PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844375

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844375

Automotive Driver Monitoring System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

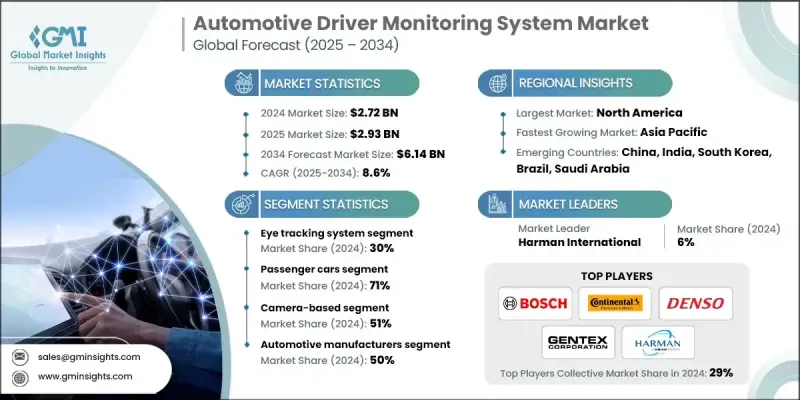

The Global Automotive Driver Monitoring System Market was valued at USD 2.72 billion in 2024 and is estimated to grow at a CAGR of 8.6% to reach USD 6.14 billion by 2034.

The growing emphasis on road safety and the rapid advancement of semi-autonomous driving technologies are accelerating the adoption of driver monitoring systems (DMS) in modern vehicles. These systems evaluate driver behavior and attentiveness by analyzing factors such as head orientation, eye movement, blinking speed, and facial expressions. As safety standards tighten worldwide, DMS is emerging as a critical feature in passenger vehicles, not just as an optional luxury but as a core element of next-generation vehicle safety architecture. Advancements in real-time eye tracking, edge AI processing, and infrared-based night vision are enhancing system capabilities, allowing better performance across different lighting conditions and user scenarios. Developers are also refining AI models using large annotated datasets to increase the accuracy of detecting fatigue, distraction, or inattention. Beyond private vehicles, DMS technology is making significant inroads into commercial fleets, where managing driver alertness plays a pivotal role in reducing accidents and improving compliance with emerging safety regulations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.72 Billion |

| Forecast Value | $6.14 Billion |

| CAGR | 8.6% |

The eye tracking technology segment held a 30% share in 2024 and is projected to grow at a CAGR of 7.6% through 2034. These systems are designed to monitor visual cues like blink duration, gaze direction, and pupil dilation to assess signs of driver fatigue or loss of focus. Eye tracking remains one of the most effective biometric techniques for identifying early indicators of distraction. Research simulations have demonstrated the system's ability to capture even subtle variations in eye movement, delivering high detection accuracy in low-light environments or when drivers wear glasses or obstructive eyewear.

The passenger cars segment held a 71% share in 2024 and is expected to grow at a 9% CAGR from 2025 to 2034. This dominance is driven by evolving safety protocols and tighter compliance requirements. Regulatory changes across global markets, especially in Asia and Europe, are pushing manufacturers to incorporate DMS as part of their standard safety features. These frameworks emphasize fatigue detection and behavioral monitoring, prompting OEMs to embed DMS into their latest passenger models to meet updated safety scoring benchmarks.

North America Automotive Driver Monitoring System Market held a 33% share and generated USD 893.9 million in 2024. The region's leadership stems from a strong push by regional authorities, OEMs, and transportation fleets seeking to integrate intelligent driver-assist systems. While DMS integration is not yet mandatory across all vehicle categories, national programs and pilot initiatives in both the US and Canada have actively promoted its adoption. These efforts focus on enhancing driver awareness, reducing distraction-related accidents, and supporting the transition to safer, smarter mobility solutions.

Key players in the Global Automotive Driver Monitoring System Market include Continental, Magna, Denso, Harman, Gentex, Aptiv, Tobii, Bosch, and Valeo. Companies operating in the automotive driver monitoring system market are leveraging strategic partnerships, investing heavily in AI and sensor technology, and aligning product innovation with regulatory frameworks. Many are forming collaborations with automakers to co-develop integrated safety platforms that combine DMS with advanced driver-assistance systems. Others are enhancing their hardware offerings with real-time eye tracking, edge-based computing, and infrared sensor capabilities to improve reliability across driving conditions.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 System

- 2.2.3 Vehicle

- 2.2.4 Technology

- 2.2.5 End Use

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future-outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factors affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Stringent government safety regulations

- 3.2.1.2 Rising demand for ADAS and semi-autonomous vehicles

- 3.2.1.3 Increasing incidents of distracted and drowsy driving

- 3.2.1.4 Growing consumer awareness of in-cabin safety features

- 3.2.1.5 Integration of AI and computer vision in automotive systems

- 3.2.1.6 Mandates for commercial fleet driver monitoring

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of DMS hardware and software integration

