1.4 Expanding reimbursement coverage

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High procedural costs

- 3.2.2.2 Risk of complications

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion into emerging markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.5.1 Current technologies

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Reimbursement scenario

- 3.8 Pipeline analysis

- 3.9 Investment landscape

- 3.10 Pricing analysis, 2024

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

- 3.13 Gap analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 North America

- 4.3.2 Europe

- 4.3.3 Asia Pacific

- 4.3.4 LAMEA

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn, Units)

- 5.1 Key trends

- 5.2 Endocardial LAA devices

- 5.3 Epicardial LAA devices

Chapter 6 Market Estimates and Forecast, By Procedure, 2021 - 2034 ($ Mn, Units)

- 6.1 Key trends

- 6.2 Percutaneous

- 6.3 Surgical

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn, Units)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers

- 7.4 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn, Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Abbott

- 9.2 AtriCure

- 9.3 Boston Scientific

- 9.4 LEPU MEDICAL

- 9.5 Lifetech

- 9.6 Medtronic

- 9.7 MicroPort