PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858803

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858803

Specialty Fiber Crops Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

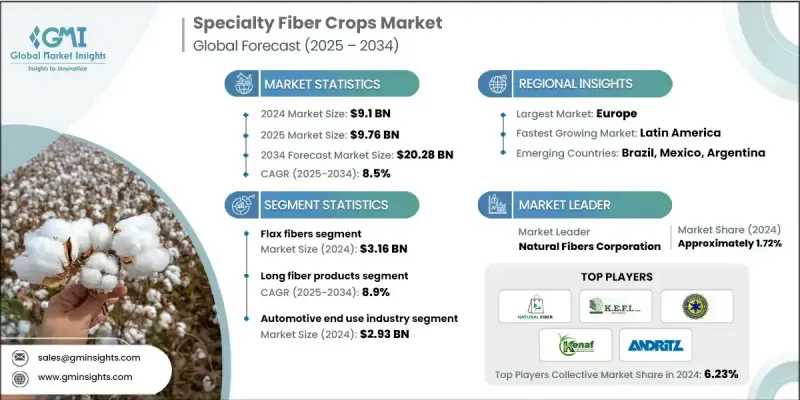

The Global Specialty Fiber Crops Market was valued at USD 9.10 billion in 2024 and is estimated to grow at a CAGR of 8.5% to reach USD 20.28 billion by 2034.

This steady market expansion is driven by rising global demand for eco-conscious and renewable raw materials across a range of industries. With increasing environmental concerns, both manufacturers and consumers are turning toward natural fibers such as jute, flax, sisal, and hemp due to their biodegradability, renewability, and reduced environmental impact. In addition, regulatory bodies in multiple regions are encouraging sustainable agriculture while imposing restrictions on synthetic materials, further accelerating the shift toward greener alternatives. This regulatory push continues to support the growth trajectory of the specialty fiber crops sector.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.10 Billion |

| Forecast Value | $20.28 Billion |

| CAGR | 8.5% |

Textile and apparel manufacturers are increasingly incorporating organic fibers into their product lines to appeal to a growing segment of sustainability-focused consumers. Advances in processing and fiber blending technologies have also elevated the quality and application range of these natural fibers, making them more competitive with synthetic counterparts in terms of durability, strength, and texture. Beyond fashion, the adoption of specialty fibers has grown in non-traditional industries, including automotive, construction, and composites, expanding their market footprint significantly.

The flax fiber segment was valued at USD 3.16 billion in 2024 and is projected to grow at a CAGR of 8.2% from 2025 to 2034. The surge in demand for both flax and hemp fibers stems from their strength, longevity, and low environmental impact, making them increasingly preferred for use in composites, textiles, and building materials. Specialty fibers derived from cotton and kenaf are also witnessing greater usage due to their biodegradable properties and application across packaging, paper, and premium textile segments. Additionally, leaf and fruit-based fibers such as coir, banana, and sisal are becoming viable materials for eco-friendly packaging, domestic textiles, and geotextile uses due to their sustainability and wide availability.

In 2024, the automotive end-use segment reached USD 2.93 billion in value and is expected to grow at an 8.7% CAGR, representing a 32.2% share during the 2025-2034 period. These natural fibers are increasingly used in vehicle interiors and composite materials, offering a lightweight and strong alternative to synthetics. The building and construction sector is also integrating these fibers in insulation panels and reinforcement components, owing to their strength and green credentials.

North America Specialty Fiber Crops Market generated USD 2.24 billion in 2024. The demand across this region is rising steadily as industries such as construction, automotive, and textiles move toward integrating sustainable materials. The shift is further supported by greater environmental awareness, growing consumer demand for sustainable products, and government incentives promoting eco-friendly farming practices. The expansion of the North American market is also facilitated by ongoing innovations in fiber processing and composite development, which are unlocking new applications for specialty fibers.

Prominent players leading the Global Specialty Fiber Crops Market include Natural Fibers Corporation, Kenaf Partners USA, and K.E.F.I. S.p.A. (Italy), ANDRITZ Group, and Hemp Inc., among others. To strengthen their presence, companies in the Global Specialty Fiber Crops Market are adopting a variety of strategic approaches. Many are expanding their production capacities to meet growing global demand for sustainable materials. R&D investments are focused on enhancing fiber quality and broadening applications through innovations in blending, processing, and composite engineering. Partnerships with construction, automotive, and textile companies are helping manufacturers integrate specialty fibers into end-use products more seamlessly. In addition, businesses are exploring vertical integration models to secure consistent supply chains and improve cost efficiency.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product Type

- 2.2.3 Processing Form

- 2.2.4 End use Industry

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Supply chain complexity

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Patent Landscape

- 3.10 Trade statistics (Note: the trade statistics will be provided for key countries only)

- 3.10.1 Major importing countries

- 3.10.2 Major exporting countries

- 3.11 Sustainability and Environmental Aspects

- 3.11.1 Sustainable Practices

- 3.11.2 Waste Reduction Strategies

- 3.11.3 Energy Efficiency in Production

- 3.11.4 Eco-friendly Initiatives

- 3.12 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021- 2034 (USD Billion, Kilo Tons)

- 5.1 Key trends

- 5.2 Hemp fibers

- 5.2.1 Bast fiber products

- 5.2.2 Hurd and core products

- 5.3 Flax fibers

- 5.4 Kenaf fibers

- 5.5 Cotton specialty fibers

- 5.6 Leaf and fruit fibers

- 5.6.1 Sisal and abaca products

- 5.6.2 Coir and milkweed products

- 5.7 Other fibers

Chapter 6 Market Estimates and Forecast, By Processing Form, 2021 - 2034 (USD Billion, , Kilo Tons)

- 6.1 Key trends

- 6.2 Long fiber products

- 6.3 Short fiber products

- 6.4 Core and hurd products

- 6.5 Fiber powders and fines

Chapter 7 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Billion, Kilo Tons)

- 7.1 Key trends

- 7.2 Automotive

- 7.2.1 Interior panel applications

- 7.2.2 Trunk liners and composite parts

- 7.3 Construction and building

- 7.3.1 Insulation materials

- 7.3.2 Biocomposite applications

- 7.4 Paper and packaging

- 7.4.1 Specialty paper applications

- 7.4.2 Security and currency paper

- 7.4.3 Cigarette paper

- 7.4.4 Packaging material

- 7.5 Textile and fashion

- 7.5.1 Technical textiles

- 7.5.2 Consumer apparel

- 7.5.3 Home textiles

- 7.5.4 Luxury and premium textiles

- 7.6 Environmental and agricultural

- 7.6.1 Erosion control applications

- 7.6.2 Animal bedding

- 7.6.3 Horticultural products

- 7.7 Other End use industries

- 7.7.1 Cosmetics and personal care

- 7.7.2 Industrial filtration

- 7.7.3 Marine and defense

- 7.7.4 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion, Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East & Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East & Africa

Chapter 9 Company Profiles

- 9.1 K.E.F.I. S.p.A. (Italy)

- 9.2 Natural Fibers Corporation

- 9.3 Mississippi Delta Fiber Cooperative

- 9.4 Kenaf Partners USA

- 9.5 ANDRITZ Group

- 9.6 Formation AG

- 9.7 Hempflax Group

- 9.8 Canadian Greenfield Technologies

- 9.9 Hemp Inc.

- 9.10 Others