PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844372

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844372

Off-Highway Vehicle Telematics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

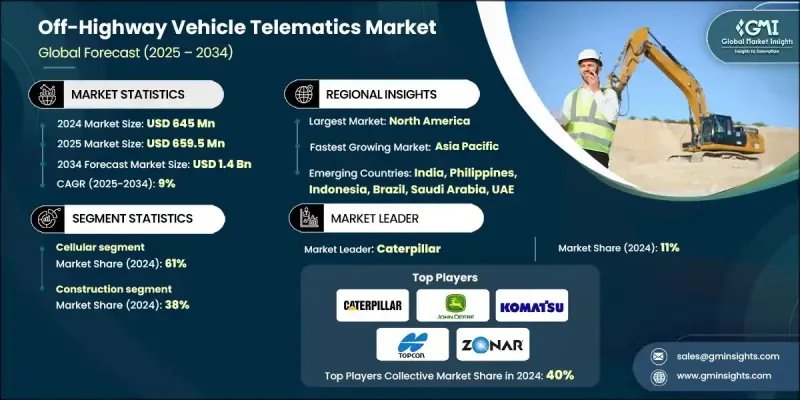

The Global Off-Highway Vehicle Telematics Market was valued at USD 645 million in 2024 and is estimated to grow at a CAGR of 9% to reach USD 1.4 billion by 2034.

The market is evolving rapidly as the push for decarbonization and the adoption of electric and hybrid-powered off-highway equipment intensifies. OEMs and operators are turning to telematics to enhance energy management, extend battery performance, and better utilize charging networks. These systems play a crucial role in various sectors by enabling smarter resource allocation, reducing downtime, and improving machine efficiency. Agricultural operations, for example, benefit from intelligent monitoring systems that support precision activities. Overall, as industries transition toward cleaner, data-driven operations, advanced telematics is becoming an essential infrastructure component.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $645 Million |

| Forecast Value | $1.4 Billion |

| CAGR | 9% |

The pandemic significantly accelerated digital transformation in off-highway industries, with companies increasingly relying on cloud-based fleet tools, predictive diagnostics, and automated analytics to keep operations moving. This led to rising investments in digital twins, secure data environments, and remote operations hubs. The growth of smart farming, automation in mining, and next-gen construction technologies has created demand for telematics systems that are scalable, accurate, and deeply integrated with operational platforms. 5G, AI-driven maintenance, and M2M communications continue to attract investment, with a focus on improving safety, reducing idle equipment time, and boosting output. North America and Europe maintain strong market positions, supported by regulatory mandates, advanced infrastructure, and widespread OEM partnerships.

In 2024, the cellular segment held a 61% share and is forecast to grow at a CAGR of 8.5% through 2034. These networks are critical to maintaining constant connectivity between heavy machines and centralized fleet management systems. Real-time access to data such as asset location, fuel levels, performance metrics, and service alerts gives operators more control and operational visibility across off-highway applications.

The construction segment held a 38% share in 2024 and is expected to grow at a CAGR of 7.6% through 2034. The segment relies heavily on telematics to manage diverse fleets of equipment like bulldozers, cranes, loaders, and excavators that operate across multiple job sites. The ability to streamline asset management and maintain schedules is key to meeting tight deadlines and budgets.

United States Off-Highway Vehicle Telematics Market held an 85% share and generated USD 209.6 million in 2024. The U.S. continues to see strong growth in telematics adoption across mining, construction, and agriculture, driven by a need to improve asset tracking, safety standards, and operational efficiency. Enhanced infrastructure, high digital readiness, and increasing enterprise digitalization are making it easier for companies to adopt and scale telematics across off-highway operations.

Key companies active in the Off-Highway Vehicle Telematics Market include Teletrac Navman, Caterpillar, Komatsu, Zonar Systems, Deere & Company, Topcon Corporation, Hitachi Construction Machinery, Orbcomm, Trimble, and Trackunit. To strengthen their market presence, companies are actively investing in R&D to develop modular and scalable telematics platforms compatible across a variety of vehicle types and applications. Collaborations with OEMs allow integration at the manufacturing stage, enhancing system efficiency and adoption. Additionally, players are focusing on AI and predictive analytics to offer smarter maintenance scheduling and machine insights. Many are also expanding their software-as-a-service (SaaS) offerings and data security frameworks to appeal to enterprise buyers.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Technology

- 2.2.3 Sales channel

- 2.2.4 Application

- 2.2.5 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.1.7 Supply chain ecosystem mapping

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rapid industrialization and infrastructure development

- 3.2.1.2 Growth of automation in off-highway vehicles

- 3.2.1.3 Rising need for operational efficiency of OHVs

- 3.2.1.4 Increased focus on the safety and security of workers

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High upfront costs of off-highway vehicle telematics

- 3.2.2.2 Accuracy and reliability challenges

- 3.2.3 Market opportunities

- 3.2.3.1 Rising demand for predictive maintenance

- 3.2.3.2 Integration of 5G and satellite IoT connectivity

- 3.2.3.3 Sustainability and green fleet initiatives

- 3.2.3.4 Expansion in emerging markets

- 3.2.1 Growth drivers

- 3.3 Growth potential

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Patent analysis

- 3.9 Data analytics & intelligence capabilities

- 3.9.1 Machine learning application assessment

- 3.9.2 Edge computing infrastructure requirements

- 3.9.3 Real-time processing capabilities

- 3.9.4 Predictive analytics framework

- 3.9.5 Data visualization & dashboard requirements

- 3.10 Power management & connectivity infrastructure

- 3.10.1 Battery & power system analysis

- 3.10.2 Wireless communication reliability

- 3.10.3 Remote area connectivity solutions

- 3.10.4 Hybrid communication system design

- 3.10.5 Infrastructure investment requirements

- 3.11 Sustainability & environmental aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly Initiatives

- 3.11.5 Carbon footprint considerations

- 3.12 Cost-breakdown analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Technology, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Cellular

- 5.3 Satellite

Chapter 6 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 OEM

- 6.3 Aftermarket

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Fleet management

- 7.3 Vehicle tracking

- 7.4 Fuel management

- 7.5 Safety and security

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 Construction

- 8.3 Agriculture

- 8.4 Mining

- 8.5 Forestry

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Philippines

- 9.4.7 Indonesia

- 9.4.8 Singapore

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 AGCO Corporation

- 10.1.2 Caterpillar

- 10.1.3 CNH Industrial

- 10.1.4 Continental

- 10.1.5 Deere & Company

- 10.1.6 Komatsu

- 10.1.7 Kubota

- 10.1.8 Orbcomm

- 10.1.9 Teletrac Navman

- 10.1.10 Topcon

- 10.1.11 Trackunit A/S

- 10.1.12 Trimble

- 10.1.13 Volvo Group

- 10.1.14 Zonar Systems

- 10.2 Regional Players

- 10.2.1 Atlas Copco

- 10.2.2 CLAAS Group

- 10.2.3 Doosan Group

- 10.2.4 Escorts Limited

- 10.2.5 Hitachi Construction Machinery

- 10.2.6 Liebherr Group

- 10.2.7 Mahindra & Mahindra

- 10.2.8 Sandvik

- 10.2.9 Volvo Construction Equipment

- 10.2.10 Yanmar Holdings

- 10.3 Emerging Players

- 10.3.1 Cartrack Holdings

- 10.3.2 Epiroc

- 10.3.3 MONTRANS

- 10.3.4 Raven Industries

- 10.3.5 TTControl