PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844376

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844376

Submerged Arc Furnace Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

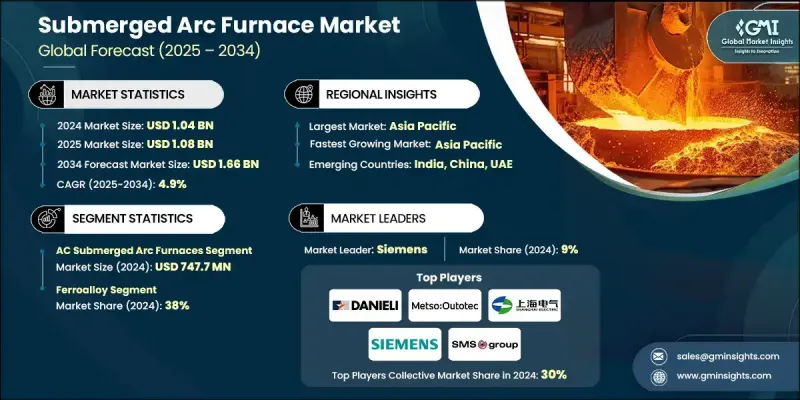

The Global Submerged Arc Furnace Market was valued at USD 1.04 billion in 2024 and is estimated to grow at a CAGR of 4.9% to reach USD 1.66 billion by 2034.

The surge in demand for submerged arc furnaces is closely tied to the global rise in steel, ferroalloy, and silicon metal production. As industrialization and urban development accelerate across emerging markets, the need for high-grade steel products continues to intensify. Submerged arc furnaces play a central role in steel manufacturing, especially in producing ferroalloys that serve as critical inputs during steelmaking processes. Growing infrastructure activity, automotive manufacturing, and the expansion of the construction sector further amplify this need. Additionally, the push for renewable energy has sparked greater demand for silicon metal used in solar panels and electronics. As silicon metal production is energy-intensive, modern SAF designs are proving vital in improving efficiency and productivity. Increasing applications across multiple sectors, coupled with innovation in furnace technologies, are fueling the market's upward trajectory. With steel and silicon remaining foundational materials in the global economy, submerged arc furnace adoption continues to expand, making it a key technology investment for manufacturing operations worldwide.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.04 Billion |

| Forecast Value | $1.66 Billion |

| CAGR | 4.9% |

The AC submerged arc furnaces segment generated USD 747.7 million in 2024 and is forecast to grow at a CAGR of 5.1% through 2034. These furnaces maintain the top spot due to their cost efficiency, mature technology base, and ease of use in industrial settings. AC-SAF systems are commonly chosen in silicon metal and ferroalloy production due to their operational reliability and compatibility with high-temperature processes. They provide consistent results while keeping capital costs manageable, making them highly attractive for large-scale industrial use.

The ferroalloy applications segment held a 38% share in 2024 and is projected to grow at a CAGR of 5% from 2025 to 2034. Among all uses of submerged arc furnaces, ferroalloy manufacturing remains the dominant driver of demand. These specialized alloys, such as ferrosilicon, ferrochrome, and ferromanganese, are essential in steel production, requiring consistent high-heat environments that only SAFs can reliably provide. The need for quality steel outputs and metallurgical precision continues to push the demand for this application across global markets.

U.S. Submerged Arc Furnace Market held a 76% share in 2024, generating USD 208.8 million. The country's leadership position is backed by its robust steel and metal production base, supported by growing investments in facility upgrades and technological improvements. SAFs are widely deployed in producing critical metals used in core industries like infrastructure, transportation, and manufacturing. Ongoing modernization efforts aimed at boosting output and energy efficiency further contribute to increased SAF adoption.

Key players shaping the Global Submerged Arc Furnace Market include Shanghai Electric, Outotec Oyj, Tenova, Xi'an Abundance Electric Technology, SMS Group, Thermtronix, Paul Wurth, Thyssenkrupp Industrial, Electrotherm, Siemens, Hatch, Metso Outotec, Primetals Technologies, Danieli, and Doshi Technologies. These companies continue to lead innovation and technological integration across major industrial furnace applications worldwide. To maintain and expand their footprint, companies in the submerged arc furnace space are prioritizing R&D to enhance energy efficiency, furnace automation, and digital monitoring. Technological upgrades are focused on minimizing downtime and extending equipment lifespan, while also optimizing high-temperature performance.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Application

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for steel, ferroalloys, and silicon metal

- 3.2.1.2 Environmental sustainability & regulation

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High capital and operating costs

- 3.2.2.2 Energy dependency and supply risks

- 3.2.3 Opportunities

- 3.2.3.1 Technological advancements & digital integration

- 3.2.3.2 Rising demand for high-purity metals

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade Statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 ($Billion, Thousand Units)

- 5.1 Key trends

- 5.2 DC submerged arc furnaces

- 5.3 AC submerged arc furnaces

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 ($Billion, Thousand Units)

- 6.1 Key trends

- 6.2 Ferroalloy

- 6.3 Silicon Metal

- 6.4 Fused Alumina

- 6.5 Calcium Carbide

- 6.6 Yellow Phosphorus

Chapter 7 Market Estimates & Forecast, By Region, 2021 - 2034 ($Billion, Thousand Units)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Danieli

- 8.2 Doshi Technologies

- 8.3 Electrotherm

- 8.4 Hatch

- 8.5 Metso Outotec

- 8.6 Outotec Oyj

- 8.7 Paul Wurth

- 8.8 Primetals Technologies

- 8.9 Shanghai Electric

- 8.10 Siemens

- 8.11 SMS Group

- 8.12 Tenova

- 8.13 Thermtronix

- 8.14 Thyssenkrupp Industrial

- 8.15 Xi’an Abundance Electric Technology