PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1850617

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1850617

Dry Vacuum Pump Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

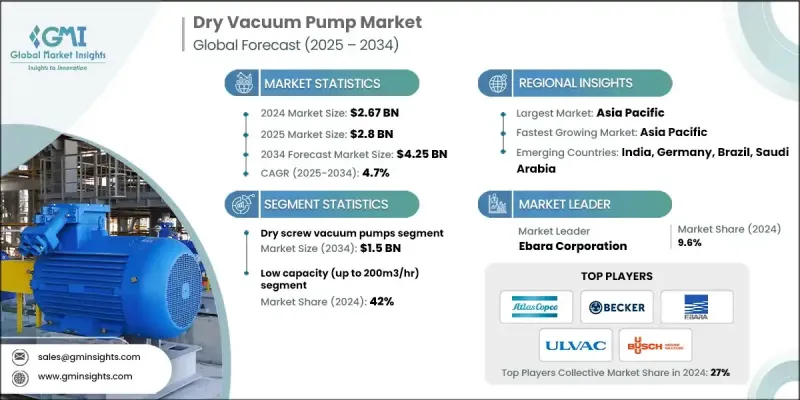

The Global Dry Vacuum Pumps Market was valued at USD 2.67 billion in 2024 and is estimated to grow at a CAGR of 4.7% to reach USD 4.25 billion by 2034.

The surge in industrial manufacturing across electronics, aerospace, and automotive continues to fuel demand for dry vacuum pumps in processes such as molding, coating, and material transport. Pharmaceutical and biotech industries boost market growth, as these pumps are essential in sterilization, freeze-drying, and solvent recovery operations. The food and beverage sector is also driving adoption due to growing requirements for clean, oil-free systems in vacuum packaging and food processing. Meanwhile, chemical companies favor dry vacuum solutions for their maintenance-friendly designs and contamination-free operation. The increasing shift toward automation and digitalization pushes manufacturers to integrate smart features in vacuum systems, offering real-time monitoring, data analytics, and predictive maintenance to improve uptime and efficiency. Two-stage systems are gaining popularity in applications needing deeper vacuum levels. Dry vacuum pumps replace oil-based systems in several applications due to their energy efficiency, durability, and environmentally friendly operation, making them an attractive choice across industries seeking cleaner and more reliable vacuum technology.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.67 Billion |

| Forecast Value | $4.25 Billion |

| CAGR | 4.7% |

The dry screw vacuum pumps segment is expected to generate USD 1.5 billion by 2034, fueled by high adoption across semiconductor fabrication, metallurgy, and chemical production. These pumps deliver high vacuum levels and fast pumping speeds without contamination. Their energy-efficient operation is a key benefit, especially for facilities aiming to reduce power consumption and operational expenses. The robust design and extended service intervals lead to reduced maintenance needs and enhanced uptime, making them ideal for high-volume, continuous-use applications. This segment's growth reflects an increasing preference for sustainable and efficient equipment in high-demand environments.

The low (up to 200m3/hr) segment held a 42% share in 2024 owing to the applications requiring precise, compact, and energy-efficient solutions. This segment is widely adopted across laboratories, small-scale pharmaceutical production, analytical instrumentation, and electronics manufacturing. Its popularity stems from the pumps' ability to deliver clean, oil-free performance in environments where contamination control and reliability are critical. Compact design, low maintenance, and cost-effective operation make these pumps suitable for limited-space installations and intermittent-use scenarios.

North America Dry Vacuum Pumps Market is projected to reach USD 1.07 billion by 2034. The pharmaceutical and biotechnology landscape is a major driver, where processes like freeze-drying and aseptic packaging require contamination-free environments. Compliance with stringent industry regulations and the expansion of biologics manufacturing in the region are strengthening demand for these systems. High production standards, rising R&D investments, and a strong focus on process integrity are key factors supporting growth across North American facilities.

The key manufacturers shaping the Dry Vacuum Pumps Industry include Edwards Vacuum, Ebara Corporation, ULVAC, Becker Vacuum Pumps, Atlas Copco, Welch Vacuum, Agilent Technologies, Grundfos, Alfa Laval, Leybold GmbH, KNF Neuberger, Flowserve Corporation, Tuthill Corporation, DEKKER Vacuum Technologies, and Graham Corporation. To strengthen their position, leading dry vacuum pump manufacturers are focusing on innovation in energy-efficient technologies and expanding their product lines to meet evolving industry demands. Many are investing in smart pump systems with automation features, enabling users to access real-time performance data and predictive maintenance tools. Companies are also entering strategic alliances and partnerships to enhance distribution networks, particularly in high-growth regions. Continuous R&D efforts are developing pumps with improved vacuum levels, quieter operation, and longer service life.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Pump type

- 2.2.3 Capacity

- 2.2.4 End use industry

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By pump type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS code-841410)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Pump Type, 2021-2034 (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Dry screw vacuum pump

- 5.3 Dry scroll vacuum pump

- 5.4 Dry diaphragm pump

- 5.5 Dry claw and hook pumps

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Capacity, 2021-2034 (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Low (Up to 200m3/hr)

- 6.3 Mid (200-500 m3/hr)

- 6.4 High (More than 500 m3/hr)

Chapter 7 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Electronics and semiconductors

- 7.3 Pharmaceutical

- 7.4 Chemical and petrochemical

- 7.5 Oil and gas

- 7.6 Food and beverages

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Direct sales

- 8.3 Indirect sales

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Billion, Million Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Agilent Technologies

- 10.2 Atlas Copco

- 10.3 Becker Vacuum Pumps

- 10.4 Busch Vacuum Solutions

- 10.5 Ebara Corporation

- 10.6 Flowserve Corporation

- 10.7 Graham Corporation

- 10.8 Ingersoll Rand Inc

- 10.9 Kashiyama Industries

- 10.10 Orion Machinery

- 10.11 Osaka Vacuum

- 10.12 Schmalz Group

- 10.13 Shinko Seiki

- 10.14 ULVAC

- 10.15 Unozawa