- 3.2.2.2 Privacy and biometric data concerns among users

- 3.2.3 Market opportunities

- 3.2.3.1 Mandatory DMS for Euro NCAP 2026 and GSR Phase II

- 3.2.3.2 Emergence of AI chipsets tailored for in-cabin monitoring

- 3.2.3.3 Integration with occupant monitoring and health analytics

- 3.2.3.4 Growing demand for DMS in commercial and shared mobility fleets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Patent analysis

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Cost breakdown analysis

- 3.8 Technology and innovation landscape

- 3.8.1 Current technological trends

- 3.8.1.1 Computer vision algorithm evolution

- 3.8.1.2 Eye tracking technology advances

- 3.8.1.3 AI and machine learning integration

- 3.8.1.4 Multi-modal sensor fusion

- 3.8.1.5 Real-time processing capabilities

- 3.8.2 Emerging technologies

- 3.8.1 Current technological trends

- 3.9 Regulatory landscape

- 3.9.1 NHTSA driver monitoring requirements

- 3.9.2 Euro NCAP safety assessment protocols

- 3.9.3 EU general safety regulation impact

- 3.9.4 ISO 26262 functional safety compliance

- 3.9.5 GDPR biometric data protection

- 3.10 Price trends

- 3.10.1 By region

- 3.10.2 By system

- 3.11 Sustainability & ESG impact analysis

- 3.11.1 Lifecycle environmental assessment

- 3.11.2 Manufacturing sustainability

- 3.11.3 End-of-life management

- 3.11.4 Carbon footprint reduction

- 3.12 Investment & funding trends analysis

- 3.13 Safety and performance standards

- 3.13.1 Automotive safety integrity levels (ASIL)

- 3.13.2 Detection accuracy requirements

- 3.13.3 Response time standards

- 3.13.4 Environmental testing protocols

- 3.13.5 Electromagnetic compatibility (EMC)

- 3.14 Autonomous vehicle integration

- 3.14.1 SAE level-specific requirements

- 3.14.2 Handover scenario management

- 3.14.3 Driver readiness assessment

- 3.15 Digital transformation impact

- 3.15.1 Connected vehicle integration

- 3.15.2 Over-the-air update capabilities

- 3.15.3 Cloud-based analytics platforms

- 3.15.4 Big data and AI integration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By System, 2021 - 2034 (USD Bn)

- 5.1 Key trends

- 5.2 Eye tracking system

- 5.3 Facial recognition system

- 5.4 Steering behavior monitoring system

- 5.5 Heart rate monitoring system

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 (USD Bn)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Hatchback

- 6.2.2 Sedan

- 6.2.3 SUV

- 6.3 Commercial vehicles

- 6.3.1 Light commercial vehicles (LCV)

- 6.3.2 Heavy commercial vehicles (HCV)

- 6.3.3 Medium commercial vehicles (MCV)

Chapter 7 Market Estimates & Forecast, By Technology, 2021 - 2034 (USD Bn)

- 7.1 Key trends

- 7.2 Camera-based

- 7.3 Sensor-based

- 7.4 Hybrid

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 (USD Bn)

- 8.1 Key trends

- 8.2 Automotive manufacturers

- 8.2.1 OEMs (Original Equipment Manufacturers)

- 8.2.2 Tier 1 suppliers

- 8.2.3 Tier 2/3 component suppliers

- 8.2.4 Aftermarket manufacturers

- 8.3 Government

- 8.3.1 Transportation & safety agencies

- 8.3.2 Government vehicle fleets

- 8.4 Individuals

- 8.5 Fleet operators

- 8.5.1 Transportation & logistics

- 8.5.2 Mobility services

- 8.5.3 Industry-specific fleets

- 8.5.4 Commercial transportation

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Nordics

- 9.3.7 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 Indonesia

- 9.4.6 Philippines

- 9.4.7 Thailand

- 9.4.8 South Korea

- 9.4.9 Singapore

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 Aptiv

- 10.1.2 Bosch

- 10.1.3 Continental

- 10.1.4 Denso

- 10.1.5 Gentex

- 10.1.6 Harman

- 10.1.7 Magna

- 10.1.8 Tobii

- 10.1.9 Valeo

- 10.2 Regional Players

- 10.2.1 Aisin

- 10.2.2 Eyesight Technologies

- 10.2.3 Ficosa

- 10.2.4 Hyundai Mobis

- 10.2.5 Panasonic

- 10.2.6 Veoneer

- 10.2.7 Visteon

- 10.2.8 ZF Friedrichshafen

- 10.3 Emerging Players / Disruptors

- 10.3.1 Affectiva

- 10.3.2 Cipia

- 10.3.3 Eyeris Technologies

- 10.3.4 Guardian Optical Technologies

- 10.3.5 Jungo Connectivity

- 10.3.6 Nauto

- 10.3.7 StradVision

- 10.3.8 Xperi Corporation